Adhesion Promoter Size

Adhesion Promoter Market Growth Projections and Opportunities

The Adhesion Promoter Market is influenced by various market factors that play a crucial role in shaping its dynamics. These factors collectively contribute to the growth, demand, and trends observed within the market. One significant factor is the increasing demand from end-use industries. As industries such as automotive, packaging, and construction continue to expand, there is a parallel rise in the need for adhesion promoters to enhance bonding capabilities in various applications. Adhesion promoters play a pivotal role in improving adhesion between dissimilar materials, a requirement in many manufacturing processes.

Moreover, the Adhesion Promoter Market is strongly influenced by advancements in technology. As research and development activities progress, new formulations and innovative solutions are introduced to the market. Manufacturers strive to develop adhesion promoters that not only offer superior performance but also meet the evolving regulatory standards. The integration of nanotechnology and other cutting-edge technologies has led to the development of more efficient and sustainable adhesion promoter products, thereby influencing market growth positively.

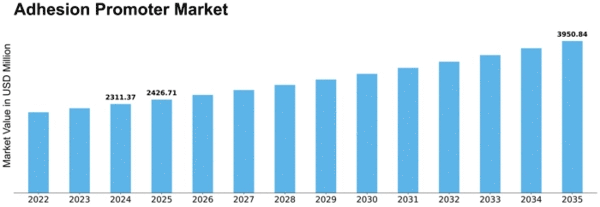

Adhesion Promoters Market size was valued at USD 3.40 Billion and was predicted to reachUSD 3.87 Billion by 2030, growing at a CAGR of 6.40% from 2021-2030.

The regulatory landscape is another vital factor shaping the Adhesion Promoter Market. Stringent environmental regulations and increasing awareness of sustainable practices have compelled manufacturers to focus on eco-friendly formulations. This shift towards environmentally responsible products has led to the development of bio-based adhesion promoters and alternatives with lower volatile organic compound (VOC) content. Compliance with regulations not only ensures market access but also aligns businesses with the growing global emphasis on sustainability.

Global economic conditions also play a pivotal role in influencing the Adhesion Promoter Market. Economic stability, fluctuations in currency exchange rates, and overall industrial growth impact the purchasing power of end-users and, subsequently, the demand for adhesion promoters. In times of economic prosperity, industries tend to invest more in research and development, leading to increased adoption of advanced adhesion promoter solutions.

Competitive factors are inherent in any market, and the Adhesion Promoter Market is no exception. The presence of multiple players, each striving to gain a competitive edge, results in continuous innovation and the introduction of diverse product portfolios. Companies engage in strategic initiatives such as mergers, acquisitions, and partnerships to expand their market presence. This competitive landscape fosters healthy market growth and encourages companies to enhance their offerings to meet the evolving needs of end-users.

Geographical factors also contribute significantly to the Adhesion Promoter Market. Regional variations in industrial activities, economic conditions, and regulatory frameworks influence the demand for adhesion promoters. For instance, regions with a robust automotive manufacturing sector may experience higher demand for adhesion promoters used in automotive applications. Understanding these geographical nuances is crucial for market players to tailor their strategies and tap into specific regional opportunities.

Customer preferences and changing market trends are key factors shaping the Adhesion Promoter Market. As end-users become more discerning, there is an increasing demand for adhesion promoters that not only improve bonding but also offer additional functionalities such as corrosion resistance, durability, and ease of application. Keeping a finger on the pulse of market trends enables manufacturers to align their product development strategies with evolving customer needs.

Leave a Comment