Abrasion Resistant Coatings Size

Abrasion Resistant Coatings Market Growth Projections and Opportunities

The dynamics and growth trajectory of the market for abrasion-resistant coatings is influenced by several factors. Notably, this reflects a rising demand for resistant surfaces across multiple industrial sectors. Abusive materials involve protective tarnished areas on surfaces which are preserved from friction, erosion, and abrasion through use of abrasion-resistant coatings. This has been manifested in many industries such as manufacturing, automotive, mining and aerospace where machines and equipment operate under harsh conditions.

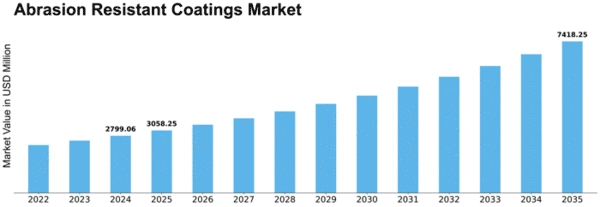

The market for abrasion-resistant coatings is projected to grow at a CAGR exceeding 6%, increasing by around USD 11.8 billion over the forecast period (2021-2030).

Again, construction and infrastructural development drive the need for these coatings. The protective coverings become more essential as infrastructure materials get exposed to environmental elements while construction projects continue to increase in size. It not only protects concrete or metals longevity but also contributes towards the strength of an entire structure. Moreover, the rise in infrastructure investments globally fuels this factor further.

Additionally, changing manufacturing landscape accompanied with calls for technological progression define the shape of the market for abrasion-resistant coatings. That is why industries have made it possible by searching novel techniques that will make their products perform better and last longer. For example producers of such kinds of paints nowadays come up with versions capable of providing high protection against wearing out due to frictional forces acts or corrosion processes occurring inside any unit constructed paintwise; thus creating competitive global manufacturers who strive at producing top-notch coating solutions with enhanced performance.

Most importantly however, because they are becoming increasingly sophisticated and advanced over time; thus implying there is great need to provide coats that can guard ultimate parts against attrition and falling out; vehicle industry appears as one where these paints are highly demanded hence requiring their application on various automotive parts including engine components like pistons suspension systems among others thereby leading to its steady growth.

Furthermore, tightening environmental regulations alongside growing concerns about sustainability impact on the abrasion-resistant coatings market. As a result, corporations are making eco-friendly products with a view to ensuring that certain materials are used according to strict regulations imposed by the government. In addition, they have been using water-based and low-VOC (volatile organic compound) abrasion-resistant coatings as per environmental laws thereby meeting the demand for sustainable coating solutions. This way is also being considered as friendly dealing with environment while facilitating other industries in the world talking about this point concerning abrasion resistant coatings.

Leave a Comment