North America : Market Leader in MRO Services

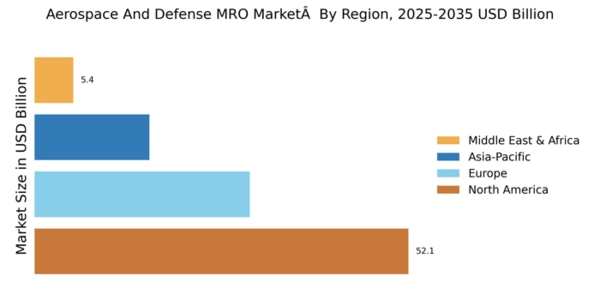

North America continues to lead the Aerospace and Defense MRO market, holding a significant share of 52.1% in 2024. The region benefits from robust defense budgets, technological advancements, and a strong focus on modernization of aging fleets. Regulatory support from agencies like the FAA ensures compliance and safety, driving demand for MRO services across commercial and military sectors.

The competitive landscape is characterized by major players such as Lockheed Martin, Northrop Grumman, and Raytheon Technologies, which dominate the market with innovative solutions. The U.S. remains the largest contributor, with Canada also playing a vital role in the MRO ecosystem. The presence of advanced manufacturing capabilities and skilled workforce further enhances the region's position as a global leader in aerospace and defense MRO.

Europe : Growing Demand for MRO Solutions

Europe's Aerospace and Defense MRO market is poised for growth, accounting for 30.0% of the global share. The region is driven by increasing air traffic, stringent safety regulations, and a shift towards sustainable aviation practices. The European Union's initiatives to enhance aviation safety and efficiency are pivotal in shaping the MRO landscape, fostering innovation and investment in new technologies.

Leading countries like the UK, France, and Germany are at the forefront, with key players such as Airbus and BAE Systems driving market dynamics. The competitive environment is marked by collaborations and partnerships aimed at enhancing service offerings. The presence of a well-established supply chain and skilled workforce further solidifies Europe's position in The Aerospace And Defense MRO.

Asia-Pacific : Emerging Market with Potential

The Asia-Pacific region is witnessing a rapid expansion in the Aerospace and Defense MRO market, holding a 16.0% share. Factors such as increasing defense budgets, rising air travel demand, and the modernization of military fleets are driving this growth. Governments are investing heavily in infrastructure and regulatory frameworks to support the burgeoning aviation sector, enhancing the overall MRO landscape.

Countries like China, India, and Japan are leading the charge, with significant investments in MRO capabilities. The competitive landscape features local and international players, including Hindustan Aeronautics Limited, which is gaining traction. The region's focus on technological advancements and partnerships with The Aerospace And Defense MRO position.

Middle East and Africa : Untapped Potential in MRO Market

The Middle East and Africa region represents an emerging frontier in the Aerospace and Defense MRO market, with a market share of 5.4%. The growth is fueled by increasing air traffic, investments in aviation infrastructure, and a strategic focus on enhancing defense capabilities. Governments are prioritizing the development of local MRO services to reduce dependency on foreign providers, which is a significant regulatory catalyst.

Countries like the UAE and South Africa are leading the way, with investments in state-of-the-art facilities and training programs. The competitive landscape is evolving, with both regional and international players vying for market share. The region's unique geopolitical position and growing aviation sector present significant opportunities for MRO service providers.