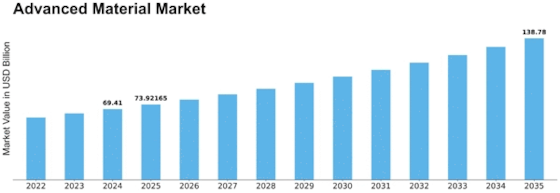

Advanced Material Size

Advanced Material Market Growth Projections and Opportunities

There are many market factors that have a big impact on the Advanced Material Market. These factors shape its trends and growth direction. These things are very important for figuring out the supply, demand, and general market trends for new materials. There are a few main things that affect how the Advanced Material Market works: Rapid progress in technology is one of the main things that drives the Advanced Material Market. New advances in materials science, nanotechnology, and production methods help create better and new improved materials. New technologies allow for the creation of materials that are stronger, more conductive, and last longer, which raises demand in many areas. Many different areas, such as airplanes, cars, computing, and healthcare, need advanced materials, so they are in high demand. These areas will need more high-performance materials with certain qualities as they continue to grow, such as being safe, having light structures, and not melting when heated. People who care more about the environment are buying products that are better for the environment and last longer. More people want goods that are better for the environment, can be used more than once, and are more modern. Regulatory efforts and customer tastes for environmentally friendly goods are pushing the creation and use of long-lasting new materials. Policies and rules made by the government have a big effect on the Advanced Material Market. The market grows when laws, funds, and rewards are in place to encourage research and development in new materials. Tough rules about product safety, pollution, and the environment also affect the market by changing the materials that different businesses use. The cost and abundance of raw materials affect how much it costs to make new products. Changes in the prices of raw materials can affect how advanced material makers set their prices generally. Businesses can establish an upper hand in the market by having access to important raw materials, especially ones that are tough to find. Meanwhile, the industry is growing the fastest in developing nations like China, India, Singapore, and Indonesia. This means that more people will want to buy modern materials. This is helping the market for these materials grow. Like, BASF opened a new research center in Shanghai, China, in August 2022. The advanced materials and Systems Research Center Asia Pacific is a new research center that works on making new materials and technologies for many fields, such as computing, building, and cars. Indonesia's focus on technology and new ideas is what's making the market for smart materials grow. The government has put a lot of money into research and development, especially in the fields of materials science, nanotechnology, and advanced manufacturing. The Indonesian Ministry of study and Technology wants to create a national study center for advanced materials to help research and development in this area and grow businesses that are connected. Intense competition between market players leads to new ideas and the creation of new materials. To set themselves apart, businesses try to come up with new products that have better qualities or are more cost-effective. Competition also impacts price tactics, market share, and the Advanced Material Market's total growth.

Leave a Comment