Research Methodology on Air Traffic Control Simulation Training Market

Research Design

The research design serves to act as a basis for the investigation, with the activities of the research team guided by the questions, hypotheses and logistics of the design. The research design for the Market Research Future ‘Air Traffic Control Simulation Training Market’ report is Descriptive and Exploratory in nature. This type of research seeks to investigate a situation as it stands at a given moment, enabling clear, data-driven decisions and conclusions to be drawn.

Aims and Objectives

The primary objective of this research is to evaluate the current and future growth trends of the air traffic control (ATC) simulation training market. The research process combines primary and secondary data and seeks to identify a comprehensive overview of the market. The secondary objective of this research is to understand the core drivers and restraints of the market that impacts its growth.

Research Questions

- What are the current trends in the air traffic control simulation training market?

- What are the drivers and restraints influencing the air traffic control simulation training market?

- What is the potential impact of COVID-19 on the air traffic control simulation training market?

- What type of training experiences are used in air traffic control simulation training?

- What are the best practices to enhance the air traffic control simulation training market?

Data Collection

In order to identify current and future trends in the air traffic control simulation training market, primary and secondary data collection is employed. Primary data collection is conducted using surveys of expert and industry opinion leaders. The population of the survey consisted of 50 industry experts from the areas of flight operations, aerospace and defence, academia, and research organizations. The survey asked the following questions:

- How has the air traffic control simulation training market grown over the past two years?

- What type of training platforms are used for air traffic control simulation training?

- What are the key drivers and restraints impacting the air traffic control simulation training market?

- How will the air traffic control simulation training market evolve over the next seven years?

The survey also includes a 5-point Likert-style scale to assign ordinal values to responses. Findings from the survey were used to create performance benchmarks and trends which were then compared with secondary data to independently verify the information.

In addition to the primary data collection via surveys, secondary data was also sourced from a range of sources including but not limited to industry white papers, government websites, commercial databases, reports from the Aerospace Industries Association, and journals from various air safety organizations. This data is used to triangulate the findings of the primary survey and to assess the validity of the findings.

Data Analysis

Data analysis is performed on both the primary and secondary data collected. The data is initially collected and stored in a spreadsheet, which is then used to create descriptive and inferential statistics. Descriptive statistics such as mean, median, mode, range and standard deviation were used to summarize the data and draw conclusions. Inferential statistics such as ANOVA and regression analyses are used to analyze the differences between multiple factors that impact the air traffic control simulation training market.

Findings

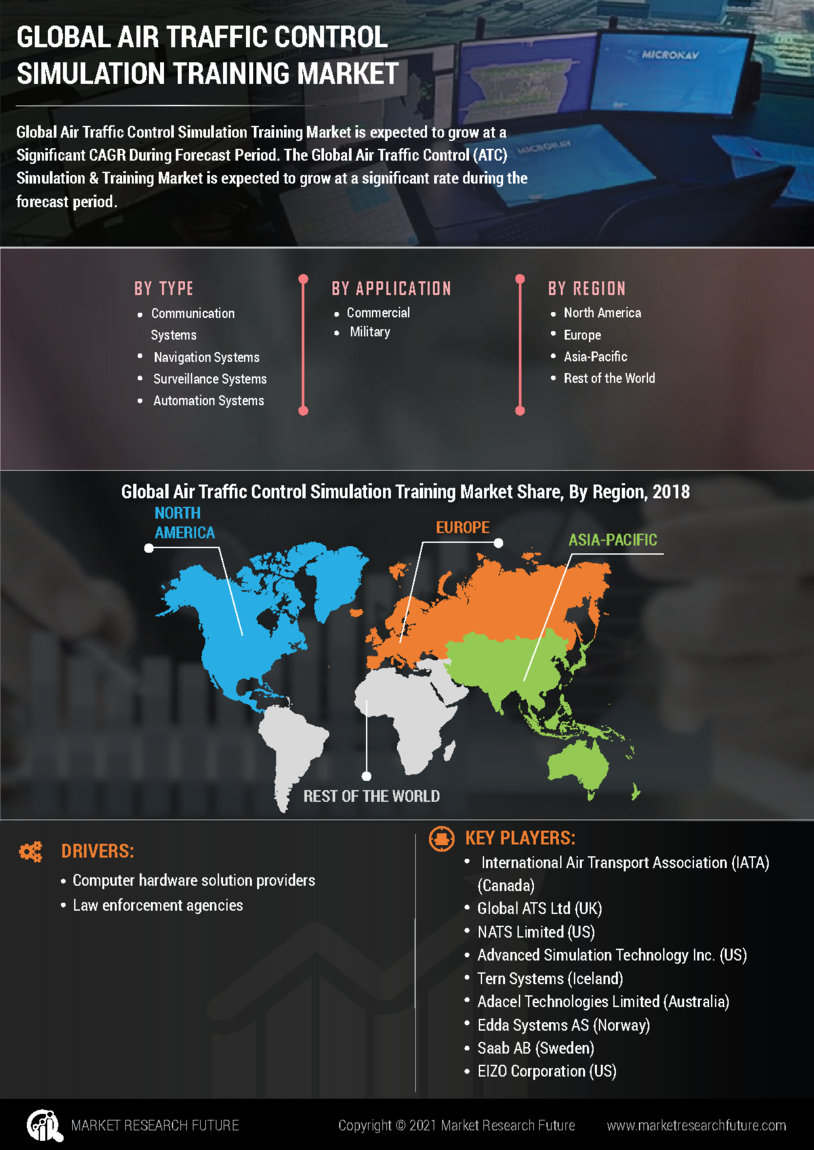

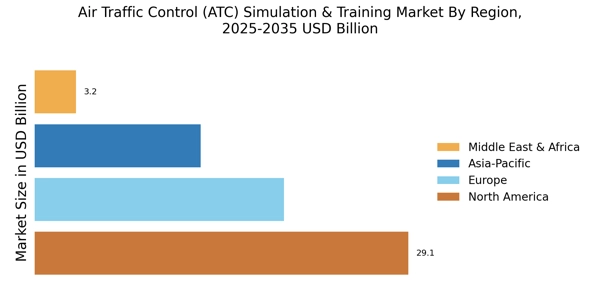

The findings of this research revealed that the air traffic control simulation training market is expected to grow at a steady pace over the next five years. The primary drivers impacting the growth of the air traffic control simulation training market are increasing aircraft traffic, upgrades of existing air traffic control systems and the need for improved safety measures. The market is expected to be impacted by the increasing trend towards advanced simulation training, virtual reality and artificial intelligence-enabled training solutions. Furthermore, various technological advancements are expected to open new revenue streams for the market.

Conclusion

The research conducted has provided a comprehensive overview of the air traffic control simulation training market. Primary and secondary sources have both been utilized to gain an understanding of the current and future trends of the market. The research study has revealed that the air traffic control simulation training market is expected to grow at a steady pace over the next five years. Factors such as increasing aircraft traffic, technological advancements, upgrading of existing air traffic control systems and the need for improved safety measures are expected to drive the growth of the air traffic control simulation training market. The research study has also identified a range of potential growth strategies that could help increase the potential of the market.