Rising Demand for Noise Control Solutions

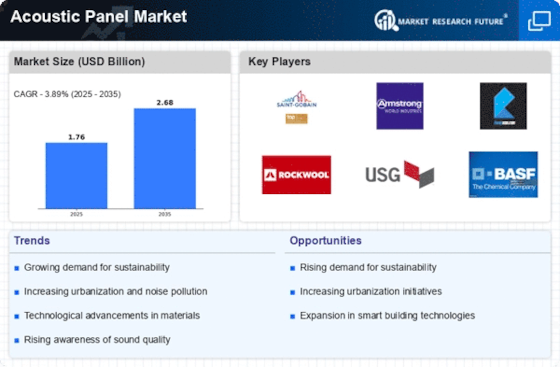

The Acoustic Panel Market experiences a notable increase in demand for effective noise control solutions across various sectors. Urbanization and population growth contribute to heightened noise pollution, prompting businesses and individuals to seek acoustic panels for soundproofing. In commercial spaces, such as offices and restaurants, the need for a conducive environment for communication and productivity drives the adoption of acoustic panels. According to recent estimates, the market for acoustic panels is projected to grow at a compound annual growth rate of approximately 7.5% over the next few years. This trend indicates a robust market potential, as more entities recognize the importance of sound management in enhancing user experience and overall satisfaction.

Increased Awareness of Health and Well-being

The Acoustic Panel Market is significantly influenced by the growing awareness of health and well-being among consumers. Research indicates that excessive noise can lead to various health issues, including stress and decreased productivity. As a result, there is a rising trend towards creating quieter environments in both residential and commercial settings. This awareness drives the demand for acoustic panels, which are essential in mitigating noise levels. The market is likely to see a surge in products designed specifically for health-conscious consumers, as they seek solutions that promote a healthier lifestyle. The integration of acoustic panels in schools, hospitals, and wellness centers further underscores this trend, as these environments prioritize sound control for improved outcomes.

Regulatory Support for Noise Control Measures

The Acoustic Panel Market is positively impacted by regulatory support for noise control measures in various sectors. Governments and regulatory bodies are increasingly recognizing the importance of sound management in urban planning and public health. Policies aimed at reducing noise pollution in residential and commercial areas are driving the adoption of acoustic panels. For instance, building codes and standards often mandate the use of sound-absorbing materials in specific environments, such as schools and hospitals. This regulatory framework creates a favorable environment for the acoustic panel market, as compliance with these regulations becomes essential for new constructions and renovations. Consequently, manufacturers are likely to see increased demand for their products as stakeholders seek to adhere to these guidelines.

Technological Innovations in Acoustic Materials

The Acoustic Panel Market benefits from ongoing technological innovations in acoustic materials. Advances in manufacturing processes and material science have led to the development of more effective and aesthetically pleasing acoustic panels. These innovations include the use of eco-friendly materials and enhanced sound absorption capabilities. The introduction of smart acoustic panels, which can adapt to changing sound environments, is also gaining traction. As consumers become more discerning about product performance and sustainability, the market is likely to expand. The integration of technology in acoustic solutions not only improves functionality but also aligns with the growing trend of sustainable building practices, making these products more appealing to environmentally conscious consumers.

Growth of the Construction and Renovation Sector

The Acoustic Panel Market is closely linked to the growth of the construction and renovation sector. As urban areas expand and existing structures undergo renovations, the need for effective soundproofing solutions becomes paramount. Acoustic panels are increasingly being integrated into new building designs and renovation projects to enhance acoustic comfort. The construction sector is projected to witness steady growth, driven by urban development and infrastructure projects. This growth presents a significant opportunity for acoustic panel manufacturers, as builders and architects seek to incorporate sound management solutions into their designs. The rising trend of open office layouts and collaborative spaces further fuels the demand for acoustic panels, as these environments require effective sound control to ensure productivity and comfort.