PU Sole Footwear Polyurethane Market Trends

PU Sole Footwear Polyurethane Market Research Report Information By Application (Casuals, Boots, Slippers & Sandals, Sports, Formals), Raw Material (Methylene Diphenyl Diisocyanate (MDI), Toluene Diphenyl Diisocyanate (TDI), Polyols), And By Region (North America, Europe, Asia-Pacific, And Rest Of The World) –Market Forecast Till 2034

Market Summary

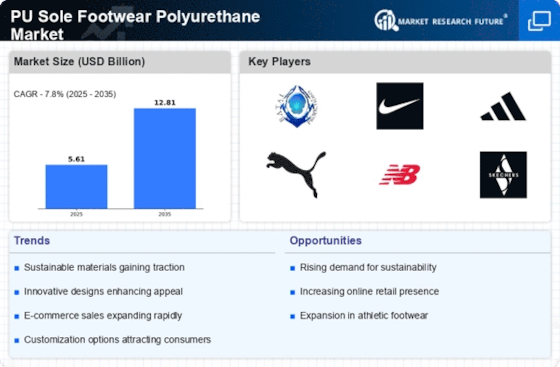

As per Market Research Future Analysis, the Global PU Sole Footwear Polyurethane Market was valued at USD 5.61 Billion in 2024 and is projected to grow to USD 11.88 Billion by 2034, with a CAGR of 7.80% from 2025 to 2034. Key drivers include increased sports activities, a growing footwear business, and a rising demand for lightweight, comfortable shoes. The market is significantly influenced by fashion trends, technological advancements, and a shift towards sustainable materials, with PU soles offering recyclability and environmental benefits.

Key Market Trends & Highlights

The growing footwear industry is a major driver of PU sole demand.

- Casual footwear dominated the market with a revenue share of 37.68%.

- Methylene Diphenyl Diisocyanate (MDI) accounted for 45.68% of market sales.

- North America held the largest market share at 45.80% in 2022.

- The Asia-Pacific region is expected to grow at the fastest CAGR from 2023 to 2032.

Market Size & Forecast

| 2024 Market Size | USD 5.61 Billion |

| 2034 Market Size | USD 11.88 Billion |

| CAGR (2025-2034) | 7.80% |

| Largest Regional Market Share in 2022 | North America. |

Major Players

Key players include Asahi Kasei Corporation, BASF SE, Huntsman International LLC, Dow, Coim Group, Wanhua, The Lubrizol Corporation, Covestro AG, INOAC CORPORATION, and Trelleborg AB.

Market Trends

-

The growing footwear industry is driving the market growth

The demand for footwear is directly impacted by the continually growing world population. There is more money available for shoe purchases as more individuals join the workforce and the middle class grows. The demand for shoes across many categories, such as athletic, casual, and formal footwear, is driven by this increase in consumer purchasing power. To accommodate a wider range of consumer tastes and keep up with rising demand, footwear makers require dependable and adaptable materials like PU soles.

Additionally, the development of the footwear sector is greatly influenced by fashion trends and shifting consumer tastes. Consumers today are increasingly concerned with their looks and fashion, looking for footwear that matches their personalities and follows the most recent fashion trends. Footwear companies rely on materials that are simple to mould and create into a variety of forms and styles in order to produce trendy and fashionable shoes. The adaptability and customisation possibilities that footwear producers require to produce one-of-a-kind and aesthetically pleasing items are provided by PU soles.

This supports the market expansion and the rising demand for fashionable footwear.

In addition, technological developments have transformed the production of footwear and fueled the industry's expansion. Complex footwear patterns and intricate embellishments are now more easily produced thanks to new production methods like computer-aided design (CAD) and computer numerical control (CNC) machining. These technologies enable producers to produce shoes with higher comfort and performance qualities by precisely moulding PU soles. The demand for PU soles is increased as a result of these technological developments drawing footwear manufacturers looking for innovative materials to set their products apart from the competition.

