Market Share

Acrylonitrile Styrene Acrylate Market Share Analysis

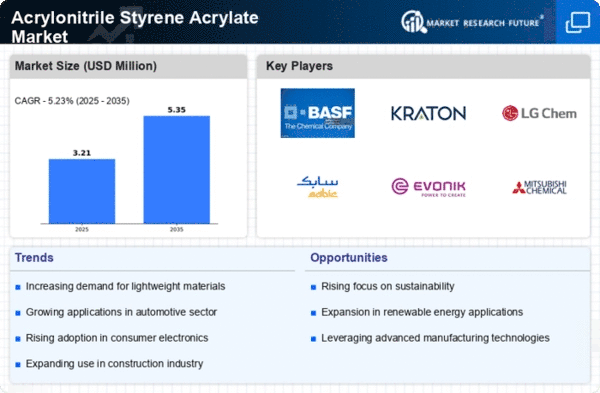

The Acrylonitrile Styrene Acrylate (ASA) market is one in which different firms employ different market share positioning strategies to gain dominance over it. One such popular strategy is differentiation, where companies try as much as possible to offer products that are superior or unique compared to those put out by others. Another key strategy is cost leadership, whereby a company aims to produce ASA materials at a relatively low cost without compromising its quality. The approaches used for production optimization include effective sourcing of raw materials as well as scaling of economies. By becoming a cost leader, firms can offer competitive prices to customers hence more chances of capturing larger shares. Nevertheless, there has always been a need for a balance between reduction in costs and maintaining product quality so as to achieve long-term success in this industry. Market share positioning in the ASA industry also includes market segmentation. Companies research their markets to identify different needs and wants of customers, which enables them to make products tailored specifically for certain segments. In addition to that, market share positioning within the ASA industry is reliant on collaboration and partnerships. These can include alliances with even raw material providers, distributors, or research institutions to improve their expertise. Partnership synergies help companies prepare themselves for sustainability by increasing their share of the market. Marketing and branding initiatives are essential as part of effective product-focused strategies aimed at achieving a good market share position. A strong brand presence creates customer loyalty and identification. This is a critical way for firms to grow using successful market share positions in the Acrylonitrile Styrene Acrylate (ASA) industry as they continue to look ahead. Research and development are required investments so as to design new, improved ASA materials ahead of competition in the marketplace. In summary, the Acrylonitrile Styrene Acrylate (ASA) industry is highly competitive, resulting in different types of market share positioning approaches used by companies. Among others, these include differentiation, cost leadership, segmentation, collaboration, branding, and innovation. Each strategy shapes the position of a company in relation to its competitors within this sector. Successful implementation of these strategies allows for easy navigation through competition, thereby enabling meeting customer preferences and capturing substantial volumes in this changing marketplace.

Leave a Comment