Indian Manufacturers Of Specialty Chemicals Anticipate Robust Q2 Results

Indian companies in the specialty chemicals sector report a robust double-digit gain in earnings YoY due to better realizations and rising sales volumes.

In Q2FY23, according to analysts at ICICI Securities, sales would increase 19.3% year over year (YoY) and decreased 0.6% sequentially, partly because of an increase in pricing brought on by an increase in input costs. Gross product will probably increase by 22.7% YoY and decrease by 1.4% sequentially, primarily because of seasonality, indicating a significant underlying trend Analyst forecasts predict a 16.5% YoY increase in net profits.

The unrest in the European chemical markets has increased the focus on specialty chemical firms. European manufacturers have been impacted by higher energy costs and decreased gas supply, resulting in the closure of numerous plants in the region and an increase in chemical prices.

But on the plus side, aside from modest destocking, management commentary has not brought up any pressing problems.

Recently, there have been predictions that margins will increase due to the decline in commodity prices and the softening of oil prices. Even though high-cost inventories may still exist, economists predict that the margins will eventually see some relief.

The outlook for producers is still generally favorable, and there may be more outsourcing and contract manufacturing prospects. However, a short-term effect slowing may be noticeable. In the event of a recession, Indian manufacturers may experience some short-term dampening of export demand.

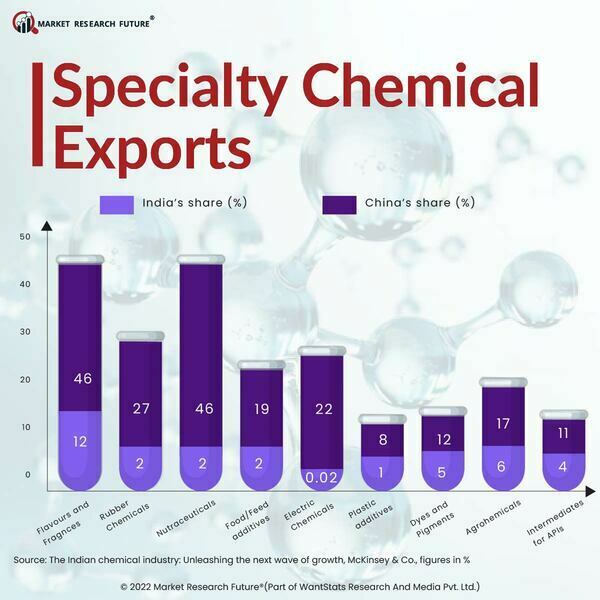

India's specialty chemicals sector is well positioned to take advantage of global tailwinds and increase its worldwide market share from 4% to 7-8% in the next years. This is mostly because of the "China Plus One" strategy.

Investors and experts are placing their bets on India's specialty chemical industry, which is anticipated to greatly profit from the current international circumstances. The market for specialty chemicals is migrating to India as a result of the Russia-Ukraine crisis and its effects, and Indian businesses are well-positioned to benefit from this development. An added plus is the decline in the rupee.