Research Methodology on Agriculture Analytics Market

The research methodology used to conduct the Agricultural Analytics Market Report has been segmented into primary research and secondary research. The secondary research encompasses sources such as press releases, company websites, annual reports, investor presentations, and trade reports. The primary research comprises interviews with agriculture industry experts and ancillary stakeholders. The primary research was conducted to understand the product, trends, the overall market landscape, and other dynamics.

Primary Research

Primary research is exploratory research and involves interviews with industry experts to gather information about the agricultural analytics market and it's changing dynamics. The interviews conducted provide a deeper insight into the agricultural analytics market, its overall dynamics, and other factors that influence its growth. The primary research conducted involves interviews with knowledgeable participants within the agricultural analytics market. The participants included members of the industry, such as product developers in the agricultural analytics sector and ecosystem partners.

This method was primarily used to assess the market size, prices and potential opportunities in the market. Secondary sources include data, published by industry bodies, white papers, case studies, conferences, association publications, industry magazines and workshops. The primary research conducted was a combination of both desk research, which involves using data from external sources, as well as interviews with industry experts such as experts, product manufacturers and other stakeholders. An in-depth analysis and confirmation of the key market drivers, trends, and market opportunities in the agricultural analytics market were conducted.

Secondary Research

Secondary research undertaken in this report was primarily focused on understanding the overall market size, market emergence and possible future for the agricultural analytics market. Various sources have been used for gathering secondary information, such as previous publications, government publications and statistical databases. The sources used for secondary research include trade journals, research articles, white papers and other relevant sources from the industry associations.

Purpose of Secondary Research

In order to develop an understanding of the overall market landscape and dynamics of the agricultural analytics market, secondary research was conducted. For this, the data collected through secondary sources were analyzed and compiled in order to help develop a better understanding of the market size and potential. Through secondary research, the report also identifies key industry participants and the strategies adopted by them.

The Secondary research section of the Agricultural Analytics Market report involved analyzing the sources of existing data, such as press releases, magazine articles, and other related news reports. We also conducted an extensive search of industry chat forums and websites in order to better understand the market and its most recent trends.

Furthermore, the Secondary research section was used to evaluate the prevailing market dynamics, such as market size, cost structure, pricing trends, industry trends, and competitive landscape. The data collected through the Secondary research section was validated and cross-checked by the primary sources in order o ensure accuracy and reliability.

Data Collection Source

The data collection process involved two distinct sources primary and secondary sources.

Primary Research Source

The primary sources used in the research involve primary surveys and interviews with subject matter experts, industry participants, and other stakeholders in the agricultural analytics market.

Secondary Research Source

The secondary source of data used in the research involves publicly available sources, including databases, trade journals, magazines, and industry associations. Secondary sources have also been used to acquire key industry developments, such as relevant market data, statistics, and other key database information.

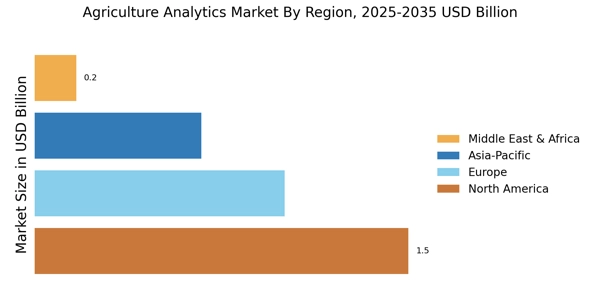

Market Estimation

The bottom-up approach was used to estimate the market for Agricultural Analytics. This approach was employed by obtaining the market data for each geographic region, segment, and country from the individual market constituents. The figures obtained from various sources have been appropriately channelized to estimate the global market.

Data Validation

The market data collected from the primary and secondary research sources is improved with the help of validation techniques, such as the triangulation method. The triangulation method involves collecting feedback from multiple sources to validate the accuracy of the market data obtained.

The data obtained from each of the sources has been cross-validated with industry participants, such as product manufacturers, consulting firms, domain experts, C-level executives, and company representatives in the agricultural analytics market.

The data obtained through primary and secondary research sources were further verified by conducting interviews, surveys, the latest developments, and feedback from stakeholders, which was the data triangulation method.