Regulatory Compliance and Safety Standards

The Aerospace Forging Market is heavily influenced by stringent regulatory compliance and safety standards imposed by aviation authorities. These regulations necessitate the use of high-quality materials and manufacturing processes to ensure the safety and reliability of aerospace components. As a result, manufacturers are compelled to invest in advanced forging technologies and quality assurance measures to meet these standards. The increasing focus on safety in aviation is likely to drive the demand for forged components that adhere to rigorous testing and certification processes. Consequently, the Aerospace Forging Market is expected to see a steady growth trajectory as companies prioritize compliance and safety in their production practices.

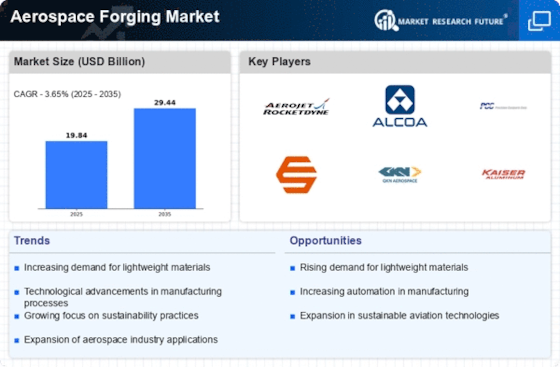

Increasing Demand for Lightweight Materials

The Aerospace Forging Market is experiencing a notable surge in demand for lightweight materials, driven by the aerospace sector's ongoing quest for fuel efficiency and performance enhancement. Manufacturers are increasingly adopting advanced forging techniques to produce components that are not only lighter but also possess superior strength-to-weight ratios. This trend is underscored by the projected growth of the aerospace industry, which is expected to reach a market size of approximately 1 trillion USD by 2030. As airlines and manufacturers prioritize reducing operational costs, the Aerospace Forging Market is likely to benefit from this shift towards lightweight materials, which are essential for modern aircraft design.

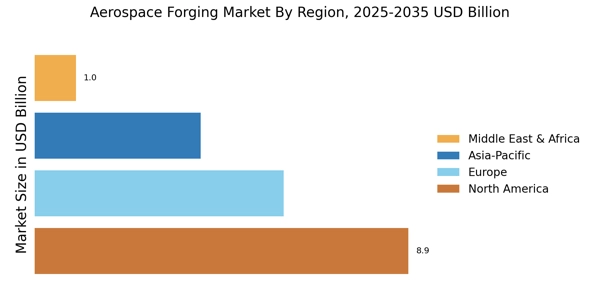

Rising Investment in Aerospace Infrastructure

The Aerospace Forging Market is benefiting from rising investments in aerospace infrastructure, including the development of new airports, maintenance facilities, and manufacturing plants. Governments and private entities are increasingly allocating funds to enhance aviation capabilities, which in turn stimulates demand for forged components used in aircraft and related systems. This trend is particularly evident in emerging markets, where infrastructure development is accelerating. As the aerospace sector expands, the need for high-quality forged materials will likely increase, providing a favorable environment for the Aerospace Forging Market to thrive. The anticipated growth in infrastructure investment is expected to bolster the overall market dynamics.

Technological Innovations in Forging Processes

Technological advancements in forging processes are significantly influencing the Aerospace Forging Market. Innovations such as precision forging, closed-die forging, and the integration of automation and robotics are enhancing production efficiency and product quality. These advancements allow manufacturers to produce complex geometries and intricate designs that meet the stringent requirements of the aerospace sector. The market is projected to grow at a compound annual growth rate (CAGR) of around 5% over the next five years, indicating a robust demand for technologically advanced forging solutions. As the industry evolves, the Aerospace Forging Market is poised to leverage these innovations to improve competitiveness and meet the rising demands of aircraft manufacturers.

Growing Focus on Sustainable Manufacturing Practices

The Aerospace Forging Market is witnessing a growing emphasis on sustainable manufacturing practices, driven by environmental concerns and regulatory pressures. Manufacturers are increasingly adopting eco-friendly forging techniques and materials to minimize their carbon footprint and comply with sustainability initiatives. This shift is not only beneficial for the environment but also aligns with the aerospace industry's goals of reducing emissions and enhancing fuel efficiency. As sustainability becomes a key consideration in procurement decisions, the Aerospace Forging Market is likely to experience increased demand for products that meet these eco-friendly standards. The integration of sustainable practices is expected to play a crucial role in shaping the future of the aerospace sector.

.png)