世界の灌流イメージング市場概要

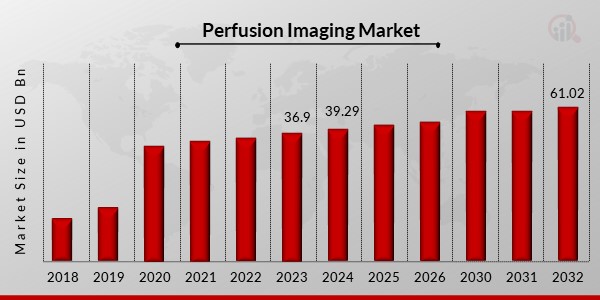

p灌流イメージング市場規模は、2023年に57億3,000万米ドルと評価されました。灌流イメージング市場は、2024年の59億8,000万米ドルから2032年には80億3,000万米ドルに成長すると予測されており、予測期間(2024~2032年)中に3.75%の年平均成長率(CAGR)を示します。心血管疾患および呼吸器疾患の発生率増加、高齢者人口の増加、細胞ベースの研究への投資増加が、市場の成長を牽引する要因となっています。いくつかの主要な市場牽引要因が、灌流イメージング市場の発展を牽引しています。

2023年9月: Philipsは、がん患者の診断の確実性を向上させることを目的とした、新しい造影超音波アプリケーションを発表しました。 Philips Ultrasound System - EPIQ Elite に Philips Microvascular Imaging Super Resolution Contrast-Enhanced Ultrasound (CEUS) を実装したことで、空間分解能が大幅に向上し、従来のオプションと比較して最大 200% 向上しました。 Philips の微小血管イメージングにより、医療従事者は病変への造影剤の流動パターンを観察し、その変化を経時的に追跡できます。他の CEUS 技術と同様に、超解像微小血管イメージング (MVI) では、患者が電離放射線にさらされることがなく、一般的にコスト効率が高く、アクセスしやすいという利点があります。CEUS に使用されるマイクロバブル造影剤の副作用率は、ヨード造影剤に比べて大幅に低くなっています。EPIQ Elite は、最先端のトランスデューサー技術と改良された機能を統合し、臨床的確実性を高め、患者一人ひとりに合わせたケアを提供する高品質超音波装置です。EPIQ Elite は、さまざまな医療専門分野の要件に対応するように設計された多様な診断アプリとツールを提供します。現代の医療現場の要求に対応するために、卓越した臨床性能と効率的なワークフロー管理を提供します。

2022 年 3 月: デジタル創傷ケア技術を専門とする世界的に有名な企業である Swift Medical は、Swift Ray 1 を発表しました。この革新的なハードウェア デバイスは、スマートフォンのカメラにワイヤレスで接続でき、詳細な臨床データを取得できます。その目的は、皮膚と創傷の状態の評価、治療、モニタリングを強化することです。 Swift Ray 1は、臨床医や患者の手に収まるほどコンパクトで、病院や自宅など、様々な環境で高品質な医療画像を容易に取得できます。さらに、この高度な画像技術により、肌の色に関わらず、患者一人ひとりの正確な臨床情報を取得できるため、すべての患者にとって公平で平等な創傷ケアが実現します。Swift Ray 1は、感染の兆候、細菌の定着、組織の損傷、灌流、炎症、血中酸素化レベルなど、創傷の重要な生理学的特性を記録・分析し、懸念事項や不十分な治癒の原因を明らかにします。この新しい装置は、長波赤外線、近赤外線、紫外線、そして強化RGB画像技術を駆使し、皮膚下の隠れた特性を明らかにします。これにより、デバイスは高度な臨床ワークフローをサポートできます。

出典:二次調査、一次調査、MRFR データベース、アナリストレビュー

灌流イメージング市場の動向 ul- 心血管疾患の罹患率の増加が市場の成長を牽引

p心血管疾患は世界中で主要な死亡原因の 1 つとして浮上しており、毎年多くの死者を出しています。世界保健機関 (WHO) によると、毎年約 940 万人が心血管疾患で亡くなっています。これらの疾患の罹患率は着実に増加しており、2012 年には CVD 関連の死亡者数が約 1,750 万人と報告され、2030 年までに 2,360 万人を超えると予測されています。 2013年には、世界で約10億人が高血圧症に罹患していると推定され、有病率は40%でした。特に、高血圧症の有病率は地域によって異なり、アフリカの有病率が最も高く46%であるのに対し、南北アメリカ大陸の有病率は最も低く35%でした。慢性閉塞性肺疾患(COPD)も死亡率の一因となっており、2015年の総死亡数の約5%、約300万人の死亡者数を占めています。COPDの有病率は、タバコ消費の増加と大気汚染レベルの上昇により、今後数年間で上昇すると予想されています。心臓疾患や呼吸器疾患の治療において、灌流システムは外科的介入中に心肺系をバイパスすることで重要な役割を果たします。これらのシステムにより、これらの疾患に罹患している患者を効果的に治療できます。灌流システムは、心肺系を迂回することで、心臓疾患や呼吸器疾患の患者の外科的治療に重要な役割を果たします。人工心肺装置を含むこれらのシステムは、心臓と肺の自然な機能が損なわれた場合に、血液に酸素を供給し、二酸化炭素を除去するように設計されています。心血管疾患と呼吸器疾患の罹患率は増加し続けており、近い将来、灌流システムの需要は増加すると予想されています。これらのシステムは、酸素供給を必要とする患者にとって重要なライフラインを提供し、治療と回復の成功に大きく貢献しています。これが市場の成長を牽引しています。

