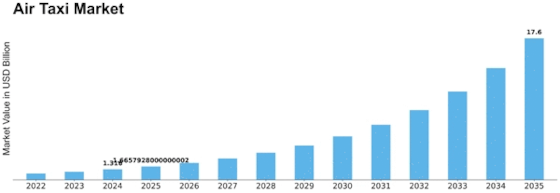

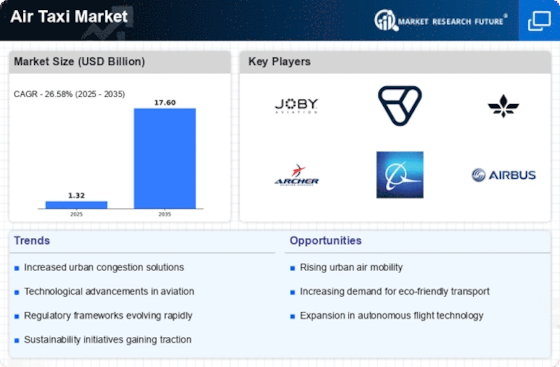

Air Taxi Size

Air Taxi Market Growth Projections and Opportunities

The air taxi market is on the verge of rapid development due to some distinctive factors that are currently transforming city transportation in the future. In addition, one of the primary aspects that contribute to filling out the development of air taxi market is increased demand for productive and efficient transportation arrangements in metropolitan areas As cities become more congested with unnecessary movement and gridlock becomes a problem of the past, there is an emerging need for solutions that would provide instantaneous and reliable transportation options. Air taxis empower us to overcome the usual transport obstacles, providing a faster and simpler way of movement. The impacts of market contest and associations on the components air taxi market also factor in. Since many organisations are now coming into this space, there is intense competition of creating and deploying affordable air taxi solutions. Additional crucial connections between air taxi manufacturers, innovation providers and urban infrastructure planners add to the overall development of the Air Taxi biological system. Collaborative work with special regulatory specialists also contributes to seamless integration of air taxis into city transport organizations. Monetary aspects such as cost of air taxi services and infrastructural investments play an important role on the market. The modesty and perception of air taxi services are essential when it comes to inevitable acceptance. Air taxi market organizations are challenged with developing usable solutions to make air more available for a larger portion of the population. In addition, monetary considerations affect the investment ecosystem that in turn determines how fast and big infrastructure is expected to develop for air taxi activities. The basic factors impacting the outcome of air taxi market involve shopper acknowledgment and public insight. The market acceptance is essential for building public confidence in the security and high-quality of air taxi administrations. With networks, organizations in the air taxi space are effectively addressing issues to address challenges with regards imparting product benefits and ensuring positive public discernment.

Leave a Comment