Market Growth Projections

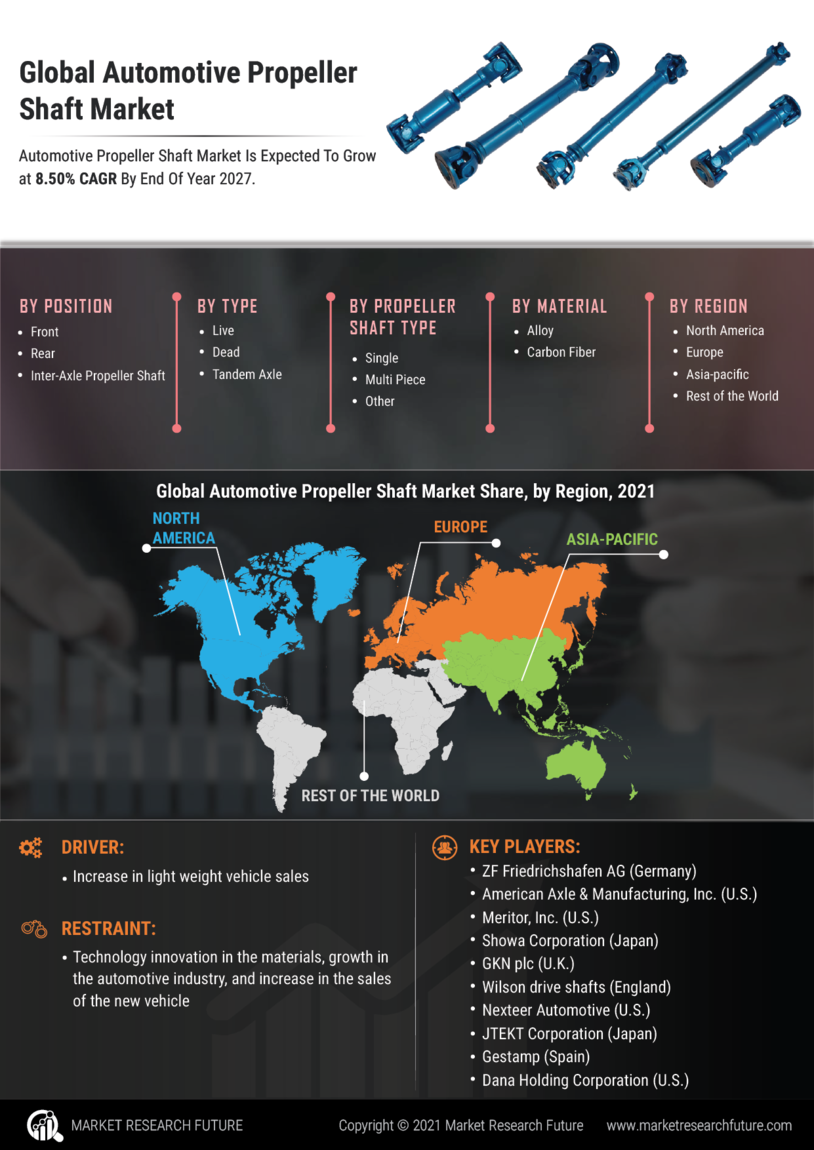

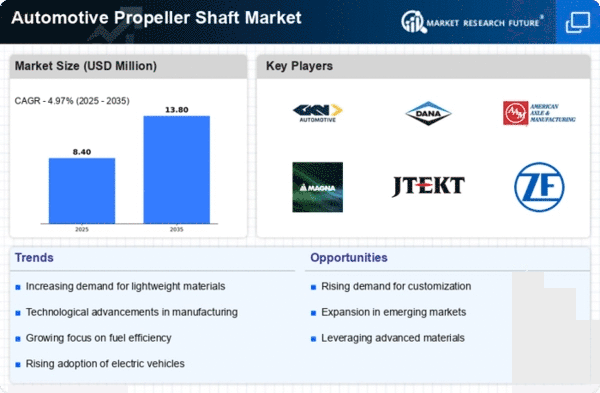

The Global Automotive Propeller Shaft Market Industry is poised for substantial growth, with projections indicating a market size of 19.5 USD Billion in 2024 and an anticipated expansion to 75.4 USD Billion by 2035. This growth trajectory suggests a robust compound annual growth rate (CAGR) of 13.1% from 2025 to 2035. Various factors contribute to this optimistic outlook, including the increasing demand for lightweight materials, technological advancements, and the rising production of vehicles. As the industry evolves, stakeholders are likely to capitalize on emerging opportunities, ensuring a dynamic and competitive market landscape.