Additionally, the footwear business has been greatly impacted by the growth of e-commerce. Customers can easily access a broad choice of footwear options from various brands and manufacturers thanks to online buying sites. Due to the increased competition, footwear manufacturers are being forced to improve the features and quality of their products in order to stand out in the online marketplace. PU soles give footwear brands a competitive edge thanks to their resiliency, comfort, and versatility. Customers are actively seeking out PU soles while shopping online as a result of their increased awareness of the advantages they offer.

Due to growing environmental concerns, the footwear industry has also seen a transition towards eco-friendly and sustainable materials. Consumers are becoming more aware of how their purchases, particularly footwear, affect the environment. In comparison to materials like PVC or rubber, PU soles offer an advantage in this regard because they are recyclable, which reduces waste and environmental contamination. PU soles are being used in footwear by brands that place a high priority on sustainability in order to appeal to buyers who care about the environment. This supports the greater sustainability movement and helps the PU sole market expand.

As a result, the market for PU soles is significantly influenced by the expanding footwear sector. The demand for footwear is rising as a result of a number of factors, including the expanding world population, shifting fashion trends, technological improvements, the rise of e-commerce, and the need for sustainable materials. With its strength, adaptability, customizability, and sustainability attributes, PU soles excellently meet the changing demands of the footwear industry. The market is expanding as a result of rising consumer demand for PU soles, which is being fuelled by footwear makers' efforts to keep up with customer needs and remain competitive.

Thus, driving the PU Sole footwear polyurethane market revenue.

The increasing consumer preference for lightweight and durable footwear materials is driving a notable shift towards polyurethane soles in the global footwear market.

U.S. Department of Commerce

PU Sole Footwear Polyurethane Market Market Drivers

Market Growth Projections

The Global PU Sole Footwear Polyurethane Market Industry is poised for substantial growth in the coming years. Projections indicate that the market will reach 5.61 USD Billion in 2024, with further expansion expected to 12.8 USD Billion by 2035. This growth trajectory suggests a robust CAGR of 7.79% from 2025 to 2035, driven by factors such as increasing consumer demand for lightweight and sustainable footwear, technological advancements, and the expansion of retail channels. These projections highlight the potential for significant investment opportunities and innovation within the industry.

Rising Demand for Lightweight Footwear

The Global PU Sole Footwear Polyurethane Market Industry experiences a notable increase in demand for lightweight footwear options. Consumers are increasingly seeking comfortable and versatile footwear that does not compromise on style. This trend is particularly evident among younger demographics who prioritize both aesthetics and functionality. The lightweight nature of polyurethane soles contributes to enhanced comfort, making them ideal for daily wear. As a result, the market is projected to reach 5.61 USD Billion in 2024, reflecting a growing preference for PU sole footwear. This shift in consumer behavior indicates a potential for sustained growth in the industry.

Sustainability and Eco-Friendly Materials

Sustainability emerges as a pivotal driver in the Global PU Sole Footwear Polyurethane Market Industry. With increasing awareness of environmental issues, consumers are gravitating towards eco-friendly footwear options. Polyurethane, being recyclable and less harmful to the environment compared to traditional materials, aligns with this trend. Brands that adopt sustainable practices in their production processes are likely to attract environmentally conscious consumers. This shift not only enhances brand loyalty but also contributes to the overall growth of the market, which is expected to expand significantly, potentially reaching 12.8 USD Billion by 2035.

Diverse Applications Across Various Segments

The versatility of polyurethane soles contributes to their widespread adoption across various segments within the Global PU Sole Footwear Polyurethane Market Industry. From athletic shoes to casual wear and formal footwear, PU soles cater to diverse consumer needs. This adaptability allows manufacturers to target multiple market segments, thereby expanding their customer base. Furthermore, the increasing popularity of athleisure and casual footwear trends drives demand for PU sole options, as they offer both comfort and style. As the market continues to evolve, this diversity in applications is expected to play a significant role in sustaining growth.

Expanding Retail Channels and E-Commerce Growth

The expansion of retail channels and the growth of e-commerce significantly influence the Global PU Sole Footwear Polyurethane Market Industry. As online shopping becomes increasingly popular, brands are enhancing their digital presence to reach a broader audience. E-commerce platforms provide consumers with convenient access to a diverse range of PU sole footwear options, facilitating informed purchasing decisions. Additionally, brick-and-mortar stores are adapting by integrating online and offline experiences, thereby enhancing customer engagement. This dual approach is likely to bolster market growth, as more consumers turn to online platforms for their footwear needs.

