Smart Personal Safety Security Device Size

Smart Personal Safety Security Device Market Growth Projections and Opportunities

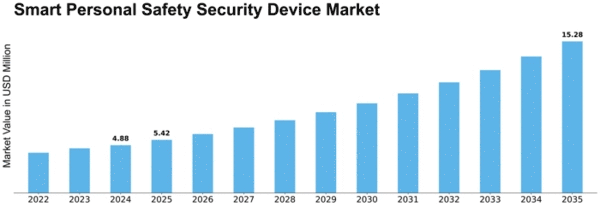

This growth is attributed to a compound annual growth rate (CAGR) of 11.00% during the forecast period from 2020 to 2025. The market is segmented based on type, end user, and region. Smart personal safety and security devices are categorized into two types: smart personal safety devices and smart personal security devices. In 2019, the latter dominated the market, holding a significant share, and is expected to maintain this position with a CAGR of 11.14% throughout the forecast period. The end-user segmentation includes consumers, factories, defense, BFSI, healthcare, telecommunications, and others. The consumer segment took the lead in 2019, commanding the global market and is anticipated to exhibit a CAGR of 13.35%. Geographically, the market is divided into North America, Europe, Asia-Pacific, and the rest of the world. North America emerged as the dominant region in 2019, contributing USD 907.24 million, and is projected to grow at a CAGR of 11.04% during the forecast period. In the examination of key players in the smart personal safety and security device market, companies like Honeywell International, Inc (US), LM Ericsson (Sweden), General Electric (US), ADT, Inc (US), and Fitbit, Inc (US) stand out. These industry leaders engage in intense competition, focusing on features, pricing, and reliability. To gain a competitive edge, they continually innovate and implement various growth strategies. An illustrative example of innovation in the market is Trackimo's introduction of the Trackimo 3G slim travel tracker in July 2019. This device not only provides GPS tracking but also features a light sensor, beneficial for detecting unauthorized access to backpacks or luggage. With Bluetooth, 3G, and Wi-Fi support, this device ensures functionality in diverse locations globally, emphasizing the industry's commitment to technological advancements and user convenience. In the context of the United States, a pivotal contributor to the smart personal safety and security device market, the mentioned companies, especially Honeywell International, Inc, General Electric, ADT, Inc, and Fitbit, Inc, play crucial roles. The US market is characterized by robust growth, aligning with the global trends, and these companies continually drive innovation and competition, elevating the industry's standards and meeting the evolving needs of consumers

Leave a Comment