Increased Defense Budgets

The Aerospace And Defense Spring Market is experiencing a notable surge in defense budgets across various nations. Governments are prioritizing national security, leading to increased investments in military capabilities. For instance, defense spending is projected to reach approximately 2 trillion USD by 2026, reflecting a compound annual growth rate of around 3.5%. This financial commitment is likely to drive demand for advanced aerospace and defense components, including springs, which are essential for various applications such as landing gear and missile systems. As nations modernize their military fleets, the Aerospace And Defense Spring Market stands to benefit significantly from this trend.

Growing Demand for Lightweight Materials

The Aerospace And Defense Spring Market is witnessing a growing demand for lightweight materials, driven by the need for fuel efficiency and enhanced performance in aerospace applications. Manufacturers are increasingly utilizing advanced materials such as titanium and composite materials, which offer superior strength-to-weight ratios. This shift is expected to propel the market for specialized springs designed to meet the unique requirements of lightweight structures. The aerospace sector is projected to require over 1 million new aircraft components by 2030, further emphasizing the importance of innovative spring solutions in the Aerospace And Defense Spring Market.

Emerging Markets and Geopolitical Tensions

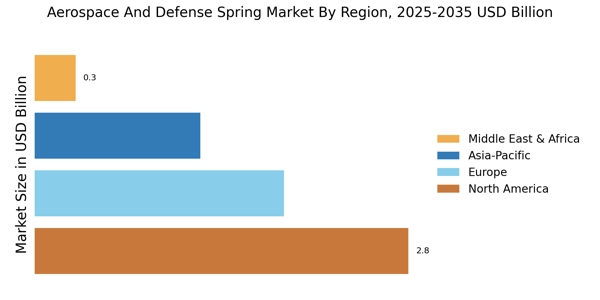

The Aerospace And Defense Spring Market is influenced by emerging markets and ongoing geopolitical tensions. Countries in Asia and the Middle East are ramping up their defense capabilities, driven by regional conflicts and security concerns. This trend is likely to result in increased procurement of defense equipment, including aerospace components. For example, defense spending in Asia is expected to grow by 5% annually, creating substantial opportunities for suppliers in the Aerospace And Defense Spring Market. As nations seek to bolster their military readiness, the demand for high-performance springs will likely rise.

Regulatory Compliance and Safety Standards

The Aerospace And Defense Spring Market is increasingly shaped by stringent regulatory compliance and safety standards. As safety becomes a paramount concern in aerospace applications, manufacturers are compelled to adhere to rigorous testing and certification processes. This trend is likely to drive demand for high-quality springs that meet or exceed these standards. The aerospace sector is expected to invest over 10 billion USD in compliance-related initiatives by 2027, highlighting the importance of reliable components. As a result, the Aerospace And Defense Spring Market must focus on quality assurance and innovation to remain competitive.

Technological Innovations in Manufacturing

The Aerospace And Defense Spring Market is benefiting from technological innovations in manufacturing processes. Advancements such as additive manufacturing and precision engineering are enabling the production of complex spring designs with enhanced performance characteristics. These innovations not only improve the efficiency of production but also reduce lead times and costs. The market for aerospace components is projected to grow at a rate of 4% annually, with a significant portion attributed to the adoption of advanced manufacturing techniques. Consequently, the Aerospace And Defense Spring Market is poised for growth as manufacturers leverage these technologies.