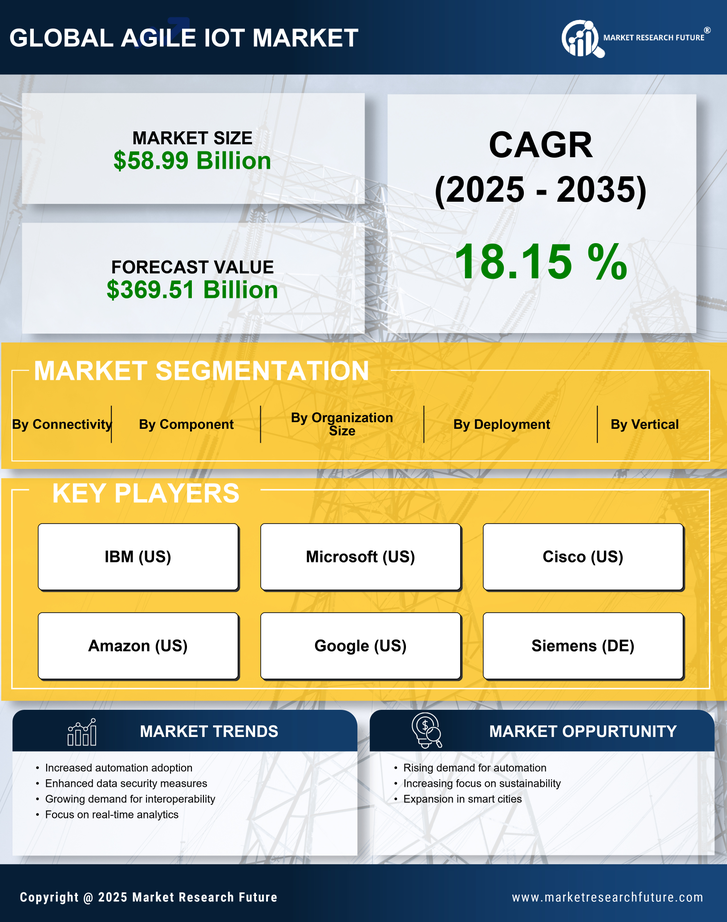

Leading market players invested heavily in research and Development (R&D) to scale up their manufacturing units and develop technologically advanced solutions, which will help the Agile IoT Market grow worldwide. Market participants are also undertaking various organic or inorganic strategic approaches to strengthen and expand their global footprint, with significant market developments including new product portfolios, contractual deals, mergers and acquisitions, capital expenditure, higher investments, and strategic alliances with other organizations. Businesses are also coming up with marketing strategies such as digital marketing, social media influencing, and content marketing to increase their scope of profit earnings. The Agile IoT industry must offer cost-effective and sustainable options to survive in a highly fragmented and dynamic market climate.Manufacturing locally to minimize operational expenses and offer aftermarket services to customers is one of the critical business strategies organizations use in the global Agile IoT industry to benefit customers and capture untapped market share and revenue. The Agile IoT industry has recently offered significant advantages to the manufacturing industry. Moreover, more industry participants are utilizing and adopting cutting-edge technology has grown substantially. Major players in the Agile IoT Market, including Bytelight (US), Fujitsu (Japan), Panasonic Corp (Japan), Qualcomm Inc. (US), Purelifi Ltd (US), ibsentelecom (US), General Electronic Corp (US), Lvx System (US), and Lightbee Corp. (US), are attempting to expand market share and demand by investing in R&D operations to produce sustainable and affordable solutions. Cisco Systems, Inc. is an IT and communications firm that designs, manufactures, and sells Internet Protocol-based networking devices and services. The company operates in three regional segments: North America, EMEA, and Asia-Pacific. Switches, NMI & Modules, Routers, Optical Communication, Network Points, Next-Generation Firewalls, Sophisticated Malware Protection, VPN Clients, and Web Security are among its product categories. Sandra Lerner and Leonard Bosack formed the firm on December 10, 1984, headquartered in San Jose, California. It released an IoT security framework in January 2020 that delivers greater insight throughout IoT and IT infrastructures while protecting workflows. Cisco's fresh offerings enable extracting information and gathering from the IoT edge, allowing organizations to expedite digitalization initiatives while increasing efficiency for making better business choices. IBM (International Business Machines) is a computer, technology, and IT consulting firm headquartered in the United States. It is the world's largest technology business and the second most valuable worldwide brand. It produces and sells software and computer components, web hosting, and consulting services in fields including mainframe systems and nanotechnology. On June 16, 1911, Charles Ranlett Flint and Thomas J. Watson Sr. created the corporation, which is located in Armonk, New York. In April 2019, IBM Corporation announced an agreement with Sund & Baelt to aid in the creation of an AI-powered IoT solution intended to help extend the useful life of passageways, railways, aging connections, and highways.