Declining Battery Costs

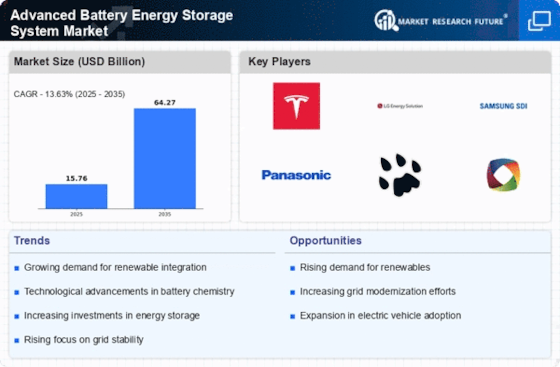

The Advanced Battery Energy Storage System Market is witnessing a notable decline in battery costs, which is a critical driver for market expansion. The cost of lithium-ion batteries has decreased by nearly 90% over the past decade, making energy storage solutions more accessible to a broader range of consumers and industries. This reduction in costs is likely to stimulate demand for advanced battery systems across various sectors, including residential, commercial, and industrial applications. As prices continue to fall, the market is expected to grow, with projections indicating a compound annual growth rate of over 20% through 2025.

Increasing Energy Storage Needs

The Advanced Battery Energy Storage System Market is experiencing a surge in demand due to the increasing need for energy storage solutions. As energy consumption rises, particularly in urban areas, the necessity for efficient energy management becomes paramount. This trend is further amplified by the growing integration of renewable energy sources, which often produce energy intermittently. According to recent data, the energy storage capacity is projected to reach over 300 GWh by 2025, indicating a robust growth trajectory. This increasing energy storage need is likely to drive investments in advanced battery technologies, thereby enhancing the overall market landscape.

Rising Electric Vehicle Adoption

The Advanced Battery Energy Storage System Market is significantly influenced by the rising adoption of electric vehicles (EVs). As governments and consumers alike prioritize sustainable transportation, the demand for high-capacity batteries is escalating. In 2025, it is estimated that the EV market will account for approximately 25% of total vehicle sales, necessitating advanced battery systems that can support longer ranges and faster charging times. This trend not only propels the battery storage market but also encourages innovations in battery technology, thereby fostering a competitive environment that benefits the Advanced Battery Energy Storage System Market.

Government Incentives and Support

The Advanced Battery Energy Storage System Market benefits significantly from government incentives and support aimed at promoting clean energy technologies. Various countries are implementing policies that encourage the adoption of energy storage systems, including tax credits, grants, and subsidies. These initiatives are designed to accelerate the transition to renewable energy and enhance energy security. As of 2025, it is projected that government funding for energy storage projects will surpass $10 billion, further propelling the growth of the Advanced Battery Energy Storage System Market and fostering innovation in battery technologies.

Enhanced Grid Stability Requirements

The Advanced Battery Energy Storage System Market is increasingly driven by the need for enhanced grid stability. As energy grids become more complex due to the integration of renewable energy sources, the demand for reliable energy storage solutions grows. Advanced battery systems can provide essential services such as frequency regulation and peak shaving, which are crucial for maintaining grid stability. In 2025, it is anticipated that the market for grid-scale energy storage will exceed 100 GWh, highlighting the critical role of advanced battery technologies in ensuring a stable and resilient energy infrastructure.