さらに、臓器移植の増加も市場の成長を加速させる重要な要因です。さらに、高齢化人口の急増、多臓器不全の発生率の増加、臓器提供を奨励する政府およびNGOの取り組みの増加、細胞ベースの研究への投資の急増、生物学的製剤製造の進歩、非侵襲性療法および治療の需要の増加、臓器不全の発生率の上昇、先進地域および発展途上地域の両方における医療成果の急増と医療費の増加、臓器提供を促進する取り組みの増加、および臓器提供の需要と相まって慢性疾患の発生率の急増は、灌流放射線診断市場の成長を促進する主な要因です。ライフスタイルの変化と不健康な食習慣に起因する神経疾患と心血管疾患の増加は、灌流放射線診断市場の発展を後押ししています。米国心臓協会統計委員会および脳卒中統計小委員会は、年間約795,000人が心臓発作に苦しんでいると報告しています。これらの統計は 2017 年に発表されました。したがって、病気の進行を追跡して治療するのに役立つ技術的進歩についての認識を高める方法を開発するために、政府資金によるプログラム、ヘルスケア センター、およびその他の機関が緊急に必要とされています。このようにして、灌流イメージング市場の収益を押し上げます。

灌流イメージング市場セグメントの洞察 h3灌流イメージング タイプに関する洞察

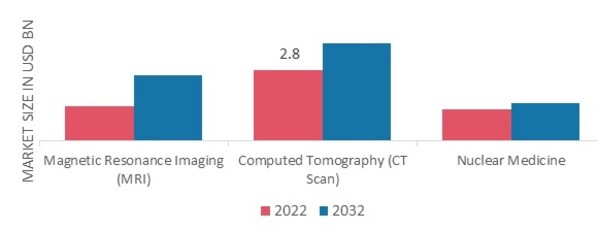

pタイプに基づいて、灌流イメージング市場は、コンピューター断層撮影 (CT スキャン)、磁気共鳴イメージング (MRI)、および 核医学 に分割されます。コンピューター断層撮影 (CT スキャン) セグメントが市場を支配しています。CT 灌流イメージングは、脳卒中、がん、心血管疾患など、さまざまな状態の診断と監視に広く使用されています。図 1 灌流イメージング市場、モダリティ別、2023 年 2032 年 (10 億米ドル)

出典二次調査、一次調査、MRFR データベース、アナリストレビュー

灌流イメージング アプリケーションの洞察

pアプリケーションに基づいて、灌流イメージング市場の区分には、心筋灌流、換気灌流、および機能的脳イメージングが含まれます。心筋灌流イメージング分野が市場を席巻しました。心筋灌流イメージングは主に心筋の血流を評価し、血液供給が減少している部位を特定するために使用されます。冠動脈疾患や心筋梗塞などの心血管疾患の診断と管理において重要な役割を果たします。心筋灌流イメージング技術は、心臓の血流と機能に関する詳細な情報を提供します。灌流イメージングの地域別分析

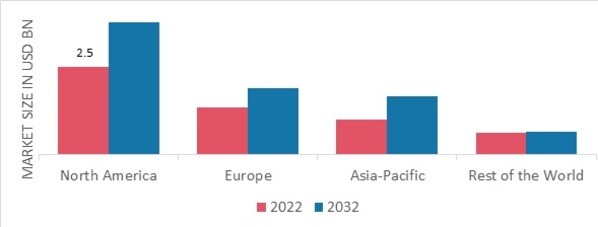

p本調査では、地域別に北米、欧州、アジア太平洋地域、その他の世界の市場分析を提供しています。北米の灌流イメージング市場は、心血管感染症、脳腫瘍、腫瘍関連血管新生などの発生率の拡大により、この地域の市場成長を促進するため、支配的となるでしょう。さらに、市場レポートで調査された主要国は、米国、カナダ、ドイツ、フランス、英国、イタリア、スペイン、中国、日本、インド、オーストラリア、韓国、ブラジルです。

図2 灌流イメージング市場シェア 地域別 2022年 (%)

出典:二次調査、一次調査、MRFR データベース、アナリストレビュー

ヨーロッパの灌流イメージング市場は、神経学的問題の蔓延の進行により、2 番目に大きな市場シェアを占めています。さらに、ドイツの灌流イメージング市場は最大の市場シェアを保持し、英国の灌流イメージング市場はヨーロッパ地域で最も急速に成長している市場でした。

アジア太平洋地域の灌流イメージング市場は、2024 年から 2032 年にかけて最も急速に成長すると予想されています。これは、老年人口が膨大であることと、急速に成長している地域経済によるものです。さらに、中国の灌流イメージング市場は最大の市場シェアを保持し、インドの灌流イメージング市場はアジア太平洋地域で最も急速に成長している市場でした。

