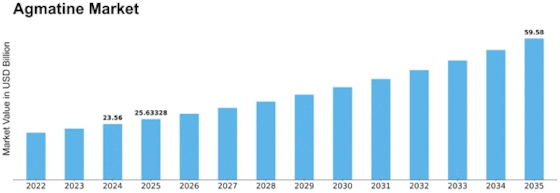

Agmatine Size

Agmatine Market Growth Projections and Opportunities

The Agmatine market, like any other, is impacted by numerous forces that collectively determine its dynamics. First and foremost, the demand for Agmatine is highly associated with pharmaceuticals as well as nutraceuticals. Being a vital bioactive compound, Agmatine has gained attention because of its potential health implications such as anti-inflammatory and neuroprotective effects. For this reason, changing tastes of customers for natural and functional ingredients in these sectors could significantly affect the marketability of Agmatine.

Moreover, regulatory factors play a major role in determining the direction the market will take. The usage of Agmatine in various applications is governed by stringent rules and regulations pertaining to these areas which can either support or hinder its market growth. This holds especially true when safety standards and health regulations are evolving influencing inclusion of agmatine into dietary supplements as well as pharmaceutical formulations.

Additionally, agricultural landscape and crop production practices also contribute to dynamics in the Agmatine market. It occurs naturally in plants hence its concentration among crops may be influenced by factors like soil quality, climate conditions and agriculture practices adopted during cultivation process. Changes that occur in these variables can affect general availability and price ranges of agamatines hence the related effects on market trends.

Technological advancements and innovations have an impact on market factors too. Development of new extraction techniques, processes for purification and synthesis may affect cost-effectiveness together with scalability of agmatine production. Besides there have been improvements with regard to analytical testing for purposes of quality control thus leading to better overall marker quality which would intern enhance consumer confidence.

The global economic landscape plays a crucial role in the Agmatine market. Economic stability, exchange rates, trade policies influence prices for raw materials, production costs, distribution costs. Currency fluctuations and trade tensions between key producing regions about currency values may engender uncertainty resulting in dynamism within markets.

There are competitive forces in the Agmatine market as well. The existence of major players, share distribution and competition intensity affect pricing strategies and product innovations. Collaboration and strategic partnerships among market players such as suppliers, manufacturers, distributors also contribute to the overall market dynamics by enabling growth or restricting competition.

Consumer awareness and preferences are integral factors in the Agmatine market. Growing health consciousness among consumers and consumer awareness about possible benefits of agmatines could be a basis for future demand. Conversely, negative perception, lack of knowledge or concerns on safety and efficacy can be roadblocks to growth of this market. Marketing strategies, educational campaigns and open communication play significant roles in shaping consumer attitudes.

Lastly, geopolitical factors may cause ambiguities within the Agmatine market. Disputes over trade policies, political tensions /concessions, changes in regulations for important consuming/producing regions who have a bearing on production costs; supply chains together with access to markets.

Leave a Comment