To gather qualitative and quantitative information unique to the use of blockchain in insurance processes, supply-side and demand-side stakeholders were interviewed as part of the primary research process. CEOs, CTOs, VPs of Blockchain Innovation, and Heads of Distributed Ledger Technology from companies that provide insurance core systems, enterprise blockchain platforms, InsurTech startups, and IT consulting organizations that specialize in financial services were among the supply-side sources. Chief Digital Officers, Chief Information Officers, Heads of Claims Transformation, VP of Underwriting Operations, and Strategy Directors from significant independent brokerages, mutual insurers, reinsurance groups, and international insurance carriers were among the demand-side sources. Primary research verified smart contract development timelines, validated deployment type preferences (public, private, and hybrid blockchain architectures), and collected information on industry consortium participation patterns, interoperability issues with legacy systems, and regulatory sandbox experiences across jurisdictions.

Primary Respondent Breakdown:

By Designation: C-level Primaries (40%), Director Level (30%), Others (30%)

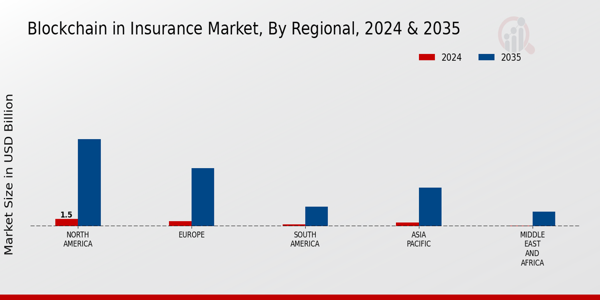

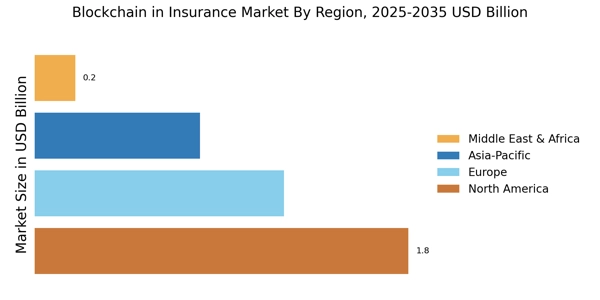

By Region: North America (38%), Europe (25%), Asia-Pacific (32%), Rest of World (5%)

Blockchain deployment value analysis and technology adoption mapping throughout the insurance value chain were used to determine the global market valuation. The methods included:

Finding more than 40 major IT companies and insurance companies that are actively using distributed ledger solutions throughout North America, Europe, Asia-Pacific, and Latin America

Solution mapping between public blockchain infrastructure, private blockchain (consortium networks), and hybrid architectures designed for applications such as fraud detection, identity management, claims management, and reinsurance

Examination of annual technological expenditures for blockchain implementations, smart contract creation, and platform license fees in insurance portfolios that have been reported and modeled

coverage of insurers and tech companies that account for 75–80% of the global blockchain's insurance market share in 2024

Segment-specific valuations for smart contracts, automated claims processing, and parametric insurance products are derived through extrapolation using top-down (enterprise IT budget allocation validation for distributed ledger initiatives) and bottom-up (licensed node deployment × transaction volume pricing by country/line of business) approaches.