Soy Based Chemicals Size

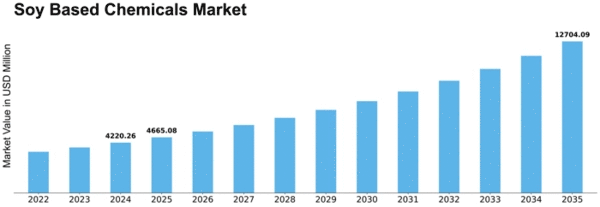

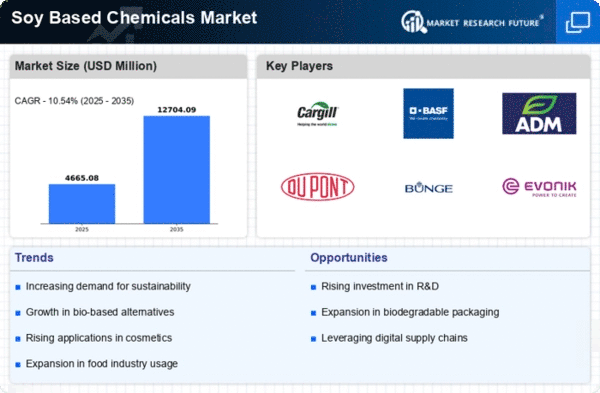

Soy Based Chemicals Market Growth Projections and Opportunities

Various factors shape the Soy-Based Chemicals Market and its growth.The global trend toward eco-friendly materials and reducing dependency on non-renewable energy sources drives market growth, reflecting soy-based chemicals' role in developing reasonable compound arrangements.

The global soy-based chemicals market was valued at USD 43 billion in 2030 and is expected to grow at 6.50%, according to MRFR.

Global economic conditions influence the Soy-Based Chemicals Market. Financial stability or instability affects modern production cycles, consumer expenditure, and soy-based chemical demand. During economic expansion, bio-based products, food, and contemporary chemicals increase demand for soy-based compounds, impacting the market. However, economic downturns may reduce consumer spending and modernization, affecting the Soy-Based Chemicals Market.

The Soy-Based Chemicals Market is heavily influenced by biofuels and green electricity. Soy-based compounds, notably soy biodiesel, provide an alternative to petroleum derivatives, helping reduce fossil fuel byproducts and fight climate change. Biofuel demand, driven by government support and environmental concerns, directly affects the Soy-Based Chemicals Market.

Mechanical advances and soy handling innovations shape the Soy-Based Chemicals Market. Soy-based synthetic production becomes more productive and cost-effective via innovation. Mechanical advances make soy-based products more serious, allowing them to adapt to changing market trends and generate new uses in automobile, packaging, and agriculture.

Environmental rules and manageability considerations shape the Soy-Based Chemicals Market. As businesses struggle to adopt eco-friendly practices, soy-based chemicals are in demand due to their inexhaustibility and minimal environmental impact. The market grows due to strict environmental regulations and controllable practices. The market meets the company's carbon footprint and manageability obligations.

Customer preferences and market trends also shape the Soy-Based Chemicals Market. Products that contain soy-based chemicals are becoming increasingly popular as consumers and businesses grow more environmentally conscious and seek alternatives to normal chemicals. The market adapts to end-client initiatives, where bio-based and inexpensive components are necessary for maintainability and consumer expectations.

The Soy-Based Chemicals Market depends on accurate estimates and bio-based material availability. Businesses utilizing soy-based compounds must consider their cost compared to bio-based or petrochemical-derived chemicals. The availability of bio-based feedstocks like corn or sugarcane can also affect market factors. The market adjusts to supply-demand fluctuations by improving soy-based chemical evaluation, production, and cost.

Leave a Comment