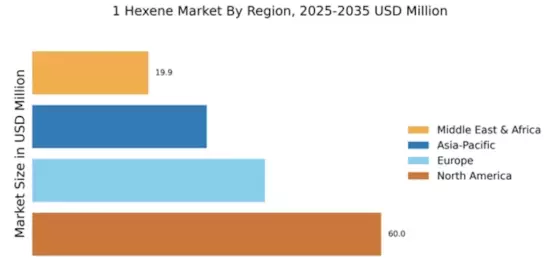

North America : Market Leader in 1 Hexene

North America is poised to maintain its leadership in the 1 Hexene market, holding a significant market share of 60.0% as of 2025. The region's growth is driven by robust demand from the polyethylene sector, particularly in packaging and automotive applications. Regulatory support for sustainable practices and advancements in production technologies further catalyze market expansion. The increasing focus on lightweight materials in various industries is also a key driver of demand.

The competitive landscape in North America is characterized by the presence of major players such as Chevron Phillips Chemical Company, ExxonMobil Chemical, and Dow Chemical Company. These companies are investing heavily in R&D to enhance production efficiency and product quality. The U.S. remains the leading country in this region, supported by a well-established infrastructure and favorable business environment, ensuring continued growth in the 1 Hexene market.

Europe : Emerging Market Dynamics

Europe's 1 Hexene market is projected to grow, capturing a market share of 40.0% by 2025. The region is increasingly focusing on sustainable production methods and circular economy initiatives, which are driving demand for eco-friendly materials. Regulatory frameworks, such as the European Green Deal, are encouraging investments in innovative technologies and sustainable practices, further enhancing market potential. The shift towards lightweight and recyclable materials in various applications is also a significant growth driver.

Leading countries in Europe include Germany, the Netherlands, and France, where companies like LyondellBasell and SABIC are prominent. The competitive landscape is evolving, with a strong emphasis on sustainability and innovation. European manufacturers are collaborating with research institutions to develop advanced materials, ensuring they remain competitive in the global market. This focus on sustainability positions Europe as a key player in the 1 Hexene market.

Asia-Pacific : Rapid Growth and Demand

The Asia-Pacific region is witnessing rapid growth in the 1 Hexene market, with a projected market share of 30.0% by 2025. This growth is primarily driven by increasing industrialization and urbanization, leading to higher demand for polyethylene products in packaging and construction. Additionally, favorable government policies and investments in infrastructure are catalyzing market expansion. The region's focus on enhancing production capabilities and adopting advanced technologies is also contributing to its growth trajectory.

Key players in the Asia-Pacific market include Mitsui Chemicals and Reliance Industries Limited, with significant operations in countries like Japan and India. The competitive landscape is becoming increasingly dynamic, with local manufacturers ramping up production to meet rising demand. As the region continues to develop, the 1 Hexene market is expected to flourish, supported by a growing consumer base and expanding industrial applications.

Middle East and Africa : Resource-Rich Market Potential

The Middle East and Africa region is emerging as a potential market for 1 Hexene, with a market share of 19.95% anticipated by 2025. The growth is driven by the region's abundant natural resources and increasing investments in petrochemical industries. Countries like Saudi Arabia and the UAE are focusing on expanding their chemical production capabilities, supported by government initiatives aimed at diversifying their economies. The rising demand for plastics and packaging materials is further fueling market growth.

In this region, key players such as SABIC are leading the charge, leveraging their extensive resources and expertise. The competitive landscape is evolving, with new entrants looking to capitalize on the growing demand. As the Middle East and Africa continue to develop their industrial sectors, the 1 Hexene market is expected to gain traction, presenting numerous opportunities for investment and growth.