Increasing Air Travel Demand

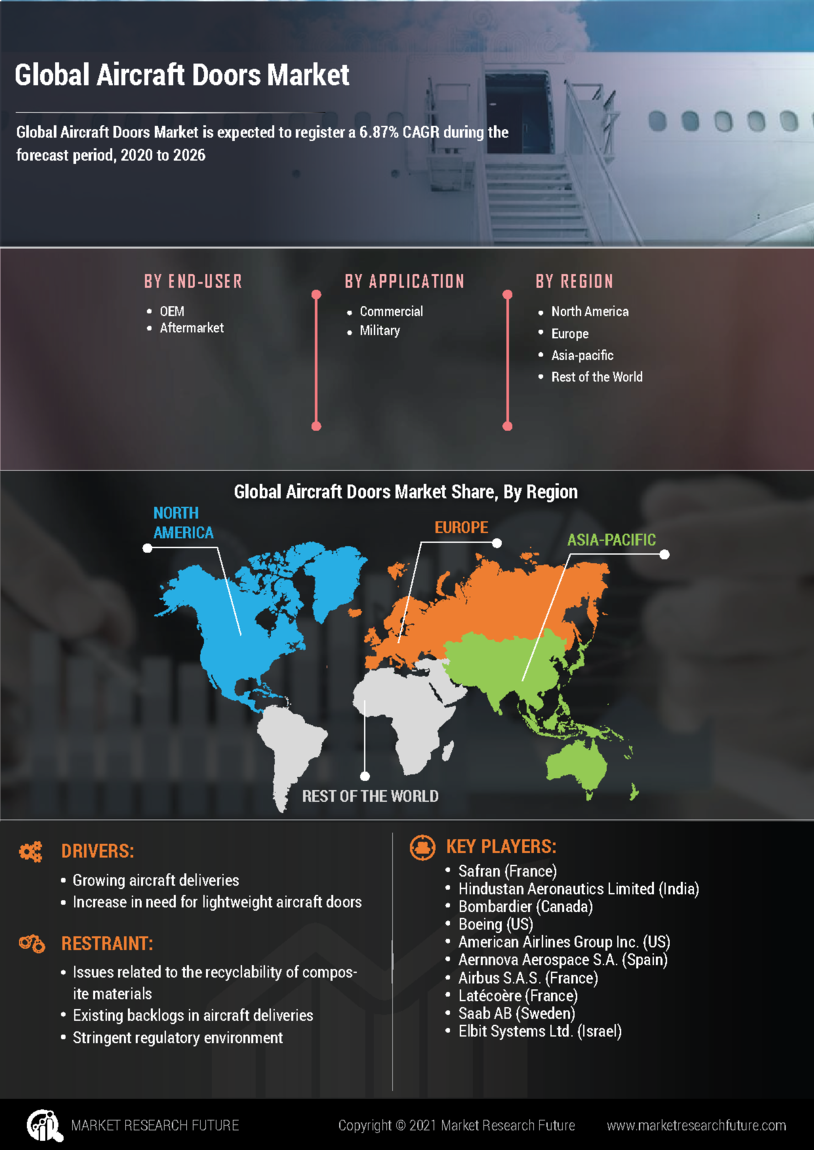

The Aircraft Doors Market is experiencing a notable surge in demand due to the increasing air travel demand. As more individuals and businesses opt for air travel, airlines are compelled to expand their fleets. This expansion necessitates the procurement of new aircraft, which in turn drives the demand for aircraft doors. According to recent data, the commercial aviation sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next decade. This growth is likely to result in a significant increase in the number of aircraft being manufactured, thereby boosting the Aircraft Doors Market. Furthermore, the rise in low-cost carriers is contributing to this trend, as they often require more aircraft to meet the growing passenger base.

Growth of the Military Aviation Sector

The Aircraft Doors Market is also benefiting from the growth of the military aviation sector. Increased defense budgets across various nations are leading to the procurement of new military aircraft, which necessitates the development and supply of specialized aircraft doors. Military aircraft often require doors that can withstand extreme conditions and provide enhanced security features. As nations invest in upgrading their military capabilities, the demand for advanced aircraft doors tailored for military applications is expected to rise. This trend suggests a robust growth trajectory for the Aircraft Doors Market, as manufacturers adapt their offerings to meet the unique requirements of military aviation.

Technological Innovations in Materials

The Aircraft Doors Market is witnessing a transformation due to technological innovations in materials used for manufacturing aircraft doors. The introduction of lightweight composite materials is particularly noteworthy, as these materials enhance fuel efficiency and reduce overall aircraft weight. This shift towards advanced materials is driven by the aviation industry's commitment to sustainability and cost reduction. Recent advancements indicate that the use of composite materials can reduce the weight of aircraft doors by up to 30% compared to traditional materials. Consequently, this trend is likely to propel the Aircraft Doors Market forward, as manufacturers seek to incorporate these innovations into their product lines to meet the demands of modern aircraft design.

Emergence of Electric and Hybrid Aircraft

The Aircraft Doors Market is poised for transformation with the emergence of electric and hybrid aircraft. As the aviation sector seeks to reduce its carbon footprint, manufacturers are exploring innovative designs and technologies for these new aircraft types. Electric and hybrid aircraft often require specialized door designs to accommodate unique propulsion systems and battery storage solutions. This shift presents a significant opportunity for the Aircraft Doors Market, as manufacturers must adapt to the evolving needs of this segment. The potential for growth in this area is substantial, as the market for electric and hybrid aircraft is projected to expand rapidly in the coming years, driven by advancements in battery technology and environmental regulations.

Regulatory Compliance and Safety Standards

The Aircraft Doors Market is significantly influenced by stringent regulatory compliance and safety standards imposed by aviation authorities. These regulations mandate that aircraft doors meet specific safety and performance criteria, which drives innovation and development within the industry. Manufacturers are compelled to invest in advanced materials and technologies to ensure that their products comply with these regulations. For instance, the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) have established guidelines that necessitate regular inspections and maintenance of aircraft doors. This regulatory environment not only enhances safety but also stimulates growth in the Aircraft Doors Market as manufacturers strive to meet these evolving standards.