Technological Advancements in Footwear Manufacturing

Technological innovations play a crucial role in shaping the Global PU Sole Footwear Polyurethane Market Industry. Advances in manufacturing processes, such as 3D printing and automated production lines, enhance efficiency and reduce costs. These technologies enable manufacturers to create customized footwear solutions that cater to individual consumer preferences. Moreover, the integration of smart technologies into footwear, such as moisture-wicking and temperature-regulating features, further elevates the appeal of PU sole footwear. As these advancements continue to evolve, they are likely to drive market growth, contributing to a projected CAGR of 7.79% from 2025 to 2035.

Market Segment Insights

PU Sole footwear polyurethane Application Insights

The PU Sole Footwear Polyurethane Market segmentation, based on application includes sports, formal, casual, boots, slippers, and sandals. With a share of the market's revenue of 37.68%, the Casuals sector dominated. Casual footwear is described as shoes that are worn every day for both comfort and style. Additionally, these shoes provide a broad spectrum of performance for outdoor activities. Commercially available examples of casual footwear include loafers, trainers and flat soles.

Figure 1: PU Sole Footwear Polyurethane Market, by Application, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

PU Sole footwear polyurethane Raw Material Insights

The PU Sole Footwear Polyurethane Market segmentation, based on Raw Material, includes polyols, toluene diphenyl diisocyanate (TDI), and methylene diphenyl diisocyanate (MDI). With 45.68% of market sales, the Methylene Diphenyl Diisocyanate (MDI) segment dominated the market. In the creation of shoe soles, the 4,4'-MDI isomer is utilised. In the presence of other additives, MDI is reacted with polyols to create polyurethane soles for footwear.

Get more detailed insights about PU Sole Footwear Polyurethane Market Research Report—Global Forecast till 2034

Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North America PU Sole Footwear Polyurethane Market dominated this market in 2022 (45.80%). The footwear industry is developed and well-established in North America. The demand for footwear in the region is steady across all market sectors, including athletic, casual, and fashionable footwear. Further, the U.S. PU Sole footwear polyurethane market held the largest market share, and the Canada PU Sole footwear polyurethane market was the fastest growing market in the North America region.

Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: GLOBAL PU SOLE (FOOTWEAR POLYURETHANE) MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe PU Sole footwear polyurethane market accounts for the second-largest market share. Europe is renowned for its emphasis on fashionable footwear and fashion-forward attitude. European shoppers strongly value footwear that is both fashionable and aesthetically pleasing. Further, the German PU Sole footwear polyurethane market held the largest market share, and the UK PU Sole footwear polyurethane market was the fastest growing market in the European region

The Asia-Pacific PU Sole Footwear Polyurethane Market is expected to grow at the fastest CAGR from 2023 to 2032. China, India, and Vietnam are important manufacturing hubs for the footwear industry, making the Asia Pacific area a vital hub for the sector. Moreover, China’s PU Sole footwear polyurethane market held the largest market share, and the Indian PU Sole footwear polyurethane market was the fastest growing market in the Asia-Pacific region.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the PU Sole footwear polyurethane market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, PU Sole footwear polyurethane industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global PU Sole footwear polyurethane industry to benefit clients and increase the market sector. In recent years, the PU Sole footwear polyurethane industry has offered some of the most significant advantages to medicine. Major players in the PU Sole footwear polyurethane market, including Many companies, including Asahi Kasei Corporation, BASF SE, Huntsman International LLC, Dow, Coim Group, Wanhua, The Lubrizol Corporation, Covestro AG, INOAC CORPORATION, Trelleborg AB, CELLULAR MOULDINGS, Rogers Corporation, MarvelVinyls, BASF SE, Unisol India, bkinds.in, LANXESS, VCM Polyurethanes Pvt.

Ltd. are attempting to increase market demand by investing in research and development operations.

