Emergence of Smart Cities

The emergence of smart cities is a transformative trend that is propelling the 5G Optical Transceiver Market forward. As urban areas increasingly adopt smart technologies for traffic management, energy efficiency, and public safety, the demand for high-speed, reliable communication networks becomes paramount. Smart city initiatives often rely on extensive sensor networks and data analytics, which require advanced optical transceivers to handle the vast amounts of data generated. The market for smart city technologies is expected to reach several hundred billion dollars by 2025, indicating a substantial opportunity for the 5G Optical Transceiver Market to provide the necessary infrastructure for these innovations. This trend highlights the intersection of urban development and telecommunications, emphasizing the importance of optical solutions in shaping the cities of the future.

Expansion of 5G Infrastructure

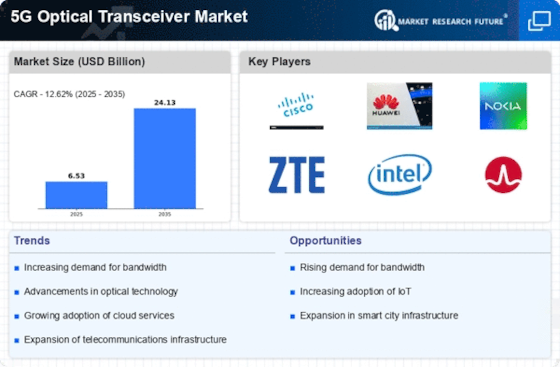

The ongoing expansion of 5G infrastructure is a key driver for the 5G Optical Transceiver Market. Telecommunications companies are investing heavily in building out their 5G networks to meet the increasing demand for faster and more reliable connectivity. This expansion is projected to result in a market growth rate of approximately 30% annually over the next few years. Optical transceivers play a vital role in this infrastructure, facilitating high-speed data transmission over fiber optic networks. As more cities and regions adopt 5G technology, the demand for optical transceivers that can support these networks is likely to rise, further solidifying the importance of the 5G Optical Transceiver Market in modern telecommunications.

Increased Adoption of Cloud Services

The rising adoption of cloud services is significantly influencing the 5G Optical Transceiver Market. As businesses and consumers increasingly rely on cloud-based applications for storage, computing, and data processing, the demand for high-speed optical transceivers is expected to rise. The cloud services market is projected to grow at a compound annual growth rate of over 20% in the coming years, which will likely drive the need for robust optical infrastructure. Optical transceivers are essential for ensuring fast and reliable connections between data centers and end-users, thereby supporting the seamless operation of cloud services. This trend underscores the critical role of the 5G Optical Transceiver Market in facilitating the digital transformation of various sectors.

Rising Demand for Enhanced Bandwidth

The 5G Optical Transceiver Market is experiencing a surge in demand for enhanced bandwidth capabilities. As data consumption continues to escalate, driven by the proliferation of high-definition video streaming, online gaming, and cloud computing, the need for robust optical transceivers becomes increasingly critical. Reports indicate that the global data traffic is expected to reach 175 zettabytes by 2025, necessitating advanced optical solutions to manage this influx. Consequently, manufacturers are focusing on developing transceivers that can support higher data rates and longer distances, thereby ensuring seamless connectivity. This trend not only enhances user experience but also positions the 5G Optical Transceiver Market as a pivotal player in the telecommunications landscape.

Integration with Artificial Intelligence

The integration of artificial intelligence (AI) into telecommunications is emerging as a significant driver for the 5G Optical Transceiver Market. AI technologies are being utilized to optimize network performance, enhance data management, and improve user experiences. This integration allows for more efficient routing of data and better resource allocation, which is essential for the high-speed demands of 5G networks. As AI continues to evolve, its application in the 5G Optical Transceiver Market is expected to grow, potentially leading to innovations in transceiver design and functionality. This trend indicates a shift towards smarter, more adaptive optical solutions that can meet the dynamic needs of modern communication.