Research Methodology on Aircraft Leasing Market

Introduction

The research methodology involved in the study of the global aircraft leasing market is a significant component of the overall research report, given the complexities and diverse facets of the market. This research methodology is implemented to conduct an in-depth study and draw accurate, factual, and verifiable conclusions about the global aircraft leasing market.

Objective of the Study

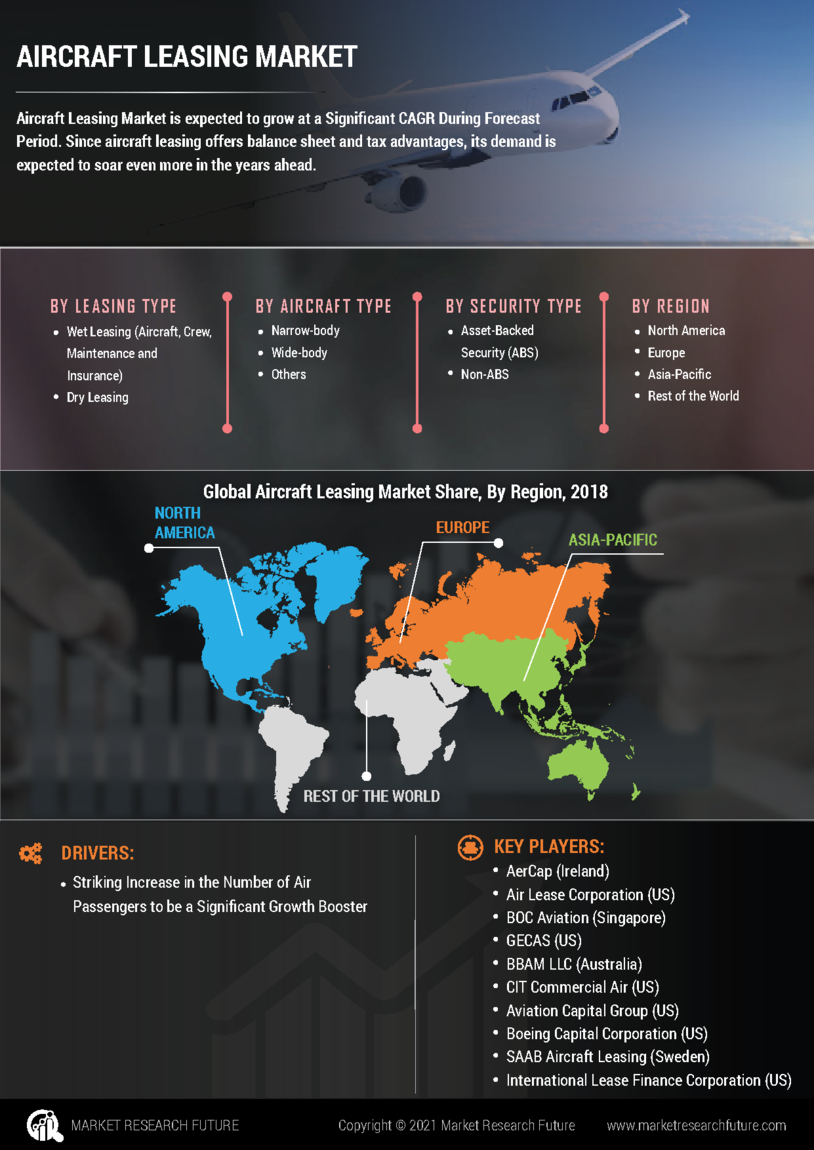

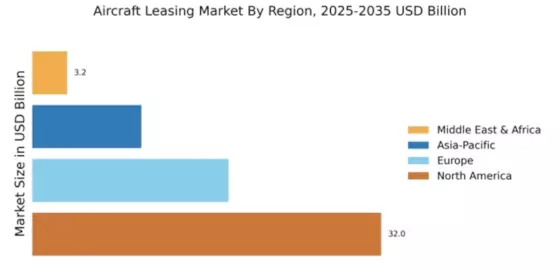

The objective of the study is to provide an in-depth analysis of the global aircraft leasing market and study various aspects of the market such as market size (in terms of volume and value), regional growth and industry trends. In addition, the study provides information on segmentation, industry structure, and competitive landscape.

Data Sources and Secondary Research

The data sources used in this report included publicly available information, industry magazines, and journals, as well as secondary research data from other sources such as government publications, industry-specific databases, and websites. The data sources are used to obtain an understanding of the global aircraft leasing market and other related information that was subsequently used to build a comprehensive market report.

Primary Research

Primary research has helped to develop a deep understanding of the aircraft leasing market. The research involved conducting interviews with key stakeholders in the market such as industry experts and primary manufacturers. These interviews serve to gain insights into opinions and current market trends. The interviews were conducted through e-mail and video calls.

Market Analysis

The market analysis involves understanding the current and future aircraft leasing market. This is done by analyzing past and current market trends and forecasting future market scenarios. Various analytical tools such as Porter’s five forces, graphical analysis, and SWOT analysis are employed to gain an understanding of the competitive environment and assess the market’s growth prospects.

Conclusion

The research methodology implemented in this report has been designed to provide a comprehensive understanding of the global aircraft leasing market. The research methodology employed was based on both primary and secondary data sources, using a combination of analytical tools such as Porter’s five forces, graphical analysis, and SWOT analysis to gain a better understanding of the market’s growth prospects. The research study had certain assumptions and limitations which are detailed in the report.