Market Trends

Key Emerging Trends in the 3D Printed Battery Market

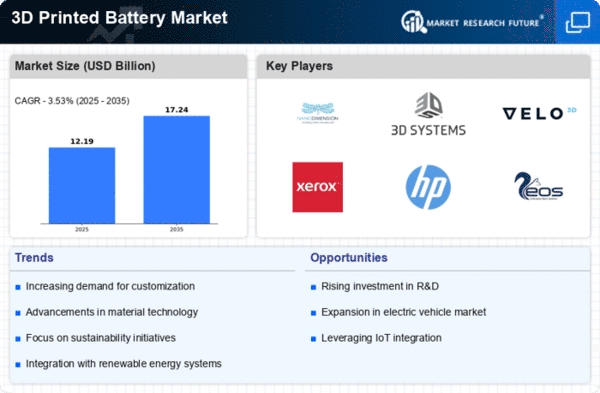

The 3D Printed Battery Market is exhibiting a compound annual growth rate (CAGR) of 19.54% during the forecast period (2023 - 2030). The 3D Printed Battery Market is witnessing a surge in innovative strategies as companies vie for a larger market share. One prominent positioning strategy involves differentiation through technology. Businesses are heavily endowed with money for research and development in order to design batteries which have improved performance and unique features. Through the integration of state-of-the-art 3D printing, these batteries can be designed to have complex structures that enhance energy storing and discharging functionality. Luckily, they not only attract the tech-savvy customers but also they represent the best examples for the advanced energy solutions.

Another noticed market share positioning strategy is cost leadership. Other companies are paying attention to and focusing on improving production processes and economies of scale so that they can offer batteries at a low cost before their competitors. This goal is to attract a weighty customer group with the price-conscious mindset who prefer buying quality products without sacrificing it at a lower cost. Through effective optimization of the production and supply chain processes, companies will achieve the status of the ultimate brands for the people who are heading the cost and strive to buy absolutely reliable 3D batteries.

Besides, sustainability is gaining importance as one of the major segmentation factors in terms of market share within the 3D Printed Battery Market. Influenced by the growing importance of environmental issues, consumers today are not only interested in buying eco-friendly and sustainable goods but also want the products to be environmentally friendly. Integration of eco-friendly manufacturing technology and green materials in the production of 3D printing batteries could help companies promote the image of their economic activity as efficient and socially responsible. This practice not only captures the new rising segment of the consumers who are aware of the environment but it is also the direction of the globalization strategies for the green future.

Customer-centric approach is also a principal factor of market positioning. Some companies are focusing on understanding and catering to the specific needs of their target audience. This involves offering customization options, such as personalized designs, sizes, and energy capacities, to meet diverse consumer preferences. By positioning themselves as customer-focused, companies can build brand loyalty and gain a competitive advantage in a market where consumer demands are continually evolving.

Leave a Comment