Growing Focus on Contamination Control

The 300 Mm Wafer Front Opening Unified Pod Market is significantly impacted by the heightened emphasis on contamination control within semiconductor manufacturing. As the industry evolves, the need for cleanroom environments and contamination-free processes becomes paramount. The use of front opening unified pods is essential in maintaining the integrity of wafers during transport and storage. According to industry reports, contamination can lead to substantial yield losses, prompting manufacturers to invest in advanced pod solutions. This focus on contamination control not only enhances product quality but also drives the demand for innovative pod designs that meet stringent cleanliness standards, thereby fostering growth in the market.

Sustainability and Eco-Friendly Practices

Sustainability initiatives are increasingly shaping the 300 Mm Wafer Front Opening Unified Pod Market. As environmental concerns gain prominence, semiconductor manufacturers are seeking eco-friendly solutions that minimize waste and energy consumption. The adoption of sustainable materials in the production of front opening unified pods is becoming more prevalent, aligning with the industry's commitment to reducing its carbon footprint. Reports suggest that companies implementing sustainable practices can achieve cost savings and improve their market competitiveness. This shift towards sustainability not only addresses regulatory pressures but also resonates with consumers who prioritize environmentally responsible products. As a result, the demand for innovative, sustainable pod solutions is likely to grow, further driving the market.

Technological Advancements in Wafer Handling

Technological innovations in wafer handling systems are significantly influencing the 300 Mm Wafer Front Opening Unified Pod Market. Enhanced automation and robotics are being integrated into wafer handling processes, which improves precision and reduces the risk of contamination. For instance, the introduction of smart pods equipped with sensors and IoT capabilities allows for real-time monitoring of environmental conditions. This advancement not only optimizes the manufacturing process but also aligns with the industry's focus on contamination control. As semiconductor manufacturers increasingly adopt these technologies, the demand for advanced front opening unified pods is likely to rise, reflecting a shift towards more efficient and reliable production methods.

Expansion of Semiconductor Manufacturing Facilities

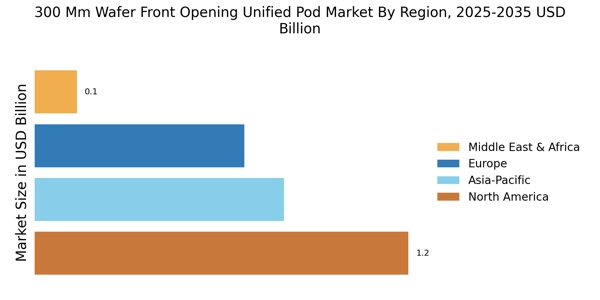

The expansion of semiconductor manufacturing facilities is a critical driver for the 300 Mm Wafer Front Opening Unified Pod Market. As demand for semiconductors continues to rise across various sectors, including automotive and consumer electronics, manufacturers are scaling up production capabilities. This expansion often involves the establishment of new fabs equipped with state-of-the-art technology, which necessitates the use of advanced wafer handling solutions. The investment in new facilities is projected to reach USD 100 billion by 2025, indicating a robust growth environment for the industry. Consequently, the demand for front opening unified pods is expected to increase, as these solutions are integral to efficient wafer management in modern manufacturing settings.

Rising Demand for Advanced Semiconductor Technologies

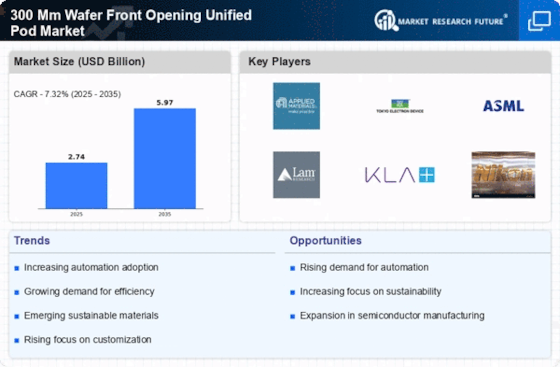

The 300 Mm Wafer Front Opening Unified Pod Market is experiencing a surge in demand driven by the increasing complexity of semiconductor devices. As technology advances, the need for more sophisticated manufacturing processes becomes apparent. This trend is reflected in the projected growth of the semiconductor market, which is expected to reach USD 1 trillion by 2030. The adoption of 300 mm wafers is pivotal in meeting the requirements for high-performance chips, particularly in sectors such as artificial intelligence and 5G technology. Consequently, manufacturers are investing in advanced equipment and materials, which in turn propels the demand for front opening unified pods. This shift indicates a robust growth trajectory for the industry, as companies strive to enhance production efficiency and yield.