Expansion of 5G Technology

The 3D Stacking Market is poised for growth due to the expansion of 5G technology. As telecommunications companies roll out 5G networks, there is a heightened demand for advanced electronic components that can support the increased data speeds and connectivity requirements. 3D stacking technology enables the integration of multiple functionalities into a single package, which is essential for the development of 5G-enabled devices. The 5G market is projected to reach a valuation of over 700 billion dollars by 2025, indicating a substantial opportunity for the 3D Stacking Market to capitalize on this trend. As more devices become 5G-compatible, the demand for innovative packaging solutions will likely intensify.

Increased Focus on Sustainability

The 3D Stacking Market is increasingly aligned with the global focus on sustainability. As environmental concerns gain prominence, manufacturers are seeking ways to reduce waste and improve energy efficiency in electronic devices. 3D stacking technology contributes to sustainability by minimizing the number of materials used and enhancing the energy efficiency of devices. This is particularly relevant in the context of regulatory pressures and consumer preferences for eco-friendly products. The market for sustainable electronics is anticipated to grow, with projections indicating a potential increase of 15% annually over the next five years. This trend suggests that the 3D Stacking Market will play a crucial role in the transition towards more sustainable electronic solutions.

Growing Need for Space-Saving Solutions

The 3D Stacking Market is propelled by the growing need for space-saving solutions across various applications. As urbanization increases, the demand for compact and efficient electronic devices rises. 3D stacking technology allows manufacturers to optimize space by vertically integrating components, which is particularly advantageous in sectors such as automotive and telecommunications. This trend is further supported by the increasing adoption of Internet of Things (IoT) devices, which require efficient use of space to accommodate numerous functionalities. The market for IoT devices is projected to expand significantly, potentially reaching over 1 trillion dollars by 2025, thereby enhancing the relevance of the 3D Stacking Market in meeting these space-saving demands.

Advancements in Semiconductor Technology

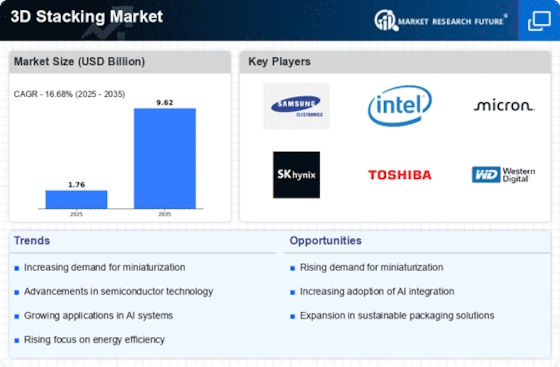

The 3D Stacking Market is significantly influenced by advancements in semiconductor technology. Innovations in materials and manufacturing processes have enabled the development of more efficient and compact semiconductor devices. These advancements facilitate the stacking of multiple layers of chips, which enhances performance while reducing the overall footprint of electronic devices. As semiconductor manufacturers continue to invest in research and development, the 3D stacking technology is likely to become more prevalent. The semiconductor market is expected to reach a valuation of over 600 billion dollars by 2025, indicating a robust growth trajectory that will likely benefit the 3D Stacking Market as it aligns with the increasing demand for miniaturized electronic components.

Rising Demand for High-Performance Electronics

The 3D Stacking Market is experiencing a surge in demand for high-performance electronics, driven by the proliferation of advanced consumer devices. As technology evolves, consumers increasingly seek devices that offer enhanced performance and efficiency. This trend is particularly evident in sectors such as smartphones, tablets, and laptops, where compact design and superior functionality are paramount. The 3D stacking technology allows for greater integration of components, thereby facilitating the development of smaller yet more powerful devices. According to recent data, the market for high-performance electronics is projected to grow at a compound annual growth rate of approximately 10% over the next five years, further propelling the 3D Stacking Market as manufacturers strive to meet consumer expectations.