Enhanced Safety and Security Features

Safety and security are paramount in the 5G In Automotive And Smart Transportation Market, driving the adoption of advanced technologies. The implementation of 5G networks enables vehicles to communicate with each other and with infrastructure, significantly enhancing safety features. For instance, vehicle-to-vehicle (V2V) communication can alert drivers to potential hazards, reducing the likelihood of accidents. The market for automotive safety systems is projected to grow substantially, with estimates suggesting a value of over 30 billion by 2026. Furthermore, 5G technology supports the development of advanced driver-assistance systems (ADAS), which are crucial for improving road safety. As consumers prioritize safety in their vehicle choices, the demand for 5G-enabled safety features is likely to increase.

Growing Interest in Electric Vehicles

The growing interest in electric vehicles (EVs) is a significant driver in the 5G In Automotive And Smart Transportation Market. As the automotive sector shifts towards electrification, the integration of 5G technology becomes essential for optimizing EV performance and infrastructure. 5G networks facilitate efficient charging solutions, enabling real-time monitoring of charging stations and vehicle status. The EV market is anticipated to reach a valuation of over 800 billion by 2027, with 5G playing a crucial role in enhancing user experience and operational efficiency. Additionally, the combination of 5G and EV technology supports the development of smart grids, which are vital for managing energy consumption and distribution. This synergy is expected to accelerate the adoption of electric vehicles, further transforming the automotive landscape.

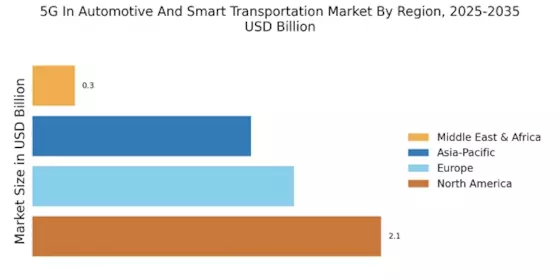

Integration of Smart City Initiatives

The integration of smart city initiatives is significantly influencing the 5G In Automotive And Smart Transportation Market. As urban areas evolve into smart cities, the demand for interconnected transportation systems increases. 5G technology supports the development of smart traffic management systems, which optimize traffic flow and reduce congestion. It is estimated that smart city investments could exceed 2 trillion by 2025, with transportation being a key focus area. The implementation of 5G networks allows for real-time data collection and analysis, enabling cities to respond dynamically to traffic conditions. This integration not only enhances the efficiency of urban transportation but also contributes to sustainability goals by reducing emissions and improving air quality.

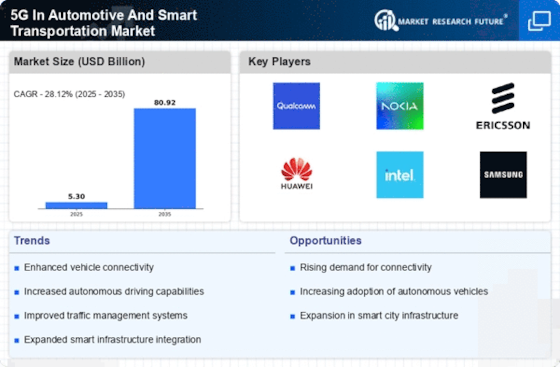

Increased Demand for High-Speed Connectivity

The demand for high-speed connectivity in the 5G In Automotive And Smart Transportation Market is surging, driven by the need for real-time data exchange between vehicles and infrastructure. As vehicles become more connected, the requirement for low-latency communication is paramount. According to recent estimates, the number of connected vehicles is projected to reach over 600 million by 2025, necessitating robust 5G networks. This connectivity enables advanced features such as real-time traffic updates, remote diagnostics, and enhanced navigation systems. Consequently, automotive manufacturers are increasingly investing in 5G technology to meet consumer expectations for seamless connectivity and improved driving experiences. The integration of 5G is likely to redefine the automotive landscape, fostering innovation and enhancing safety measures.

Advancements in Autonomous Driving Technologies

The evolution of autonomous driving technologies is a pivotal driver in the 5G In Automotive And Smart Transportation Market. As manufacturers strive to develop fully autonomous vehicles, the reliance on 5G networks becomes critical. These networks facilitate the necessary communication between vehicles, sensors, and infrastructure, enabling real-time decision-making. Research indicates that the autonomous vehicle market could reach a valuation of over 500 billion by 2030, with 5G playing a crucial role in this transformation. Enhanced data processing capabilities and reduced latency provided by 5G networks are essential for the safe operation of autonomous vehicles. This technological synergy is expected to accelerate the adoption of autonomous driving solutions, thereby reshaping transportation dynamics.