Aircraft Fire Protection Systems Size

Market Size Snapshot

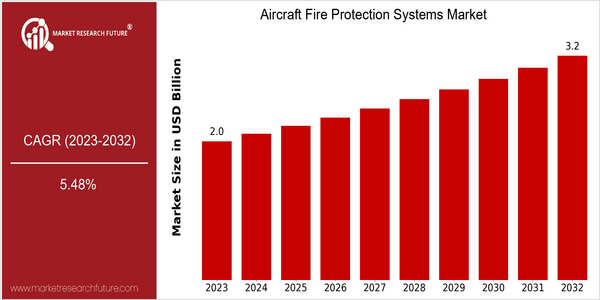

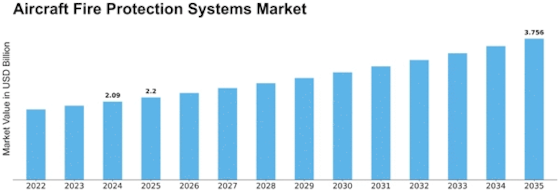

| Year | Value |

|---|---|

| 2023 | USD 1.98 Billion |

| 2032 | USD 3.2 Billion |

| CAGR (2024-2032) | 5.48 % |

Note – Market size depicts the revenue generated over the financial year

During the years of our report, the aircraft fire protection system market is expected to reach $ 3 billion, with a CAGR of 5.48% from 2024 to 2032. It is expected that the demand for advanced fire protection solutions in the aviation industry will continue to increase steadily. , driven by the increasing emphasis on safety regulations and technological advances in fire detection and fire extinguishing systems. The number of passengers travelling by air is increasing, and therefore the safety of aircraft is also increasing. This has led to a sharp increase in the demand for aircraft fire detection and fire extinguishing systems. In addition, the development of lightweight fire-retardant materials and the development of advanced detection systems are also expected to promote the development of the market. The major companies in the industry, such as Honeywell, UTC, and Kidde, are actively promoting their market shares through various strategic initiatives, such as strategic alliances and product launches. For example, recent alliances that combine the Internet of Things with fire protection systems are expected to improve the response speed and efficiency of fire protection systems, which will also promote the development of the market.

Regional Market Size

Regional Deep Dive

The aircraft fire-protection systems market is experiencing considerable growth in various regions, driven by rising air traffic, stricter safety regulations, and technological advancements. North America has the highest market share of manufacturers, and a regulatory framework that emphasizes innovation and safety. Europe is experiencing a surge in demand for advanced fire-protection systems, owing to an increasing focus on environmentalism and compliance with EU regulations. Asia-Pacific is the fastest-growing region, with rising investments in the aviation industry and a growing middle class. The Middle East and Africa are also embracing aircraft fire-protection systems, as regional airlines modernize their fleets. Latin America, a developing region, is beginning to understand the importance of fire-protection systems, as air traffic increases and regulations change.

Europe

- The European Union Aviation Safety Agency (EASA) has introduced new guidelines that require more stringent testing and certification of fire protection systems, leading to increased demand for compliant products.

- Companies such as Safran and Airbus are collaborating on projects to integrate advanced materials and technologies into fire protection systems, enhancing their effectiveness and reliability.

Asia Pacific

- The rapid growth of the aviation sector in countries like China and India is driving demand for advanced fire protection systems, with local manufacturers emerging to meet this need.

- Government initiatives aimed at improving aviation safety standards are encouraging investments in fire protection technologies, with companies like Thales and Boeing expanding their operations in the region.

Latin America

- Regulatory changes in countries like Brazil and Mexico are pushing airlines to adopt more stringent fire safety measures, creating opportunities for fire protection system providers.

- Local companies are beginning to partner with international firms to enhance their technological capabilities in fire protection, reflecting a growing awareness of safety standards in the aviation sector.

North America

- The Federal Aviation Administration (FAA) has recently updated regulations to enhance fire safety standards in aircraft, prompting manufacturers to innovate and improve their fire protection systems.

- Key players like Honeywell and UTC Aerospace Systems are investing heavily in R&D to develop next-generation fire detection and suppression technologies, which are expected to dominate the market.

Middle East And Africa

- The Gulf Cooperation Council (GCC) countries are investing heavily in modernizing their aviation infrastructure, which includes upgrading fire protection systems in new aircraft.

- Regional airlines such as Emirates and Qatar Airways are prioritizing safety and compliance, leading to increased procurement of advanced fire protection solutions from global suppliers.

Did You Know?

“Did you know that the first aircraft fire protection systems were developed in the 1940s, and they have evolved significantly to include advanced materials and technologies that can detect and suppress fires in seconds?” — Aerospace Safety Network

Segmental Market Size

The Aircraft Fire-Protection System is of utmost importance for the safety and reliability of aircraft operations. This segment is currently experiencing steady growth, as a result of the increasing number of safety regulations and the technological developments. Among the most important driving forces are the increasing fire-safety requirements imposed by the FAA and EASA, as well as the increasing demand for materials with improved fire-resistance in aircraft design. The current market development is characterized by a mature implementation of advanced fire-detection and fire-suppression systems in both commercial and military aircraft. The most important applications are in the engine compartment, in the cargo compartment and in the passenger compartment. Recent notable implementations are in the Boeing 787 and the Airbus A350. In the near future, the market will be influenced by the increasing trend towards sustainability and the greening of the aviation industry. Moreover, the development of sensors and the automation of fire-suppression systems will have a significant influence on the future development of the market.

Future Outlook

The Aircraft Fire Protection System Market is expected to increase from $1.98 billion to $3.19 billion by 2032, at a CAGR of 5.48%. It is driven by the increasing demand for advanced safety measures in the aviation sector, mainly due to stringent regulations and a focus on passenger safety. The penetration of fire-suppression systems in commercial and cargo aircraft is expected to rise as a result of the increased focus on safety compliance. In addition, the integration of smart fire detection systems and the development of lightweight, high-performance materials are expected to further enhance the effectiveness of fire-suppression systems. Moreover, the electrification of aircraft and the increasing demand for urban air mobility are expected to create new opportunities for fire-suppression systems. The industry is evolving to meet these changes, and as it does, it must remain alert to new regulations and emerging threats to ensure that fire-suppression systems are not only compliant but also capable of addressing future challenges to aviation safety.

Leave a Comment