Market Share

3D Printed Battery Market Share Analysis

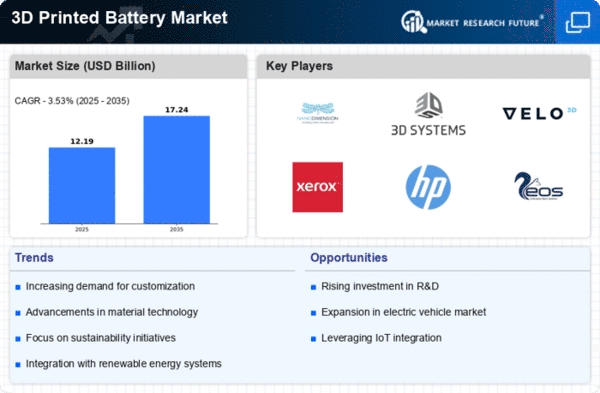

The global 3D Printed Battery market is expected to reach USD 90.08 billion by 2030, at a CAGR of 19.54% during the forecast period. The North America region accounted for the fastest-growing global market. The 3D printed battery market is experiencing significant growth, driven by a confluence of technological advancements and increasing demand for energy storage solutions across various industries. Among major market tends is the ongoing development of new materials for 3D printing batteries. Manufacturers evaluate new types of materials with the improved conductivity, wearability, and safety features to create batteries 3D printed at the highest performance.

Another noticeable factor in 3D printed battery industry is the use of advanced manufacturing processes like, multi-material and multi-process 3D printing. This is achieved through these techniques that solely allow for the creation of very small, intricate battery designs with complex geometries which were quite difficult to achieve before. Consequently, a lot of laptops can now be personalized to fit particular devices or be fitted into odd spaces, streamlining the process of design and application.

Markets have been experiencing a rise in R&D activity that concentrates on increasing the energy density of 3D printed batteries. Battery energy density is the key determinant of their overall performance and researchers are extensively engaged to advance the existing electrode structures as well as enhance the operational efficiency of functional components in order to increase it. On the other hand, this will create an opportunity for the battery industry to innovate more, producing solutions with higher energy storage capacities, which can power more powerful and longer lasting energy sources, which will be used in many applications.

Moreover the 3D printed battery sector is enjoying accelerating demand in the electronics and consumer goods industry. Permitting for the battery design to be customized to define an application, extensible for the rapid prototyping and production elevates 3D printed battery printing an attractive attitude to the manufacturers of the above-said industries. This trend is expected to continue as more companies recognize the advantages of 3D printing in achieving product differentiation and meeting the evolving demands of consumers for compact, lightweight, and high-performance electronic devices.

Leave a Comment