灌流イメージングの主要市場プレーヤー競合分析

主要市場プレーヤーは、製品ラインの拡充を目指して研究開発に多額の投資を行っており、これがパーフュージョンイメージング市場のさらなる成長を後押しするでしょう。市場参加者は、新製品の発売、契約締結、合併・買収、投資拡大、他社との提携など、重要な市場動向を踏まえ、事業基盤の拡大を目指して様々な戦略的活動を展開しています。パーフュージョンイメージング業界は、競争が激化し成長著しい市場環境において、コスト効率の高い製品を提供し、事業を拡大していく必要があります。

現地生産によって運用コストを最小限に抑えることは、灌流イメージング業界において、メーカーが顧客に利益をもたらし、市場セクターを拡大するために用いる重要なビジネス戦略の一つです。灌流イメージング業界は近年、医療分野において最も重要な利点のいくつかを提供してきました。灌流イメージング市場の主要企業には、ゼネラル・エレクトリック・カンパニー(米国)、アドバンティス・メディカル・イメージング(オランダ)、アエトナ(米国)、ラセズ・メディカル・イメージング(米国)、コーニンクレッカ・フィリップス(オランダ)、キヤノンメディカルシステムズ(日本)、メドトロニック(アイルランド)、シーメンス(ドイツ)、ブラッコ・ダイアグノスティックス(イタリア)、東軟集団(中国)、島津製作所(日本)、ペリメッド(米国)などが挙げられますが、これらは研究開発事業への投資によって市場需要の拡大に取り組んでいます。

メドトロニックは、米国に拠点を置く老舗医療機器メーカーです。事業および経営本部はミネソタ州ミネアポリスにありますが、法務部門はアイルランドにあります。これは、メドトロニックが2015年にアイルランドに拠点を置くヘルスケア製品メーカーであるCovidienを買収した結果です。両社の専門知識とリソースを組み合わせることで、メドトロニックは継続的な製品開発と革新的技術の統合を通じて、ヘルスケアの課題にさらに効果的に対処することを目指しています。

CytoSorbents Corporationは、ニュージャージー州モンマスジャンクションに本社を置く株式公開企業です。CytoSorbentsは、多孔質ポリマーをベースとした血液浄化技術であるサイトカイン吸着カラムを販売しています。テルモは、体外式血液浄化吸着剤CytoSorbを製造するCytoSorbents Corporation(米国)と提携しました。医療機器メーカーであるテルモは、心臓手術用途向けにCytoSorb体外式血液浄化吸着剤を市場に投入するための提携契約を締結しました。この提携により、フランス、スウェーデン、デンマーク、ノルウェー、フィンランド、アイスランドを含むヨーロッパのいくつかの国で CytoSorb を商品化できるようになります。この提携を通じて、テルモはCytoSorbの普及拡大を図り、心臓外科医に手術中の血液浄化に役立つツールを提供することを目指しています。

灌流イメージング市場の主要企業

- ゼネラル・エレクトリック・カンパニー(米国)

- アドバンティス・メディカル・イメージング(オランダ)

- アエトナ(米国)

- lathes Medical Imaging, Inc.(米国)

- Koninklijke Philips NV (オランダ)

- キヤノンメディカルシステムズ株式会社 (日本)

- メドトロニック (アイルランド)

- シーメンス (ドイツ)

- Bracco Diagnostic, Inc. (イタリア)

- Neusoft Corporation (中国)

- 島津製作所 (日本)

- Perimed (米国)

- コンピュータ断層撮影 (CT)スキャン)

- 磁気共鳴画像法(MRI)

灌流イメージング応用展望 ul - 心筋灌流イメージング

- 換気灌流イメージング

- 機能的脳イメージング

h3

灌流イメージング地域展望 ul - 北アメリカ

- 米国

- カナダ

- ヨーロッパ

- ドイツ

- フランス

- イギリス

- イタリア

- スペイン

- ヨーロッパのその他の地域

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- オーストラリア

- 残りの部分アジア太平洋

- 世界のその他の地域

- 中東

- アフリカ

- ラテンアメリカ

FAQs

What is the current valuation of the Perfusion Imaging Market as of 2024?

The Perfusion Imaging Market was valued at 5.98 USD Billion in 2024.

What is the projected market valuation for the Perfusion Imaging Market in 2035?

The market is projected to reach 8.967 USD Billion by 2035.

What is the expected CAGR for the Perfusion Imaging Market during the forecast period 2025 - 2035?

The expected CAGR for the Perfusion Imaging Market during 2025 - 2035 is 3.75%.

Which companies are considered key players in the Perfusion Imaging Market?

Key players include GE Healthcare, Siemens Healthineers, Philips Healthcare, and Canon Medical Systems.

What are the main segments of the Perfusion Imaging Market by type?

The main segments by type include Computed Tomography, Magnetic Resonance Imaging, and Nuclear Medicine.

How did the Computed Tomography segment perform in 2024?

The Computed Tomography segment was valued at 2.39 USD Billion in 2024.

このレポートの無料サンプルを受け取るには、以下のフォームにご記入ください

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”