Global Healthcare Costs to Rise 10% in 2023 - Survey

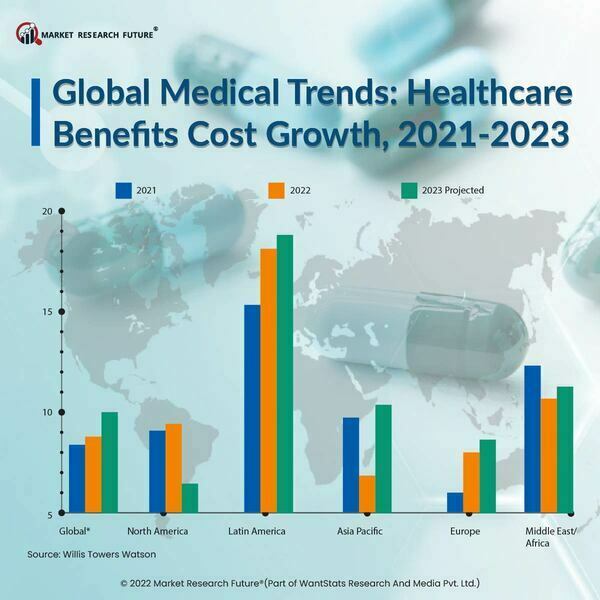

Willis Towers Watson (WTW), a British-American MNC insurance advisor, recently conducted the 2023 Global Medical Trends Survey. The London-based company revealed findings of the survey in a media release that the combination of inflation and rising healthcare consumption will cause increases in global healthcare benefit costs to reach their highest level in almost 15 years. The 2023 Global Medical Trends Survey by WTW finds that the healthcare benefit cost trend is forecast to rise sharply to a global average of 10% in 2023 after rising from 8.2% in 2021 to a higher-than-expected 8.8% in 2022.

A portion of the blame for the increase to two other healthcare stakeholders, providers, and beneficiaries, by the 257 top insurers representing 55 nations. Beneficiaries tend to overprescribe owing to their poor lifestyle choices, and the providers often recommend too many services to patients.

In 2023, medical costs are anticipated to rise even faster. Over the next three years, more than seven in ten health insurers (78%) predict that medical trends will be higher or much higher. Eighty-four percent of insurers in Europe, 73% in Asia-Pacific, 69% in Latin America, and 60% in the Middle East and Africa anticipate a higher or noticeably higher medical trend during this time.

The survey points out that cancer continues to be the illness with the most significant impact on medical costs, followed by musculoskeletal and cardiovascular conditions. By the incidence of claims and expense, insurers classified mental and behavioural health disorders as the fourth most common condition. Telehealth, which ranked third in the poll from the previous year to second this year, is continuing to gain ground as a strategy for controlling medical expenses. Preapprovals for scheduled inpatient services underwent a substantial change from the previous year, falling from number two (67%) to number five (52%) last year.

Two hundred fifty-seven insurers from 55 different nations took part in the poll, which was performed between July and September 2022. Medical expenditures are still primarily driven by the high cost of new technologies (62%) and provider profit margins (35%). Insurers have also mentioned more general factors that affect these expenses, such as the deterioration of public health systems' quality or funding (27%) and geopolitical conflicts (19%). These results offer a thorough perspective of various outside influences that influence medical expenses.

Payers continue to face historically enormous hurdles because of the COVID-19 outbreak. WTW has cautioned employers and insurers that "old solutions will not work". It is impossible to shift the costs; innovation, strategy, and fresh approaches are necessary for any meaningful outcome.

Medical prices are primarily attributed to the high cost of new medical technologies and the providers' profit-driven practices. However, insurers point to more general problems that impact these expenses, such as geopolitical conflicts and a reduction in the standard or funding of public health systems.