Growing Demand for Functional Foods

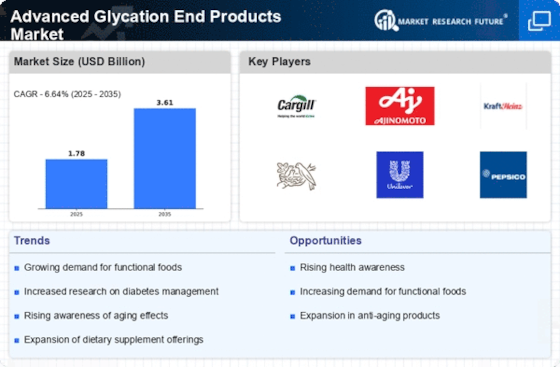

The consumer shift towards functional foods, which are perceived to offer health benefits beyond basic nutrition, is likely to bolster the Advanced Glycation End Products Market. As individuals become more health-conscious, there is an increasing interest in foods that can help reduce AGE levels in the body. Products enriched with antioxidants and other compounds that inhibit glycation are gaining traction. Market data indicates that the functional food sector is expected to grow at a compound annual growth rate of over 8% in the coming years. This trend suggests that the Advanced Glycation End Products Market could see a corresponding rise in demand for innovative food products that address AGE-related health concerns.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases such as diabetes and cardiovascular disorders appears to be a significant driver for the Advanced Glycation End Products Market. These conditions are often linked to elevated levels of advanced glycation end products, which are implicated in various complications. As healthcare systems increasingly focus on managing these diseases, the demand for products that can mitigate the effects of AGEs is likely to grow. According to recent estimates, the prevalence of diabetes alone is projected to reach 700 million by 2045, thereby amplifying the need for effective interventions. This trend suggests that the Advanced Glycation End Products Market may experience substantial growth as healthcare providers seek solutions to combat the detrimental effects of AGEs.

Rising Awareness of Aging and Skin Health

The growing awareness regarding the impact of AGEs on skin aging is likely to drive the Advanced Glycation End Products Market. Consumers are becoming increasingly informed about how AGEs contribute to skin damage and aging, leading to a surge in demand for skincare products that claim to combat these effects. The Advanced Glycation End Products Market is anticipated to reach over 200 billion by 2026, with a notable segment focusing on anti-aging solutions. This trend indicates that the Advanced Glycation End Products Market could see a rise in product offerings that specifically target AGE-related skin issues, thereby appealing to a broader consumer base.

Regulatory Support for Healthier Food Options

Regulatory frameworks aimed at promoting healthier food options are likely to influence the Advanced Glycation End Products Market positively. Governments and health organizations are increasingly advocating for reduced sugar and processed food consumption, which are primary contributors to AGE formation. Initiatives that encourage food manufacturers to reformulate products to lower AGE content may lead to a more favorable market environment. Recent policy changes in various regions have emphasized the need for transparency in food labeling, which could further drive consumer demand for AGE-conscious products. This regulatory support suggests that the Advanced Glycation End Products Market may experience growth as manufacturers adapt to meet new standards.

Technological Advancements in Food Processing

Technological innovations in food processing techniques are emerging as a pivotal driver for the Advanced Glycation End Products Market. Methods such as high-pressure processing and advanced cooking techniques are being developed to minimize the formation of AGEs in food products. These advancements not only enhance food safety but also improve nutritional profiles, aligning with consumer preferences for healthier options. The food processing industry is projected to witness a growth rate of approximately 5% annually, indicating a robust market for technologies that reduce AGEs. This evolution suggests that the Advanced Glycation End Products Market may benefit from increased collaboration between food technologists and health researchers to create AGE-reducing food solutions.