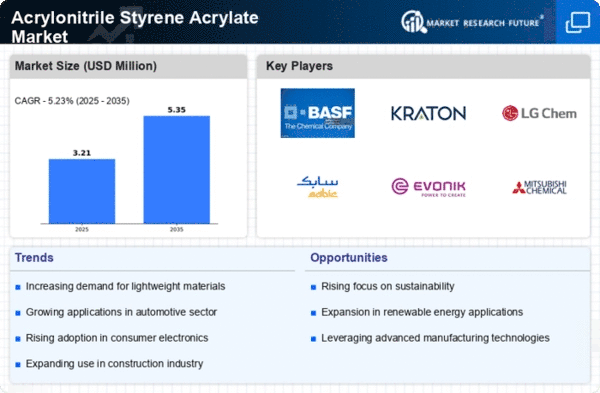

Market Growth Projections

The Global Acrylonitrile Styrene Acrylate Market Industry is projected to experience substantial growth over the coming years. With a market value anticipated to reach 992.1 USD Million in 2024 and further expand to 1899.3 USD Million by 2035, the industry is on a promising trajectory. This growth is underpinned by a compound annual growth rate of 6.08% from 2025 to 2035, indicating a robust demand across various sectors. The increasing applications of Acrylonitrile Styrene Acrylate Market in automotive, consumer electronics, and construction are likely to drive this expansion, reflecting the material's versatility and adaptability in meeting diverse market needs.

Expansion in Consumer Electronics

The Global Acrylonitrile Styrene Acrylate Market Industry is poised for growth due to its expanding applications in consumer electronics. The material's superior properties, such as high gloss finish and excellent processability, make it a preferred choice for manufacturers of electronic devices. With the increasing demand for lightweight and aesthetically appealing products, Acrylonitrile Styrene Acrylate Market is likely to see heightened usage in smartphones, laptops, and other gadgets. This sector's growth is anticipated to contribute significantly to the market, with projections indicating a rise to 1899.3 USD Million by 2035, showcasing the material's integral role in the consumer electronics landscape.

Growing Demand in Automotive Sector

The Global Acrylonitrile Styrene Acrylate Market Industry is experiencing a surge in demand from the automotive sector, driven by the need for lightweight and durable materials. Acrylonitrile Styrene Acrylate Market is increasingly utilized in automotive applications due to its excellent impact resistance and thermal stability. As manufacturers strive to enhance fuel efficiency and reduce emissions, the adoption of advanced materials like Acrylonitrile Styrene Acrylate Market is likely to rise. This trend is reflected in the projected market value, which is expected to reach 992.1 USD Million in 2024, indicating a robust growth trajectory fueled by the automotive industry's evolving requirements.

Rising Demand for Sustainable Materials

The Global Acrylonitrile Styrene Acrylate Market Industry is witnessing a shift towards sustainable materials, as environmental concerns gain prominence. Manufacturers are increasingly focusing on developing eco-friendly products that meet regulatory standards while maintaining performance. Acrylonitrile Styrene Acrylate Market, being recyclable and exhibiting low environmental impact, aligns with this trend. The growing emphasis on sustainability is likely to drive innovations in material formulations, enhancing the market's appeal. As industries adopt greener practices, the demand for Acrylonitrile Styrene Acrylate Market is expected to rise, contributing to a projected compound annual growth rate of 6.08% from 2025 to 2035.

Technological Advancements in Manufacturing

The Global Acrylonitrile Styrene Acrylate Market Industry is benefiting from technological advancements in manufacturing processes. Innovations such as improved polymerization techniques and enhanced processing methods are enabling manufacturers to produce high-quality Acrylonitrile Styrene Acrylate Market with greater efficiency. These advancements not only reduce production costs but also enhance the material's properties, making it more appealing for various applications. As manufacturers leverage these technologies, the market is likely to witness increased production capacity and product diversification, further driving growth. This trend is expected to support the market's expansion, aligning with the overall upward trajectory of the industry.

Increased Investment in Research and Development

The Global Acrylonitrile Styrene Acrylate Market Industry is experiencing increased investment in research and development, which is crucial for fostering innovation. Companies are allocating resources to explore new applications and improve existing formulations of Acrylonitrile Styrene Acrylate Market. This focus on R&D is likely to lead to the development of advanced materials that meet the evolving needs of various industries, including automotive, electronics, and construction. As a result, the market is expected to benefit from enhanced product offerings and improved performance characteristics, positioning Acrylonitrile Styrene Acrylate Market as a versatile solution in multiple sectors.