Chemical products are manufactured and sold by Asahi Kasei Corp (Asah Kasei). The company's product line consists of acrylonitrile, styrene, diagnostic tools, foam insulation panels, foundation systems, polymers, functional additives, membrane filtration systems, ion-exchange membranes, medical devices and sensors. It also comprises methyl methacrylate, polyethylene, polystyrene and polymers. Also available are prescription medicines. The industries of chemicals and fibres, electronics, healthcare, and construction all use Asahi Kasei products. Under the Duranol, Sepacell, Polydurex, Ceolus, Aciplex, and Hipore brands, it sells these goods. North America, Central and South America, Europe, Asia, and Oceania are all operationally present for the company.

The headquarters of Asahi Kasei are in Tokyo, Japan's Chiyoda-ku.

BASF SE (BASF) is a multinational chemical corporation engaged in the production, marketing, and sale of chemicals, polymers, crop protection products, and performance goods. The company offers a wide range of products including solvents, adhesives, surfactants, fuel additives, electronic chemicals, pigments, paints, food additives, fungicides, and herbicides. BASF serves various industries such as construction, furniture and wood, agricultural, electronics and electrical, paints and coatings, automotive, home care, nutrition, chemicals, and others.

The company conducts research and development in collaboration with international clients, partners, and scientists, and is supported by a global network of production sites spanning North America, Europe, Asia Pacific, South America, Africa, and the Middle East. BASF is headquartered in Ludwigshafen, Germany.

Key Companies in the PU Sole Footwear Polyurethane Market market include

Industry Developments

January 2023: The expansion of BASF's PU sole manufacturing facility in Nanjing, China, was announced. The plant's capacity will grow by 50% after the expansion, which is scheduled to be finished by the end of 2023.

February 2023: Leading polyurethanes maker Hexion Inc. was purchased by Huntsman Corporation. Huntsman's position in the PU sole market is anticipated to improve as a result of the acquisition.

March 2023: A collaboration between Toray Industries and BASF to create innovative PU soles for footwear was revealed. The collaboration is anticipated to lead to the creation of soles that are lighter, more robust, and more pleasant.

2022 saw the development of a groundbreaking production innovation - a line of sneakers with plant-based soles - with the assistance of footwear experts at Huntsman, Inc. (KEEN). The Advanced Concepts Team at KEEN developed the Field to Foot (F2F) sneakers using a specifically designed bio-based polyurethane solution from Huntsman that includes a by-product from agricultural operations. With a bio content of between 35% and 51%, the polyurethane system emits less carbon dioxide than easily accessible petroleum-based substitutes, which are now the standard in the footwear industry.

Future Outlook

PU Sole Footwear Polyurethane Market Future Outlook

The PU Sole Footwear Polyurethane Market is projected to grow at a 7.79% CAGR from 2024 to 2035, driven by rising consumer demand for lightweight, durable footwear and sustainable materials.

New opportunities lie in:

- Invest in advanced manufacturing technologies to enhance production efficiency and reduce costs.

- Develop eco-friendly PU formulations to meet increasing sustainability demands from consumers.

- Expand into emerging markets with tailored product offerings to capture new customer segments.

By 2035, the market is expected to exhibit robust growth, positioning itself as a leader in innovative footwear solutions.

Market Segmentation

PU Sole footwear polyurethane Regional Outlook

- U.S.

- Canada

PU Sole footwear polyurethane Application Outlook

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formals

PU Sole footwear polyurethane Raw Material Outlook

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | USD 5.61 Billion |

| Market Size 2025 | USD 6.04 Billion |

| Market Size 2034 | USD 11.88 Billion |

| Compound Annual Growth Rate (CAGR) | 7.80% (2025-2034) |

| Base Year | 2024 |

| Market Forecast Period | 2025-2035 |

| Historical Data | 2020-2024 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Application, Raw Material, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The U.S., Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Asahi Kasei Corporation, BASF SE, Huntsman International LLC, Dow, Coim Group, Wanhua, The Lubrizol Corporation, Covestro AG, INOAC CORPORATION, Trelleborg AB., CELLULAR MOULDINGS, Rogers Corporation, MarvelVinyls, Airysole Footwear Pvt Ltd, BASF SE, Unisol India, bkinds.in, LANXESS, VCM Polyurethanes Pvt. Ltd., NEVEON Holding GmbH, Era Polymers Pty Ltd., and Perstorp, among others. |

| Key Market Opportunities | Technological Advancements |

| Key Market Dynamics | Rising Demand for Comfortable and Lightweight |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the PU Sole footwear polyurethane market?

