Research Methodology on Air Quality Sensors Market

1. Introduction

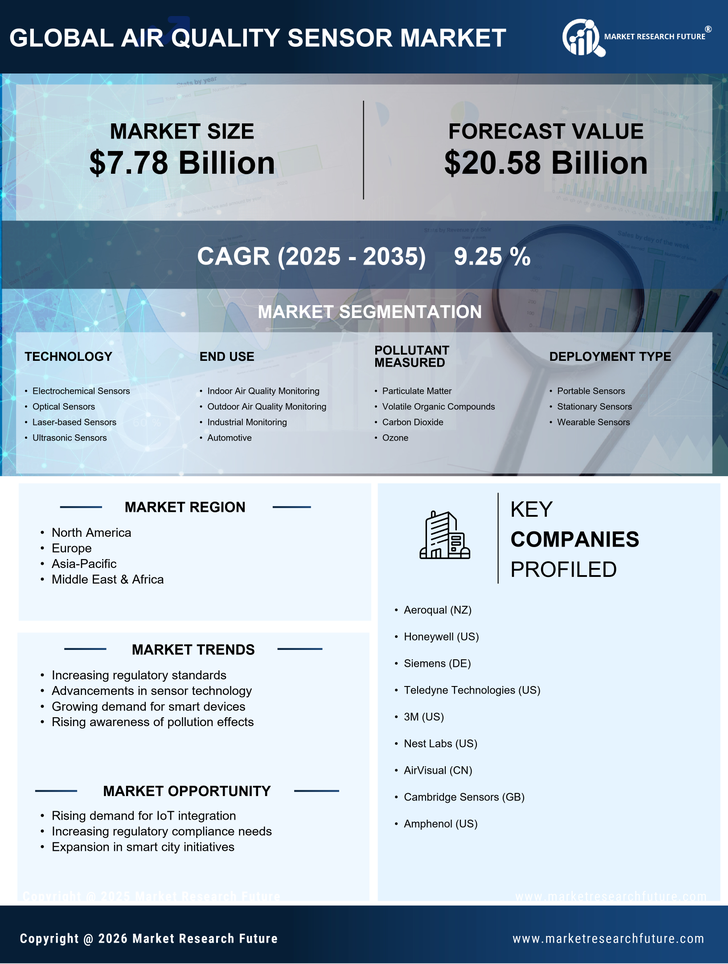

This research methodology intends to outline the methods of research independently undertaken by Market Research Future (MRFR), an independent research provider, to ascertain and analyze the current and future trends of the global Air Quality Sensor market. The market intelligence report delineates the market structure, technological advancements, and the presence of the key players in the market. The research is expected to provide a detailed insight into the market dynamics and demand for air quality sensors over the forecast period of 2023 to 2030.

2. Research Objective

The primary objective of this research report is to understand the current market trend and evaluate the past, present, and future growth prospects of the Air Quality Sensor Market. The research report also analyses trends in technology, innovation, consumers and product offerings from key players in the market.

3. Market Definition

Air quality sensors are used to detect the volatile organic compounds present in the air. As well as to measure the concentration of the amount of the material present in the atmosphere. They are used to detect a range of gases such as CO2, VOCs and other hazardous compounds. Air quality sensors are used in a variety of industries. The air quality sensors are used in the manufacturing of pharmaceuticals and in the military.

4. Research Methodology

This research project is conducted by using both primary and secondary data. The methodology adopted and methods employed such as structured interviews and a questionnaire survey have been described in detail below.

a) Interviews

Structured interviews are conducted with a range of experts in the air quality sensor industry. Participants are selected based on their expertise in the industry and their knowledge of the recent developments in the industry.

b) Questionnaire

A survey is conducted with a focus group of experts to assess respondent’s opinion on the Air Quality Sensor market. The survey is aimed at understanding key market insights, recent trends, and technological advancements. The survey questionnaire is administered online and produced qualified responses.

c) Data Collection

Data is collected from internal and external sources including, press releases, newspapers, news agency databases, industry associations, and journals. Secondary data is obtained from government organizations and industry-specific reports of companies and regulatory authorities. The primary data is gathered through questionnaire survey and telephonic interviews.

5. Research Assumptions

- The analysis and research report prepared will be based on research assumptions and projections.

- The report will include inputs from the stakeholders of the Air Quality Sensor market.

- The report is compiled to the best of our understanding about the air quality sensor market and should not be taken as an indication of the accuracy of any proposed segment or market measurement.

- The information obtained from the secondary research has been checked for statistical veracity.

- The questionnaire and interviews are designed to cover key aspects of the air quality sensor market such as market size and estimation, segmentation, and trends, etc.

6. Conclusion

The research project is conducted in accordance with the research methodology previously outlined. The research aims to provide an understanding of the past, present, and future trends of the global Air Quality Sensor market over the period of 2023 to 2030. The data collected is subject to rigorous statistical veracity and checks, and is used to produce comprehensive and reliable estimates of the future market size and development. All research assumptions and limitations have been taken into account and have been addressed to the extent.