Research Methodology on Medical Nutrition Market

Introduction

Medical nutrition is a form of nutrition intervention used to treat diseases and chronic ailments that are highly or moderately influenced by dietary changes. It is designed to address the specific physiological and medical needs of individuals suffering from certain diseases and related disorders. The market research process of Medical Nutrition involves in the development of this report includes a primary and secondary market survey. Both research approaches provide valuable and exploratory insights into the Medical Nutrition market.

Primary Research

Primary research is the method used in the development of this report, which includes interviews and surveys with industry experts and opinion leaders, such as key opinion leaders (KOLs) in Medical Nutrition, industry analysts, and stakeholders in the Medical Nutrition industry. The primary research process further includes collecting data from key stakeholders in the Medical Nutrition market, such as manufacturers, service providers, distributors, and resellers of Medical Nutrition products and services.

The primary research process also includes collecting data from various sources such as the internet, magazines, journals, books, and medical databases. This data is used to gain comprehensive market insights about the Medical Nutrition market and the key stakeholders in the Medical Nutrition industry. Interviews and surveys with key stakeholders, revenue managers, industry experts and opinion leaders in the Medical Nutrition industry provide a detailed insight into the Medical Nutrition market. Furthermore, data from various sources such as the internet, magazines, journals, books and medical databases are also analysed and collated to provide the market estimates and forecasts in the report.

Secondary Research

Secondary research is used to gain extensive insight into the Medical Nutrition market. The secondary research process includes searching through databases such as Factiva, Bloomberg, Businessweek, and Avention. This is followed by a detailed study of articles and research reports related to the Medical Nutrition market published by well-known publishers such as Datamonitor, GlobalData, Hoover’s, and Factiva. Relevant information obtained through this method is cross-checked with data derived from the primary research process to provide a detailed estimate of the Medical Nutrition market.

Secondary research is also used to identify various trends in the Medical Nutrition market, determine the competitive landscape, and understand the overall market dynamics. The secondary research process includes searching through databases such as Hoover’s, Factiva, and Bloomberg, and following a detailed study of prominent journals and magazines such as the American Journal of Clinical Nutrition, and Nutritional Reviews. This process is further used to identify and study the various trends and industry dynamics at play in the Medical Nutrition market.

Research Assumptions

The research assumptions used in the development of this report include:

- The market for Medical Nutrition is growing at a steady rate, driven largely by the increasing prevalence of chronic diseases, increasing health awareness, vast product innovations, and increasing availability of Medical Nutrition products.

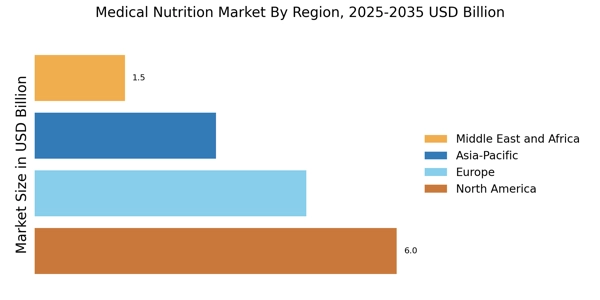

- The regional market for Medical Nutrition is currently driven by a significant level of innovation and development.

- The Medical Nutrition market is highly competitive and is dominated by the presence of several large players.

- The Medical Nutrition market is expected to witness significant growth over the forecast period, driven mainly by the increasing prevalence of chronic diseases, changing lifestyles, rising health awareness, and increasing demand for medical nutrition products.

Data Analysis

The collected data is analysed with the help of several statistical and graphical snapshots using Microsoft Excel, SPSS statistics software, and Microsoft PowerPoint. The data is further analysed and validated using Econometric modelling, where the demand-supply gap in each market segment is identified. The collected data is studied, cross-referenced, and analysed to gain extensive insight into the Medical Nutrition market.

Conclusion

This research report provides a comprehensive analysis of the Medical Nutrition market. The research process involves extensive primary research with key stakeholders and secondary research using various databases and databases. Econometric modelling is further used to identify the demand-supply gap in each market segment. The analysis of the data provides a detailed understanding of the market opportunities, competitive landscape, and dynamics at play in the Medical Nutrition market.