Tesla Focused More on the Volume Than Prices, in the Second Quarter Earnings of 2023

The electric vehicle (EV) maker company Tesla is growing its production and reaching new levels of achievement in the global market. The company released its second-quarter earnings in 2023 in July. It cited the second quarter earnings as the record quarter on many platforms due to production and deliveries together as a joint venture for better results.

The company gained around USD 25 billion in revenue in a single quarter and is pleased to achieve this figure. Simultaneously, Tesla has also marked the challenges faced by the company to overcome the macroeconomic environment and cites it as exciting in tackling the occurring issue. The company is playing on the market with the strategy of investing in the long-term market share over short-term profit that resulted in a gain of ten-point year-on-year profit margin in the first quarter but a six-point drop in the second quarter of 2023. Despite cost reductions in both quarters from the beginning of 2023 with a blooming 10 percent operating margin. Several factors affected the operating margin, such as price reduction, rising production success in Texas and Berlin, and well service and performance in the businesses.

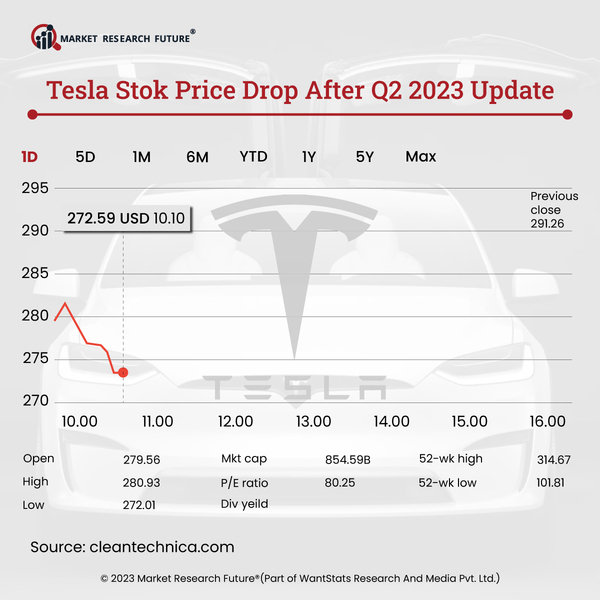

According to some sources, Tesla is anticipated to produce a revenue of USD 24.9 billion for the current quarter that, exceeds 50 percent higher on sales of USD 16.9 billion in 2022. In 2023, the company has risen to 168.2 percent since the beginning of the year, as per the trustable sources. Tesla has announced the arrival of its first cybertruck, and the stocks closed at USD 290.38 in the third week of July 2023. Sources said 1.5 million reservations are pending with the company for cybertruck. The company added that the productive gains in the second quarter of 2023 are due to the development of artificial intelligence (AI), with the production of Dojo computers in the initial stage. The company focuses on the volume over the profit gains as it has recorded delivery of 466,140 vehicles quarterly in 2023, which is 83 percent more compared to the second quarter of 2022. Hence, the company's year-over-year profit decreased slightly in the second quarter to USD 2.4 billion with a 9.6 percent operating margin.