Cost Efficiency

Cost efficiency is emerging as a pivotal driver in the aircraft electric motor Market. The operational costs associated with electric motors are generally lower than those of traditional jet engines, primarily due to reduced fuel expenses and lower maintenance requirements. As airlines seek to optimize their operational budgets, the shift towards electric propulsion systems becomes increasingly appealing. The Aircraft Electric Motor Market is projected to see a significant uptick in adoption rates as airlines recognize the long-term savings associated with electric motors. Furthermore, advancements in manufacturing processes are likely to reduce the initial investment costs for electric motors, making them more accessible to a broader range of operators. This trend suggests that cost efficiency will continue to be a driving force in the market, influencing purchasing decisions and shaping the future of aviation.

Regulatory Support

Regulatory support is a significant driver for the Aircraft Electric Motor Market. Governments and aviation authorities are implementing stringent regulations aimed at reducing emissions and promoting the use of electric propulsion systems. This regulatory framework encourages manufacturers to invest in electric motor technologies, as compliance with environmental standards becomes increasingly critical. For example, initiatives such as the European Union's Green Deal and various national policies are fostering a favorable environment for electric aviation. The Aircraft Electric Motor Market is likely to benefit from these regulations, as they create a sense of urgency for airlines to transition to cleaner technologies. Additionally, financial incentives and grants for research and development in electric propulsion are further stimulating market growth. As regulatory bodies continue to prioritize sustainability, the demand for electric motors in aviation is expected to rise.

Sustainability Initiatives

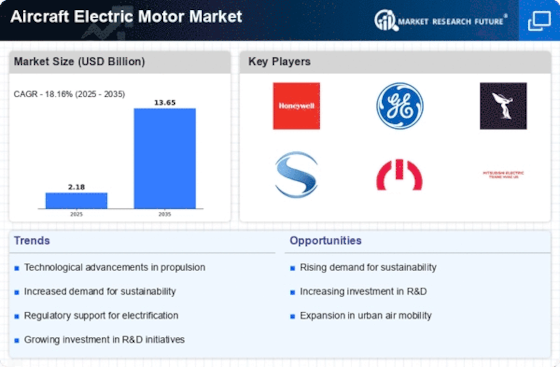

The Aircraft Electric Motor Market is experiencing a notable shift towards sustainability initiatives. As environmental concerns intensify, the aviation sector is increasingly adopting electric motors to reduce carbon emissions. This transition aligns with global efforts to combat climate change, as electric motors offer a cleaner alternative to traditional combustion engines. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 15% in the coming years. This growth is driven by the need for greener technologies and the push for sustainable aviation practices. Furthermore, governments are incentivizing the adoption of electric propulsion systems, which further propels the Aircraft Electric Motor Market forward. Companies are investing in research and development to enhance the efficiency and performance of electric motors, indicating a robust commitment to sustainability in aviation.

Technological Advancements

Technological advancements play a crucial role in shaping the Aircraft Electric Motor Market. Innovations in battery technology, materials science, and motor design are enhancing the performance and efficiency of electric motors. For instance, the development of high-energy-density batteries is enabling longer flight ranges and shorter charging times, which are essential for commercial aviation. The integration of advanced control systems and lightweight materials is also contributing to improved motor efficiency. As a result, the Aircraft Electric Motor Market is witnessing a surge in demand for electric propulsion systems, with projections indicating a market size exceeding USD 5 billion by 2030. These advancements not only improve operational efficiency but also reduce maintenance costs, making electric motors an attractive option for airlines and manufacturers alike. The continuous evolution of technology is likely to drive further growth in this sector.

Market Demand for Urban Air Mobility

The growing demand for urban air mobility is significantly influencing the Aircraft Electric Motor Market. As cities become more congested, the need for efficient and rapid transportation solutions is becoming increasingly apparent. Electric motors are well-suited for urban air mobility applications, such as air taxis and drones, due to their quiet operation and lower environmental impact. This segment of the market is expected to expand rapidly, with forecasts indicating a potential market size of USD 1.5 billion by 2030. The Aircraft Electric Motor Market is likely to capitalize on this trend, as manufacturers develop specialized electric motors tailored for urban air mobility vehicles. Additionally, partnerships between technology companies and aviation firms are emerging to accelerate the development of these innovative solutions. The demand for urban air mobility is poised to drive significant growth in the electric motor sector.