The PU Sole Footwear Polyurethane Market size was valued at USD 4.9 Billion in 2022.

What is the growth rate of the PU Sole footwear polyurethane market?

The global market is projected to grow at a CAGR of 7.80% during the forecast period, 2025-2034.

Which region held the largest market share in the PU Sole footwear polyurethane market?

North America had the largest share in the global market

Who are the key players in the PU Sole footwear polyurethane market?

The key players in the market are Asahi Kasei Corporation, BASF SE, Huntsman International LLC, Dow, Coim Group, Wanhua, The Lubrizol Corporation, Covestro AG, INOAC CORPORATION, Trelleborg AB., CELLULAR MOULDINGS, Rogers Corporation, MarvelVinyls, Airysole Footwear Pvt Ltd, BASF SE, Unisol India, bkinds.in, LANXESS, VCM Polyurethanes Pvt. Ltd., NEVEON Holding GmbH, Era Polymers Pty Ltd., and Perstorp, among others.

Which Application led the PU Sole footwear polyurethane market?

The Casuals category dominated the market in 2022.

Which Raw Material had the largest market share in the PU Sole footwear polyurethane market?

The Methylene Diphenyl Diisocyanate (MDI) had the largest share in the global market.

-

EXECUTIVE SUMMARY

-

MARKET INTRODUCTION

- Definition

-

Scope of the Study

- Research Objective

- Assumptions

- Limitations

-

RESEARCH METHODOLOGY

-

Overview

- Data Mining

- Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

- Breakdown

-

of Primary Respondents

- Forecasting Modality

-

Market Size Estimation

- Bottom-Up Approach

- Top-Down Approach

- Data Triangulation

- Validation

-

MARKET DYNAMICS

- Overview

- Drivers

- Restraints

- Opportunities

-

MARKET FACTOR ANALYSIS

-

Value Chain Analysis

-

Porter’s Five Forces Analysis

- Bargaining

-

Porter’s Five Forces Analysis

-

Power of Suppliers

-

Bargaining Power of Buyers

- Threat of

-

Bargaining Power of Buyers

-

New Entrants

-

Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional

-

Threat of Substitutes

-

Impact

- Opportunity and Threat Analysis

-

GLOBAL PU SOLE FOOTWEAR

-

POLYURETHANE MARKET, BY APPLICATION

- Overview

- Casuals

-

Boots

- Slippers & Sandals

- Sports

- Formats

-

GLOBAL PU SOLE FOOTWEAR POLYURETHANE MARKET, BY RAW MATERIAL

- Overview

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate

-

(TDI)

- Polyols

-

GLOBAL PU SOLE FOOTWEAR POLYURETHANE MARKET, BY

-

REGION

- Overview

-

North America

- U.S.

