Increased Defense Budgets

The 155mm munitions Market is experiencing a notable surge in defense budgets across various nations. Countries are prioritizing military modernization and enhancing their artillery capabilities, which directly influences the demand for 155Mm munitions. For instance, recent reports indicate that defense spending in several regions has increased by approximately 5 to 10% annually. This trend suggests a robust commitment to upgrading military arsenals, thereby driving the growth of the 155Mm Munitions Market. As nations seek to bolster their defense capabilities, the procurement of advanced munitions becomes a focal point, further stimulating market expansion.

Rising Geopolitical Tensions

The 155Mm Munitions Market is significantly impacted by rising geopolitical tensions in various regions. Ongoing conflicts and territorial disputes have led to an increased emphasis on military preparedness. For example, nations involved in regional conflicts are likely to enhance their artillery capabilities, resulting in a heightened demand for 155Mm munitions. This environment of uncertainty appears to drive governments to invest in more sophisticated and reliable munitions, thereby propelling the growth of the 155Mm Munitions Market. The need for effective deterrence strategies may further contribute to the sustained demand for these munitions.

Focus on Joint Military Exercises

The 155Mm Munitions Market is influenced by the growing trend of joint military exercises among allied nations. These exercises often emphasize interoperability and the use of standardized munitions, including 155Mm artillery shells. As countries collaborate on defense strategies, the demand for compatible munitions increases. Recent data indicates that joint exercises have risen by approximately 15% over the past few years, highlighting the importance of cohesive military operations. This trend suggests that the 155Mm Munitions Market will continue to benefit from the need for munitions that can be effectively utilized across different military forces.

Emerging Markets and Defense Modernization

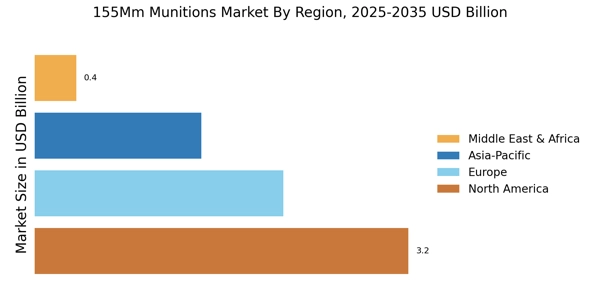

The 155Mm Munitions Market is experiencing growth in emerging markets as nations modernize their defense capabilities. Countries in Asia and the Middle East are increasingly investing in artillery systems, which drives the demand for 155Mm munitions. Reports indicate that defense spending in these regions is projected to grow by 7% annually, reflecting a commitment to enhancing military readiness. This modernization trend suggests that the 155Mm Munitions Market will see increased activity as these nations seek to acquire advanced munitions to support their evolving defense strategies.

Technological Innovations in Artillery Systems

The 155Mm Munitions Market is witnessing a transformation due to technological innovations in artillery systems. Advancements in precision-guided munitions and smart artillery shells are reshaping the landscape of military operations. The integration of these technologies enhances the effectiveness and accuracy of 155Mm munitions, making them more appealing to armed forces. Reports suggest that the adoption of such innovations could lead to a market growth rate of around 6% annually. As militaries increasingly prioritize precision and efficiency, the demand for technologically advanced 155Mm munitions is likely to rise, further driving the market.