Rising Demand for Automation

The Advanced Process Control Market experiences a notable surge in demand for automation across various sectors, including manufacturing, oil and gas, and pharmaceuticals. This trend is driven by the need for enhanced efficiency, reduced operational costs, and improved product quality. According to recent data, the automation market is projected to grow at a compound annual growth rate of approximately 9% over the next five years. As industries increasingly adopt automated solutions, the Advanced Process Control Market is poised to benefit significantly, as these systems facilitate seamless integration of processes and minimize human error. Furthermore, the push for digital transformation in industrial operations further propels the adoption of advanced process control technologies, indicating a robust growth trajectory for the industry.

Regulatory Compliance and Safety Standards

The Advanced Process Control Market is significantly shaped by stringent regulatory compliance and safety standards across various sectors. Industries such as pharmaceuticals and food processing are subject to rigorous regulations that mandate the implementation of advanced control systems to ensure product safety and quality. As regulatory bodies continue to enforce these standards, companies are compelled to adopt advanced process control technologies to maintain compliance and avoid penalties. This trend is expected to drive market growth, as organizations recognize the importance of integrating advanced control solutions to meet safety requirements. Furthermore, the increasing focus on workplace safety and environmental sustainability further emphasizes the need for advanced process control systems, suggesting a robust future for the industry as it aligns with regulatory demands.

Focus on Energy Efficiency and Sustainability

The Advanced Process Control Market is increasingly influenced by the focus on energy efficiency and sustainability. As organizations strive to reduce their carbon footprint and comply with environmental regulations, the demand for advanced process control solutions that optimize energy consumption is on the rise. Industries such as manufacturing and chemical processing are particularly affected, as they seek to implement systems that minimize waste and enhance resource utilization. It is projected that the market for energy-efficient process control technologies could grow by over 7% annually in the coming years. This trend not only aligns with The Advanced Process Control Industry to innovate and develop solutions that contribute to a greener future.

Increasing Complexity of Industrial Processes

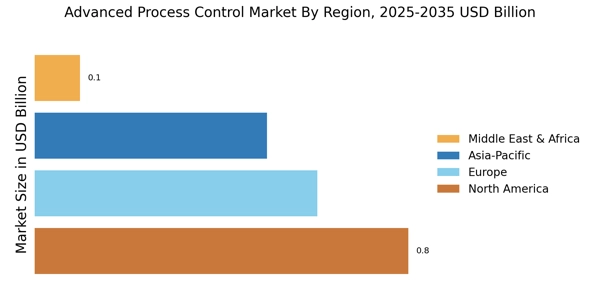

The Advanced Process Control Market is influenced by the growing complexity of industrial processes, which necessitates sophisticated control systems. As industries evolve, processes become more intricate, requiring advanced methodologies to ensure optimal performance. This complexity is particularly evident in sectors such as chemical processing and energy production, where the interplay of various variables demands precise control. The market for advanced process control solutions is expected to expand as companies seek to manage these complexities effectively. In fact, it is estimated that the market could reach a valuation of over 5 billion dollars by 2027, driven by the need for enhanced process optimization and operational reliability. Consequently, the Advanced Process Control Market is likely to see increased investment in innovative control technologies to address these challenges.

Technological Advancements in Control Systems

The Advanced Process Control Market is propelled by rapid technological advancements in control systems, including the integration of artificial intelligence and machine learning. These innovations enhance the capabilities of process control systems, enabling real-time monitoring and predictive analytics. As industries strive for greater efficiency and reduced downtime, the adoption of these advanced technologies becomes imperative. Recent studies indicate that the market for AI-driven process control solutions is expected to grow significantly, potentially reaching a market size of 3 billion dollars by 2026. This growth is indicative of the industry's shift towards more intelligent and adaptive control systems, which can optimize processes dynamically. Consequently, the Advanced Process Control Market stands to benefit from these technological advancements, as they offer enhanced performance and operational insights.