Rising Food Demand

The Agricultural Forestry Machinery Market is significantly impacted by the rising global food demand. As the world population continues to grow, the need for efficient agricultural practices becomes paramount. By 2025, it is estimated that food production must increase by approximately 70% to meet the needs of the burgeoning population. This demand drives the necessity for advanced machinery that can enhance crop yields and streamline production processes. Consequently, manufacturers are focusing on developing high-performance equipment that can operate under various conditions. The Agricultural Forestry Machinery Market is thus positioned to expand as stakeholders seek innovative solutions to address food security challenges.

Global Trade Dynamics

The Agricultural Forestry Machinery Market is influenced by global trade dynamics, which affect the availability and pricing of machinery. Trade agreements and tariffs can significantly impact the cost of importing and exporting agricultural equipment. In 2025, the market is expected to see fluctuations in pricing due to changing trade policies and international relations. As countries seek to enhance their agricultural capabilities, the demand for imported machinery may rise, particularly in regions with limited manufacturing capabilities. This interplay of trade dynamics is likely to shape the competitive landscape of the Agricultural Forestry Machinery Market, as companies adapt to evolving market conditions and consumer preferences.

Technological Integration

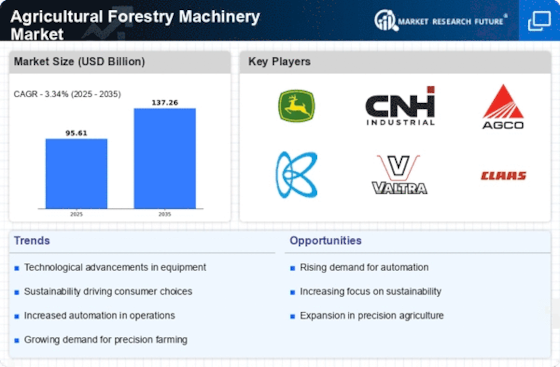

Technological integration plays a pivotal role in shaping the Agricultural Forestry Machinery Market. The incorporation of advanced technologies such as IoT, AI, and automation is revolutionizing traditional farming practices. In 2025, the market is expected to witness a compound annual growth rate of around 7%, driven by the increasing adoption of smart machinery. These technologies enable farmers to optimize operations, enhance productivity, and reduce labor costs. For instance, precision farming tools allow for real-time monitoring of crop health and soil conditions, leading to more informed decision-making. As technology continues to evolve, the Agricultural Forestry Machinery Market is likely to experience significant transformations, fostering greater efficiency and sustainability.

Sustainability Initiatives

The Agricultural Forestry Machinery Market is increasingly influenced by sustainability initiatives. As environmental concerns rise, there is a growing demand for machinery that minimizes ecological impact. This trend is reflected in the adoption of biofuels and electric machinery, which are designed to reduce carbon emissions. In 2025, the market for sustainable agricultural machinery is projected to reach a valuation of approximately 15 billion USD, indicating a robust shift towards eco-friendly practices. Companies are investing in research and development to create equipment that not only meets regulatory standards but also appeals to environmentally conscious consumers. This focus on sustainability is likely to drive innovation and enhance the competitive landscape within the Agricultural Forestry Machinery Market.

Government Support and Policies

Government support and policies are crucial drivers of the Agricultural Forestry Machinery Market. Various governments are implementing initiatives aimed at modernizing agricultural practices and promoting the use of advanced machinery. Subsidies, grants, and tax incentives are being offered to encourage farmers to invest in new technologies. In 2025, it is anticipated that government funding for agricultural innovation will exceed 10 billion USD, reflecting a commitment to enhancing food production efficiency. Such policies not only stimulate market growth but also foster research and development within the Agricultural Forestry Machinery Market, leading to the introduction of cutting-edge solutions that address contemporary agricultural challenges.