Integration of Advanced Analytics

The integration of advanced analytics into the Accounting And Budgeting Software Market is transforming how organizations manage their finances. Businesses are increasingly seeking software solutions that not only automate traditional accounting tasks but also provide predictive analytics and data visualization tools. This shift allows organizations to make informed financial decisions based on historical data and future projections. The market is witnessing a rise in demand for software that can analyze trends, forecast budgets, and identify potential financial risks. As organizations recognize the value of data analytics, the market for accounting and budgeting software is expected to expand significantly, with estimates suggesting a growth rate of around 10% annually in the coming years.

Growing Importance of Cybersecurity

In the Accounting And Budgeting Software Market, the growing importance of cybersecurity cannot be overlooked. As financial data becomes increasingly digitized, organizations are prioritizing the protection of sensitive information against cyber threats. This heightened focus on cybersecurity is driving demand for software solutions that incorporate robust security features, such as encryption and multi-factor authentication. Companies are more likely to invest in accounting software that not only meets their financial management needs but also ensures the safety of their data. The market is responding to this demand by developing solutions that comply with stringent security standards. As a result, the industry is expected to see a shift towards software that balances functionality with enhanced security measures.

Shift Towards Subscription-Based Models

The shift towards subscription-based models is reshaping the Accounting And Budgeting Software Market. Organizations are increasingly favoring software-as-a-service (SaaS) solutions that offer flexibility and scalability. This model allows businesses to access the latest features and updates without the burden of large upfront costs. Subscription-based accounting software often includes cloud storage, enabling users to access their financial data from anywhere. This trend is particularly appealing to startups and SMEs, which may prefer lower initial investments. Market analysis indicates that the SaaS segment of the accounting software industry is expected to grow at a CAGR of approximately 12% over the next few years, reflecting a broader acceptance of subscription models across various sectors.

Increased Demand for Financial Transparency

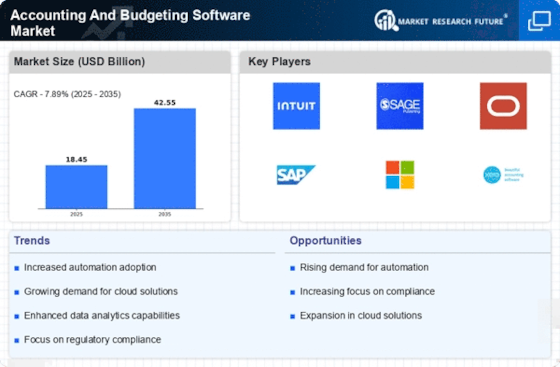

The Accounting And Budgeting Software Market experiences a notable surge in demand for financial transparency among organizations. Stakeholders, including investors and regulatory bodies, increasingly require detailed financial reporting and analysis. This trend is driven by the need for businesses to demonstrate accountability and maintain trust. As a result, companies are investing in advanced accounting and budgeting software solutions that provide real-time insights into financial performance. According to recent data, the market for such software is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years. This growth reflects a broader shift towards data-driven decision-making, where organizations leverage technology to enhance their financial reporting capabilities.

Rise of Small and Medium Enterprises (SMEs)

The rise of small and medium enterprises (SMEs) is a pivotal driver in the Accounting And Budgeting Software Market. As SMEs continue to proliferate, there is an increasing need for accessible and affordable financial management solutions. These businesses often lack the resources to maintain extensive accounting departments, leading them to seek software that simplifies budgeting and financial reporting. The market is responding to this demand by offering tailored solutions that cater specifically to the needs of SMEs. Recent statistics indicate that SMEs account for over 90% of businesses in many regions, highlighting the potential for growth in the accounting software sector. This trend suggests that the industry will continue to evolve, focusing on user-friendly interfaces and cost-effective pricing models.