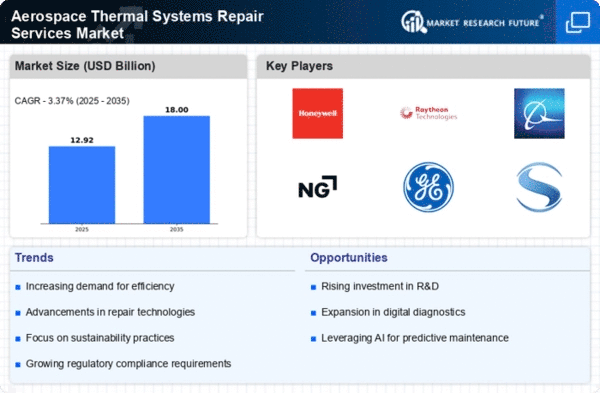

The Aerospace Thermal Systems Repair Services Market is characterized by a competitive landscape that is increasingly shaped by technological advancements and strategic collaborations. Key players such as Honeywell (US), Raytheon Technologies (US), and Rolls-Royce (GB) are actively pursuing innovation and digital transformation to enhance their service offerings. Honeywell (US) has focused on integrating advanced analytics into its repair services, which appears to improve efficiency and reduce turnaround times. Meanwhile, Raytheon Technologies (US) emphasizes partnerships with aerospace manufacturers to streamline supply chains and enhance service delivery, thereby positioning itself as a leader in the market. Collectively, these strategies indicate a shift towards a more integrated and technologically advanced service model, which is likely to redefine competitive dynamics in the sector.In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to respond to regional demands more effectively. The market structure is moderately fragmented, with several key players exerting influence over specific segments. This fragmentation allows for niche players to thrive, while larger companies leverage their scale to optimize operations and enhance service capabilities. The collective influence of these key players fosters a competitive environment where innovation and operational efficiency are paramount.

In November Rolls-Royce (GB) announced a strategic partnership with a leading aerospace manufacturer to co-develop next-generation thermal management systems. This collaboration is significant as it not only enhances Rolls-Royce's technological capabilities but also positions the company to capture emerging market opportunities in sustainable aviation. The partnership is expected to yield innovative solutions that could redefine thermal system efficiencies in aerospace applications.

In October Honeywell (US) launched a new predictive maintenance service that utilizes AI and machine learning to anticipate thermal system failures before they occur. This initiative is crucial as it aligns with the growing trend towards digitalization in aerospace services, potentially reducing maintenance costs and improving aircraft availability. By leveraging cutting-edge technology, Honeywell (US) is likely to strengthen its competitive edge in the market.

In September Raytheon Technologies (US) expanded its repair capabilities by acquiring a specialized thermal systems repair firm. This acquisition is indicative of Raytheon's strategy to enhance its service portfolio and improve its market position. By integrating specialized expertise, the company aims to offer more comprehensive solutions to its clients, thereby increasing customer loyalty and market share.

As of December the competitive trends in the Aerospace Thermal Systems Repair Services Market are increasingly defined by digitalization, sustainability, and AI integration. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to drive innovation and enhance service delivery. The competitive landscape is shifting from traditional price-based competition to a focus on technological advancement and supply chain reliability. This evolution suggests that future differentiation will hinge on the ability to innovate and adapt to changing market demands.