Africa Explosives Market Summary

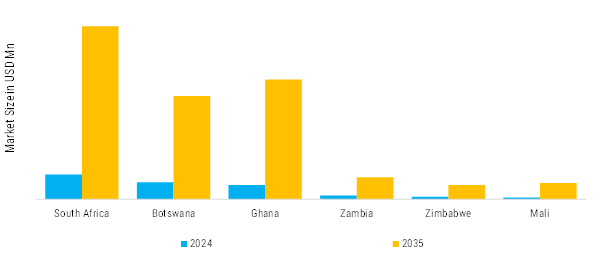

As per Market Research Future analysis, the Africa Explosives Market Size was valued at USD 10,250.46 million in 2024. The Africa Explosives Market industry is projected to grow from USD 11,078.14 million in 2025 to USD 21,195.07 million by 2035, exhibiting a compound annual growth rate (CAGR) of 6.703% during the forecast period (2025 - 2035).

Key Market Trends & Highlights

Africa's explosives market exhibits several evolving trends shaped by mining dominance, infrastructure expansion, and technological shifts:

- Africa's mining sector fuels the majority of explosives consumption, particularly in South Africa, Ghana, Zambia, and the DRC. Gold, platinum, coal, copper, and cobalt extraction require bulk blasting solutions, with coal mining alone holding the largest share due to steel and construction needs.

- Urbanization and government investments in roads, dams, and housing drive-controlled blasting needs. Large-scale projects across the continent increase demand for industrial explosives.

- Innovations like automation, AI, IoT integration, and non-detonating explosives enhance safety and efficiency. Bulk explosives lead due to water resistance and high detonation velocity, while emulsions and water gels gain traction for large-scale operations.

- Strategic alliances between firms like AECI, Orica, and Omnia with mining giants ensure reliable supply chains. Emphasis on R&D tailors explosives to local needs, mitigating risks from volatile raw material prices.

Market Size & Forecast

| 2024 Market Size | 10,250.46 (USD Million) |

| 2035 Market Size | 21,195.07 (USD Million) |

| CAGR (2025 - 2035) | 6.703% |

Major Players

Orica Limited, MAXAM, Dyno Nobel, AECI Limited, BME (Bulk Mining Explosives), Sasol, Enaex Africa, Titanobel, Ideal Mining Services, EPC Groupe.