Market Growth Projections

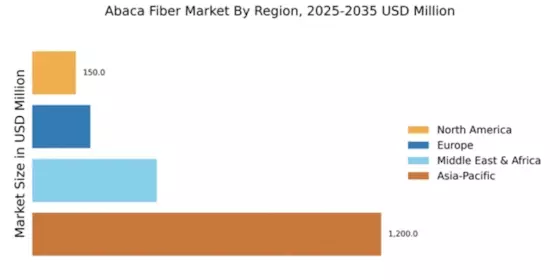

The Global Abaca Fiber Market Industry is projected to experience substantial growth in the coming years. With a market value anticipated to reach 450 USD Million in 2024 and potentially expanding to 1200 USD Million by 2035, the industry is on a promising trajectory. The compound annual growth rate of 9.33% from 2025 to 2035 indicates a robust demand for abaca fiber across various sectors. This growth is driven by factors such as increasing consumer preference for sustainable materials, government initiatives supporting abaca cultivation, and the diversification of applications in industries ranging from textiles to automotive.

Growth in the Textile Industry

The Global Abaca Fiber Market Industry is significantly influenced by the expansion of the textile industry. Abaca fiber, with its unique properties such as strength and durability, finds extensive applications in the production of high-quality textiles. As the global textile market continues to grow, driven by increasing consumer demand for natural fibers, abaca fiber is poised to benefit. The market is expected to witness a compound annual growth rate of 9.33% from 2025 to 2035, indicating a robust future for abaca fiber in textile manufacturing. This growth is likely to be supported by innovations in processing techniques that enhance the fiber's appeal.

Consumer Awareness and Education

Consumer awareness regarding the benefits of natural fibers is a driving force in the Global Abaca Fiber Market Industry. As consumers become more informed about the environmental and health advantages of using natural materials, the demand for abaca fiber products is likely to increase. Educational campaigns highlighting the properties of abaca, such as its hypoallergenic nature and durability, contribute to changing consumer preferences. This heightened awareness not only fosters a market for abaca-based products but also encourages manufacturers to invest in sustainable practices. Consequently, the market is expected to grow significantly, reflecting a shift towards more responsible consumption.

Government Support and Initiatives

Government support plays a crucial role in the Global Abaca Fiber Market Industry, as various countries implement initiatives to promote the cultivation and utilization of abaca. These initiatives often include financial incentives for farmers, research funding for sustainable practices, and marketing support for abaca products. For instance, in the Philippines, which is the largest producer of abaca, government programs aim to enhance production efficiency and market access for local farmers. Such support not only boosts the supply of abaca fiber but also encourages its adoption in various industries, thereby contributing to the market's growth trajectory.

Rising Demand for Eco-Friendly Products

The Global Abaca Fiber Market Industry experiences a notable surge in demand for eco-friendly products. As consumers increasingly prioritize sustainability, abaca fiber, known for its biodegradability and low environmental impact, becomes a preferred choice for various applications. This trend is particularly evident in the textile and packaging sectors, where companies seek sustainable alternatives to synthetic fibers. The market is projected to reach 450 USD Million in 2024, reflecting a growing awareness of environmental issues. This shift towards sustainable materials is likely to drive innovation and investment in the abaca fiber sector, positioning it favorably in the global market.

Increasing Applications in Diverse Industries

The versatility of abaca fiber contributes to its rising prominence in the Global Abaca Fiber Market Industry. Beyond textiles, abaca is increasingly utilized in diverse sectors such as automotive, construction, and home furnishings. Its strength and lightweight characteristics make it an attractive option for composite materials in automotive manufacturing, while its aesthetic appeal enhances interior design applications. As industries seek innovative materials that combine performance with sustainability, the demand for abaca fiber is likely to expand. This diversification of applications is expected to support the market's growth, potentially reaching 1200 USD Million by 2035.