North America : Market Leader in Innovation

North America continues to lead the Accounting Software Consulting Services Market, holding a significant share of 9.25 billion. The region's growth is driven by technological advancements, increasing demand for cloud-based solutions, and a robust regulatory environment that encourages digital transformation. Companies are increasingly adopting automated accounting solutions to enhance efficiency and compliance, further propelling market growth.

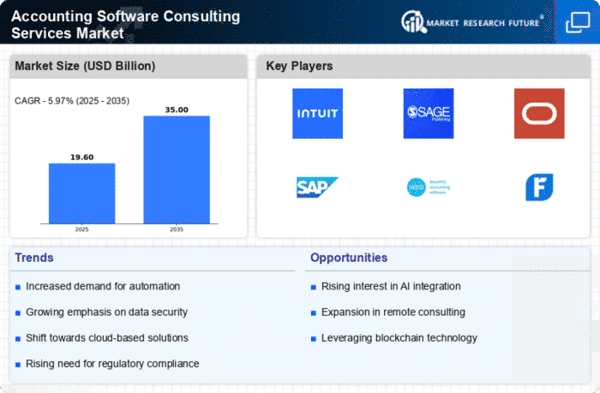

The competitive landscape is characterized by major players such as Intuit, Oracle, and Microsoft, which dominate the market with innovative offerings. The U.S. remains the largest contributor, supported by a strong startup ecosystem and investment in fintech. As businesses seek to streamline operations, the presence of established firms and emerging startups fosters a dynamic environment for accounting software consulting services.

Europe : Emerging Market with Growth Potential

Europe's Accounting Software Consulting Services Market is valued at 5.5 billion, driven by increasing regulatory compliance requirements and a shift towards digital solutions. The region is witnessing a surge in demand for integrated accounting systems that enhance transparency and efficiency. Regulatory bodies are promoting digitalization, which is expected to further stimulate market growth as businesses adapt to new compliance standards.

Leading countries like Germany, the UK, and France are at the forefront of this transformation, with key players such as SAP and Sage providing innovative solutions. The competitive landscape is evolving, with a mix of established firms and new entrants focusing on niche markets. The European market is poised for growth as businesses increasingly recognize the value of consulting services in navigating complex regulatory environments.

Asia-Pacific : Rapidly Growing Market Segment

The Asia-Pacific region, valued at 3.0 billion, is experiencing rapid growth in the Accounting Software Consulting Services Market. This growth is fueled by increasing digital adoption among SMEs and a rising awareness of the benefits of automated accounting solutions. Governments in countries like India and China are also promoting digital initiatives, which are expected to drive demand for consulting services in the accounting sector.

Key players such as Xero and Zoho are expanding their presence in this region, catering to the unique needs of local businesses. The competitive landscape is becoming more dynamic, with both The Accounting Software Consulting Services share. As the region continues to embrace digital transformation, the demand for accounting software consulting services is set to rise significantly, creating new opportunities for growth.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa region, valued at 1.75 billion, is an emerging market for Accounting Software Consulting Services. The growth is primarily driven by increasing digitalization efforts and a rising number of SMEs seeking efficient accounting solutions. Governments are investing in technology infrastructure, which is expected to enhance the adoption of accounting software and consulting services across various sectors.

Countries like South Africa and the UAE are leading the charge, with local firms and international players like FreshBooks establishing a foothold. The competitive landscape is evolving, with a focus on tailored solutions that meet regional needs. As businesses in this region recognize the importance of efficient accounting practices, the demand for consulting services is anticipated to grow, presenting significant opportunities for market players.