Growing Adoption of Electric Vehicles

The Global Automotive Propeller Shaft Market Industry is undergoing transformation due to the rising adoption of electric vehicles (EVs). As the automotive industry shifts towards electrification, the design and functionality of propeller shafts are evolving to accommodate new drivetrains. While traditional internal combustion engine vehicles utilize propeller shafts extensively, the integration of electric drivetrains may alter their design requirements. Nevertheless, the demand for specialized propeller shafts in hybrid and electric vehicles is expected to grow, as these vehicles still require efficient power transmission systems. This shift indicates a potential for innovation within the market, as manufacturers adapt to the changing landscape.

Increasing Vehicle Production and Sales

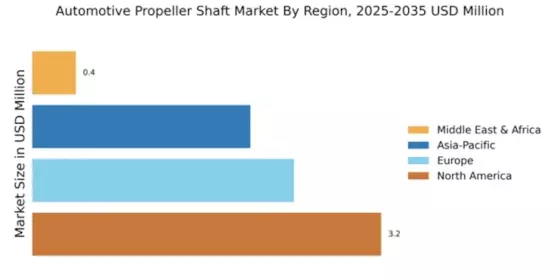

The Global Automotive Propeller Shaft Market Industry is closely linked to the rising production and sales of vehicles worldwide. As emerging economies continue to develop, the demand for automobiles is surging, leading to increased production rates. This growth is particularly evident in regions such as Asia-Pacific, where countries like India and China are witnessing a boom in automotive manufacturing. The increase in vehicle production directly correlates with the demand for propeller shafts, as every vehicle requires this critical component. The market is expected to grow at a CAGR of 13.1% from 2025 to 2035, reflecting the robust demand driven by vehicle sales.

Rising Demand for Lightweight Materials

The Global Automotive Propeller Shaft Market Industry is experiencing a notable shift towards lightweight materials, driven by the automotive sector's focus on enhancing fuel efficiency and reducing emissions. Manufacturers are increasingly adopting materials such as aluminum and composite materials to replace traditional steel shafts. This transition not only contributes to weight reduction but also improves performance and handling. As a result, the market is projected to reach 19.5 USD Billion in 2024, reflecting the growing preference for lightweight solutions in vehicle design. The emphasis on sustainability and regulatory compliance further propels this trend, indicating a robust future for lightweight propeller shafts.

Technological Advancements in Manufacturing

Technological innovations are significantly influencing the Global Automotive Propeller Shaft Market Industry. Advanced manufacturing techniques, such as 3D printing and automated production processes, are enhancing the precision and efficiency of propeller shaft production. These advancements enable manufacturers to produce complex designs that meet the evolving demands of modern vehicles. Furthermore, the integration of smart technologies, such as sensors and IoT capabilities, is expected to enhance the functionality and performance of propeller shafts. This trend aligns with the projected market growth, as the industry is anticipated to expand to 75.4 USD Billion by 2035, driven by continuous technological evolution.

Regulatory Compliance and Emission Standards

The Global Automotive Propeller Shaft Market Industry is significantly influenced by stringent regulatory compliance and emission standards imposed by governments worldwide. As environmental concerns escalate, automotive manufacturers are compelled to develop vehicles that meet these regulations, which often necessitates the use of advanced propeller shaft technologies. Compliance with these standards not only enhances vehicle performance but also contributes to reduced emissions. Consequently, manufacturers are investing in research and development to create propeller shafts that align with these regulations. This focus on compliance is likely to drive market growth, as the industry adapts to evolving environmental policies.