North America : Market Leader in Consulting Services

North America continues to lead the Accounting and Auditing Consulting Services market, holding a significant share of 315.0 million in 2024. The region's growth is driven by a robust regulatory environment, increasing demand for compliance, and technological advancements in financial reporting. The rise of digital transformation initiatives has further fueled the need for consulting services, as businesses seek to enhance operational efficiency and transparency.

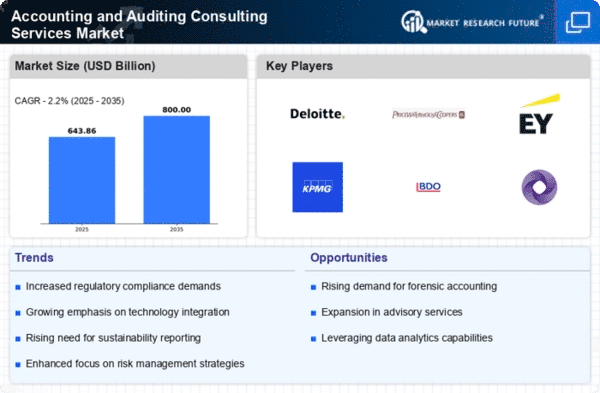

The competitive landscape is characterized by the presence of major players such as Deloitte, PricewaterhouseCoopers, and Ernst & Young, which dominate the market. The U.S. remains the largest contributor, supported by a strong economy and a high concentration of multinational corporations. This competitive environment fosters innovation and service diversification, ensuring that North America maintains its leadership position in the global market.

Europe : Emerging Hub for Consulting Services

Europe's Accounting and Auditing Consulting Services market is projected to reach 210.0 million by 2025, driven by increasing regulatory requirements and a focus on sustainability. The region is witnessing a shift towards digital solutions, enhancing the efficiency of auditing processes. Additionally, the European Union's stringent regulations on financial reporting are catalyzing demand for consulting services, as companies strive to comply with evolving standards.

Leading countries such as Germany, the UK, and France are at the forefront of this growth, with a competitive landscape featuring firms like KPMG and BDO International. The presence of established players and a growing number of startups in the fintech space are reshaping the market dynamics. As businesses adapt to new regulations, the demand for specialized consulting services is expected to rise significantly.

Asia-Pacific : Rapidly Growing Market Potential

The Asia-Pacific region is emerging as a significant player in the Accounting and Auditing Consulting Services market, with a projected size of 90.0 million by 2025. The growth is fueled by increasing economic activity, foreign investments, and a rising middle class demanding better financial services. Regulatory reforms in countries like India and China are also enhancing the need for compliance and auditing services, creating a favorable environment for consulting firms.

Countries such as China, India, and Australia are leading this growth, with a mix of local and international firms competing for market share. Key players like Crowe and Grant Thornton are expanding their presence, leveraging technology to offer innovative solutions. As the region continues to develop, the demand for high-quality consulting services is expected to rise, driven by both regulatory and market forces.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region, while smaller in size at 15.0 million, is gradually developing its Accounting and Auditing Consulting Services market. The growth is driven by increasing investments in infrastructure and a push for regulatory compliance across various sectors. Governments are focusing on enhancing transparency and accountability, which is creating opportunities for consulting firms to offer their expertise in auditing and financial advisory services.

Countries like South Africa and the UAE are leading the market, with a growing number of local and international firms entering the space. The competitive landscape is evolving, with firms like Baker Tilly and RSM International expanding their services. However, challenges such as political instability and varying regulatory environments may impact growth prospects in the region.