Expansion of 5G Networks

The rollout of 5G networks is fundamentally transforming the landscape of the Ai Edge Computing Market. With enhanced bandwidth and reduced latency, 5G technology facilitates the deployment of edge computing solutions across various applications, including autonomous vehicles and smart cities. The increased connectivity provided by 5G enables devices to communicate more efficiently, thereby enhancing the performance of edge computing systems. Industry analysts suggest that the proliferation of 5G could lead to a substantial increase in edge computing deployments, potentially reaching a market size of 100 billion USD by 2028. This expansion is likely to drive innovation within the Ai Edge Computing Market, as companies explore new use cases and applications that leverage the capabilities of 5G.

Advancements in AI Algorithms

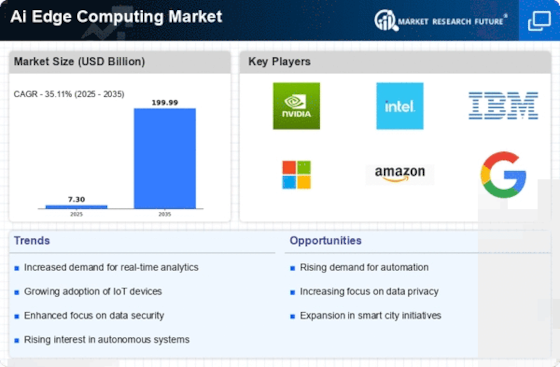

The continuous advancements in artificial intelligence algorithms are driving innovation within the Ai Edge Computing Market. Enhanced machine learning and deep learning techniques enable more sophisticated data analysis at the edge, allowing for improved decision-making and automation. As organizations seek to harness the power of AI, the integration of these algorithms into edge computing solutions becomes increasingly vital. The market for AI in edge computing is anticipated to grow at a compound annual growth rate of 30%, reaching approximately 27 billion USD by 2027. This growth reflects the increasing reliance on AI-driven insights and the potential for the Ai Edge Computing Market to revolutionize various sectors, including retail, healthcare, and logistics.

Increased Focus on Data Security

Data security remains a critical concern for organizations, thereby impacting the Ai Edge Computing Market. As data breaches become more prevalent, businesses are increasingly seeking solutions that enhance data protection at the edge. Edge computing offers the advantage of processing data closer to its source, which can reduce the risk of exposure during transmission. Furthermore, regulatory frameworks are evolving to address data privacy, compelling organizations to adopt edge solutions that comply with these regulations. The market for edge security solutions is expected to grow significantly, with estimates suggesting a potential market size of 20 billion USD by 2026. This trend highlights the pivotal role of the Ai Edge Computing Market in addressing security challenges and ensuring compliance.

Growth of Smart Cities Initiatives

The development of smart cities is significantly influencing the Ai Edge Computing Market. As urban areas strive to enhance sustainability and improve the quality of life for residents, the integration of edge computing technologies becomes essential. Smart city initiatives often rely on real-time data from various sensors and devices to manage resources efficiently, optimize traffic flow, and enhance public safety. The Ai Edge Computing Market is projected to reach 2.57 trillion USD by 2025, indicating a robust opportunity for edge computing solutions. This growth underscores the importance of the Ai Edge Computing Market in supporting the infrastructure necessary for smart city applications, thereby driving further investment and innovation.

Rising Demand for Real-Time Data Processing

The Ai Edge Computing Market is experiencing a notable surge in demand for real-time data processing capabilities. As organizations increasingly rely on instantaneous data analysis for decision-making, the need for edge computing solutions becomes paramount. This trend is particularly evident in sectors such as manufacturing and healthcare, where timely insights can significantly enhance operational efficiency and patient outcomes. According to recent estimates, the edge computing market is projected to reach a valuation of approximately 43 billion USD by 2027, driven by the necessity for low-latency data processing. Consequently, the Ai Edge Computing Market is poised to benefit from this growing demand, as businesses seek to leverage edge solutions to optimize their data workflows and improve responsiveness.