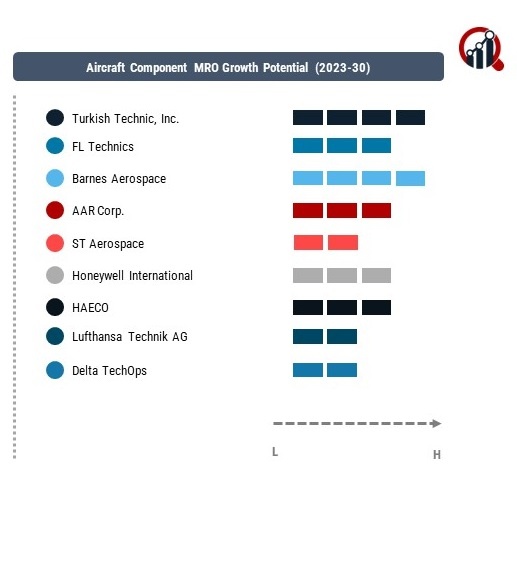

Top Industry Leaders in the Aircraft Component MRO Market

Strategies Adopted: Surviving and thriving in the competitive Aircraft Component MRO market requires strategic acumen. A significant focus lies on technological innovation and investment in research and development (R&D) to stay abreast of evolving aviation technologies. Strategic collaborations and partnerships with OEMs, airlines, and other MRO providers are common strategies to enhance service offerings and global reach. Diversification into specialized niches, such as avionics, landing gear, and engine components, allows companies to cater to specific market demands. Global expansion through acquisitions and setting up strategic MRO facilities ensures proximity to key markets and customers.

Competitive Landscape of Aircraft Component MRO Market

Key Companies in the aircraft component MRO market include

- Turkish Technic, Inc. (Turkey)

- FL Technics (Lithuania)

- Barnes Aerospace (US)

- AAR Corp. (US)

- ST Aerospace (Singapore)

- Honeywell International (US)

- HAECO (Japan)

- Lufthansa Technik AG (Germany)

- Delta TechOps (US).

Factors for Market Share Analysis: Market share analysis in the Aircraft Component MRO market considers several factors crucial to a company's positioning. Technical capabilities and certifications, compliance with stringent aviation regulations, and the ability to offer a wide spectrum of component services contribute significantly. Companies excelling in the overhaul and repair of critical components such as avionics, landing gear, and engines are often more competitive. Adaptability to emerging technologies, responsiveness to changing market demands, and customer satisfaction also play pivotal roles in determining market share dynamics.

New and Emerging Companies: While established players dominate the market, new and emerging companies bring innovation and agility, injecting fresh perspectives into the Aircraft Component MRO landscape. Companies such as TurbineAero and MOBIAero are gaining recognition for their specialized services, including advanced engine component MRO and innovative solutions for emerging aircraft technologies. Emerging companies often bring a nimble approach to adopting new technologies, contributing to the overall advancement of MRO capabilities in the industry.

Industry News: Recent industry news in the Aircraft Component MRO market reflects ongoing developments and trends. Innovations in predictive maintenance using data analytics and machine learning are gaining prominence, enabling MRO providers to optimize component maintenance schedules. News often covers advancements in sustainability initiatives, including the use of eco-friendly materials and processes. Additionally, industry news showcases collaborations for the development of new repair technologies, advancements in additive manufacturing for component parts, and the adoption of digital twins for predictive analysis. The evolving landscape of Aircraft Component MRO is evident through initiatives aimed at efficiency, sustainability, and the integration of emerging technologies.

Current Company Investment Trends: Investment trends in the Aircraft Component MRO market underscore a commitment to technology-driven solutions, sustainability, and global expansion. Companies are allocating substantial resources to R&D initiatives focused on predictive maintenance tools, automation, and digitalization of MRO processes. Investments in sustainable practices, including the use of green technologies and eco-friendly materials, align with the aviation industry's broader environmental goals. Strategic acquisitions of technology startups and partnerships with component OEMs contribute to a holistic approach, ensuring a continuous stream of cutting-edge solutions and maintaining a competitive stance in the market.

Overall Competitive Scenario: The overall competitive scenario in the Aircraft Component MRO market is characterized by a dynamic interplay between established industry leaders and emerging companies that bring innovation and flexibility to the sector. Established MRO providers leverage their extensive experience, certifications, and global networks to set industry standards. Simultaneously, emerging companies contribute to the diversification of services, often specializing in specific component categories or adopting advanced technologies. The industry's response to global challenges, such as the increasing demand for sustainability and the evolution of aircraft technologies, underscores the adaptability and resilience of Aircraft Component MRO providers. As the aviation industry continues to advance, with a focus on digitalization, sustainability, and emerging aircraft technologies, the Aircraft Component MRO market is poised for continued evolution. The emphasis on technological advancements, strategic collaborations, and meeting the dynamic needs of the aviation industry positions this market as a critical enabler for the reliability and longevity of aircraft components in the global aviation fleet.

Recent Development:

April 2023:

Azul Airlines revealed its new business unit dedicated to regular maintenance, repair, and overhaul services. These MRO services are open for various aircraft, including A321, Embraer E1/E2, and Boeing 737-400F.

May 2023: ExecuJet MRO Services, a Middle East-based MRO startup in Dubai and a subsidiary of Dassault Aviation, launched the Dubai World Central Facility, a new maintenance facility. This development reflects the company's commitment to providing aerospace services with a separate ownership and management team.Top of Form

December 2022:

Embraer, a global aircraft manufacturer, announced the signing of two maintenance service agreements via Embraer Aircraft Maintenance Services (EAMS) in Georgia. The contracts involve JSX and Envoy Air Inc. and focus on providing airframe maintenance and repair services by Embraer.

June 2022:

An agreement was formed between Ghana’s Aerojet and Jordan’s Joramco, a major MRO provider from the MEA region. The Aerojet Aviation Training Academy was established to offer advanced study in aircraft maintenance in the sub-regions of Ghana, responding to the MRO boost in West Africa.

May 2022: OASES, a provider of MRO software and components airworthiness, launched a new maintenance control module. The advanced module is designed for flexible line maintenance planning for aircraft, aiming to ensure improved scheduling and enhanced safety.