4d Printing Healthcare Size

Market Size Snapshot

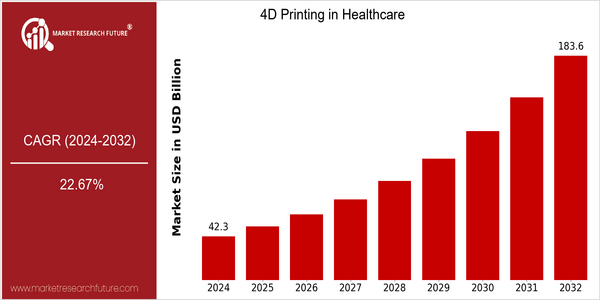

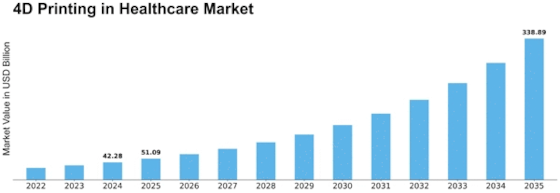

| Year | Value |

|---|---|

| 2024 | USD 42.28 Billion |

| 2032 | USD 183.64 Billion |

| CAGR (2024-2032) | 22.67 % |

Note – Market size depicts the revenue generated over the financial year

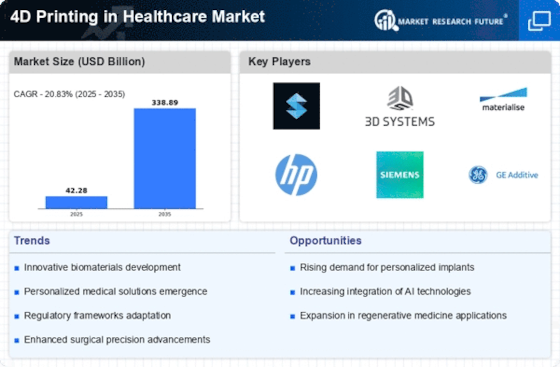

The market for four-dimensional printing in medicine is expected to grow at a CAGR of 21.7% from 2024 to 2032, with a market size of USD 42.28 billion in 2024, estimated to reach USD 183.64 billion by 2032. This high growth rate corresponds to a CAGR of 22.67% for the forecast period. The growing demand for individualized medicine, the technological advances in bioprinting, the increase in the prevalence of chronic diseases are the main factors driving this market. The medical industry is looking for new solutions to improve patient outcomes. Four-dimensional printing can produce dynamic and responsive medical devices and tissue constructs that adapt to the physiological environment of the body. This is in addition to the integration of smart materials and the development of sophisticated printing methods. At the forefront of this innovation are companies such as Organovo, which specializes in bioprinting human tissues, and 3D Systems, which offers a wide range of four-dimensional printing solutions. Strategic initiatives, such as the signing of agreements with research institutions and the investment in R & D, are enabling these companies to develop their products and services and extend their market share. Moreover, the medical industry continues to embrace four-dimensional printing, which will lead to a strong market growth, mainly driven by the need for more effective and individualized treatments.

Regional Market Size

Regional Deep Dive

Throughout the world, the four-dimensional printing in the medical field is undergoing a significant change, owing to technological advancements, increasing demand for individualized medicine, and the need for new solutions in patient care. Each region has its own distinctive characteristics, influenced by local health systems, regulatory environments, and cultural attitudes to technology adoption. Consequently, as clinicians and academics explore the potential of four-dimensional printing to produce dynamic, responsive medical devices and tissue-engineering solutions, the market is primed for transformative developments, suited to the needs of the individual region.

Europe

- The European Union is funding several research initiatives aimed at integrating 4D printing into healthcare, with projects like the '4D-Health' initiative focusing on developing smart materials for medical applications.

- Countries like Germany and the Netherlands are leading in the adoption of 4D printing technologies, driven by strong collaborations between universities and healthcare providers, which are expected to foster innovation and commercialization.

Asia Pacific

- China is rapidly advancing in the 4D printing space, with government support for research and development in bioprinting technologies, which is expected to enhance the country's capabilities in personalized medicine.

- Japanese companies, such as Fujifilm, are exploring the use of 4D printing for regenerative medicine, focusing on creating scaffolds that can adapt to the body's needs, which could revolutionize tissue engineering.

Latin America

- Brazil is emerging as a hub for 4D printing research, with universities collaborating on projects that aim to develop smart medical devices tailored to local healthcare challenges.

- Regulatory bodies in Latin America are beginning to recognize the potential of 4D printing, leading to a more favorable environment for innovation and investment in healthcare technologies.

North America

- The U.S. Food and Drug Administration (FDA) has recently streamlined the regulatory pathway for 3D and 4D printed medical devices, which is expected to accelerate the approval process for innovative healthcare solutions in the region.

- Key players like Stratasys and 3D Systems are investing heavily in R&D for 4D printing technologies, focusing on applications such as bioprinting and smart implants, which are anticipated to enhance patient outcomes.

Middle East And Africa

- The UAE is investing in healthcare innovation, with initiatives like the Dubai Health Authority's focus on integrating advanced technologies, including 4D printing, into their healthcare system to improve patient care.

- South Africa is seeing growth in 4D printing applications for prosthetics and orthotics, driven by local startups that are leveraging this technology to provide affordable solutions for patients.

Did You Know?

“4D printing technology can create objects that change shape or function over time when exposed to external stimuli, such as temperature or moisture, making it particularly valuable for developing adaptive medical devices.” — Journal of Medical Devices

Segmental Market Size

The field of four-dimensional printing in medicine is growing rapidly. It is driven by developments in bioprinting and personal medicine. Customized prostheses and implants and regenerative medicine that can adapt to individual conditions are driving the market. The regulatory framework is also favourable, encouraging investment and development in four-dimensional printing. The field is currently in the pilot phase, with notable examples including research at the University of Pennsylvania into four-dimensionally printed organs and tissues and the work of companies such as Organovo, which specializes in the bioprinting of human tissue. The main applications are in the area of dynamic scaffolds for tissue engineering and smart, biologically responsive implants. The pandemic of COV 19 and the rapid prototyping trend are increasing the focus on on-demand production and the use of bio-based materials. The future of four-dimensional printing in medicine is also dependent on developments in shape-memory polymers and programmable materials.

Future Outlook

4D printing in the medical field is expected to grow rapidly from 2024 to 2032, and the market value is expected to grow from 42.28 million to 183.64 million, with a high annual growth rate of 22.67%. , mainly driven by the development of bioprinting technology, which can print dynamic and flexible medical devices and tissue. Constructs that can adapt to the environment. Also, with the increasing demand for individualized medicine and regenerative medicine, the demand for 4D printing solutions is expected to increase significantly, and the penetration rate of 4D printing solutions is expected to reach 15% to 20% in some special fields by 2032. , driven by the development of smart materials that can change shape and function. This will greatly improve the performance of medical devices and achieve better clinical results. The development of 4D printing in the medical field is also driven by the government's support for medical technology innovation and the accelerated development of medical technology. Also, the trend of combining artificial intelligence into the design process and the use of 4D printing in surgical applications will also be able to play a major role in the future development of this industry. Also, the 4D printing industry will also be able to make a great leap forward, enabling it to become a leader in medical technology innovation.

Leave a Comment