- Canada

-

Europe

- Germany

- France

- U.K

-

Italy

-

Spain

- Rest of Europe

- Asia-Pacific

-

Spain

-

China

-

India

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

-

Rest of the World

- Middle East

- Africa

- Latin America

-

India

-

COMPETITIVE LANDSCAPE

-

Overview

- Competitive Analysis

- Market Share Analysis

-

Major Growth Strategy in the Global Pu sole footwear polyurethane Market,

-

Competitive Benchmarking

- Leading Players in Terms of Number of Developments

-

in the Global Pu sole footwear polyurethane Market,

- Key developments and

-

Growth Strategies

-

New APPLICATION Launch/Raw material Deployment

- Merger & Acquisitions

- Joint Ventures

- Major Players

-

New APPLICATION Launch/Raw material Deployment

-

Financial Matrix

-

Sales & Operating Income, 2022

- Major

-

Sales & Operating Income, 2022

-

Players R&D Expenditure. 2022

-

COMPANY PROFILES

- Asahi Kasei

-

Corporation

-

Company Overview

- Financial Overview

-

Company Overview

-

Application Offered

-

Key Developments

- SWOT Analysis

- Key Strategies

-

BASF SE

- Company Overview

-

Key Developments

-

Financial Overview

-

Application Offered

- Key Developments

- SWOT Analysis

- Key Strategies

- Huntsman International

-

Application Offered

-

LLC

-

Company Overview

- Financial Overview

- Application

-

Company Overview

-

Offered

-

Key Developments

- SWOT Analysis

- Key

-

Key Developments

-

Strategies

-

Dow

- Company Overview

- Financial Overview

- Application Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Coim Group

- Company Overview

- Financial Overview

- Application Offered

- Key Developments

- SWOT Analysis

- Key Strategies

- Wanhua

-

Dow

-

Company Overview

-

Financial Overview

- Application Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

The Lubrizol Corporation

- Company Overview

- Financial

-

Financial Overview

-

Overview

-

Application Offered

- Key Developments

-

Application Offered

-

SWOT Analysis

- Key Strategies

-

Covestro AG

- Company

-

Overview

-

Financial Overview

- Application Offered

-

Financial Overview

-

Key Developments

-

SWOT Analysis

- Key Strategies

-

SWOT Analysis

-

INOAC CORPORATION

-

Company Overview

- Financial Overview

- Application Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Trelleborg AB.

- Company Overview

- Financial Overview

- Application Offered

- Key

-

Company Overview

-

Developments

-

SWOT Analysis

- Key Strategies

-

SWOT Analysis

-

CELLULAR MOULDINGS

-

Company Overview

- Financial Overview

- Application Offered

- Key Developments

- SWOT

-

Company Overview

-

Analysis

- Key Strategies

- Rogers Corporation

-

Company Overview

-

Financial Overview

- Application Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

MarvelVinyls

- Company Overview

- Financial Overview

- Application Offered

- Key Developments

- SWOT

-

Financial Overview

-

Analysis

- Key Strategies

- Airysole Footwear Pvt Ltd

-

Company Overview

-

Financial Overview

- Application Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

BASF SE

- Company Overview

- Financial Overview

- Application Offered

- Key Developments

- SWOT

-

Financial Overview

-

Analysis

- Key Strategies

-

Unisol India

- Company

-

Overview

-

Financial Overview

- Application Offered

-

Financial Overview

-

Key Developments

-

SWOT Analysis

- Key Strategies

-

SWOT Analysis

-

bkinds.in

-

Company Overview

- Financial Overview

-

Company Overview

-

Application Offered

-

Key Developments

- SWOT Analysis

- Key Strategies

-

LANXESS

- Company Overview

- Financial Overview

- Application Offered

- Key

-

Key Developments

-

Developments

-

SWOT Analysis

- Key Strategies

-

SWOT Analysis

-

VCM Polyurethanes Pvt. Ltd.

-

Company Overview

- Financial

-

Company Overview

-

Overview

-

Application Offered

- Key Developments

-

Application Offered

-

SWOT Analysis

- Key Strategies

- NEVEON Holding GmbH

-

Company Overview

-

Financial Overview

- Application Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Era Polymers Pty Ltd.

- Company Overview

- Financial

-

Financial Overview

-

Overview

-

Application Offered

- Key Developments

-

Application Offered

-

SWOT Analysis

- Key Strategies

-

Perstorp

- Company

-

Overview

-

Financial Overview

- Application Offered

-

Financial Overview

-

Key Developments

-

SWOT Analysis

- Key Strategies

- References

- Related Reports

-

SWOT Analysis

-

LIST

-

OF TABLES

-

2034 (USD BILLION)

-

BY APPLICATION, 2025-2034 (USD BILLION)

-

MARKET, BY RAW MATERIAL, 2025-2034 (USD BILLION)

-

FOOTWEAR POLYURETHANE MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

NORTH AMERICA PU SOLE FOOTWEAR POLYURETHANE MARKET, BY RAW MATERIAL, 2025-2034

-

(USD BILLION)

-

COUNTRY, 2025-2034 (USD BILLION)

-

MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

POLYURETHANE MARKET, BY RAW MATERIAL, 2025-2034 (USD BILLION)

-

PU SOLE FOOTWEAR POLYURETHANE MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

(USD BILLION)

-

2034 (USD BILLION)

-

BY RAW MATERIAL, 2025-2034 (USD BILLION)

-

MARKET, BY COUNTRY, 2025-2034 (USD BILLION)

-

POLYURETHANE MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

PU SOLE FOOTWEAR POLYURETHANE MARKET, BY RAW MATERIAL, 2025-2034 (USD BILLION)

-

(USD BILLION)

-

MATERIAL, 2025-2034 (USD BILLION)

-

MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

POLYURETHANE MARKET, BY RAW MATERIAL, 2025-2034 (USD BILLION)

-

PU SOLE FOOTWEAR POLYURETHANE MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

(USD BILLION)

-

2034 (USD BILLION)

-

BY RAW MATERIAL, 2025-2034 (USD BILLION)

-

POLYURETHANE MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

OF EUROPE PU SOLE FOOTWEAR POLYURETHANE MARKET, BY RAW MATERIAL, 2025-2034 (USD

-

BILLION)

-

2034 (USD BILLION)

-

MARKET, BY RAW MATERIAL, 2025-2034 (USD BILLION)

-

FOOTWEAR POLYURETHANE MARKET, BY COUNTRY, 2025-2034 (USD BILLION)

-

JAPAN PU SOLE FOOTWEAR POLYURETHANE MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

(USD BILLION)

-

2034 (USD BILLION)

-

BY RAW MATERIAL, 2025-2034 (USD BILLION)

-

MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

POLYURETHANE MARKET, BY RAW MATERIAL, 2025-2034 (USD BILLION)

-

PU SOLE FOOTWEAR POLYURETHANE MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

(USD BILLION)

-

APPLICATION, 2025-2034 (USD BILLION)

-

POLYURETHANE MARKET, BY RAW MATERIAL, 2025-2034 (USD BILLION)

-

OF ASIA-PACIFIC PU SOLE FOOTWEAR POLYURETHANE MARKET, BY APPLICATION, 2025-2034

-

(USD BILLION)

-

BY RAW MATERIAL, 2025-2034 (USD BILLION)

-

POLYURETHANE MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

OF WORLD PU SOLE FOOTWEAR POLYURETHANE MARKET, BY RAW MATERIAL, 2025-2034 (USD BILLION)

-

(USD BILLION)

-

APPLICATION, 2025-2034 (USD BILLION)

-

POLYURETHANE MARKET, BY RAW MATERIAL, 2025-2034 (USD BILLION)

-

PU SOLE FOOTWEAR POLYURETHANE MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

(USD BILLION)

-

BY APPLICATION, 2025-2034 (USD BILLION)

-

POLYURETHANE MARKET, BY RAW MATERIAL, 2025-2034 (USD BILLION)

-

LIST

-

OF FIGURES

-

GLOBAL PU SOLE FOOTWEAR POLYURETHANE MARKET

-

GLOBAL PU SOLE FOOTWEAR POLYURETHANE MARKET

-

POLYURETHANE MARKET, SHARE (%), BY APPLICATION, 2022

-

FOOTWEAR POLYURETHANE MARKET, SHARE (%), BY RAW MATERIAL, 2022

-

PU SOLE FOOTWEAR POLYURETHANE MARKET, SHARE (%), BY REGION, 2022

-

AMERICA: PU SOLE FOOTWEAR POLYURETHANE MARKET, SHARE (%), BY REGION, 2022

-

EUROPE: PU SOLE FOOTWEAR POLYURETHANE MARKET, SHARE (%), BY REGION, 2022

-

ASIA-PACIFIC: PU SOLE FOOTWEAR POLYURETHANE MARKET, SHARE (%), BY REGION, 2022

-

BY REGION, 2022

-

SHARE ANALYSIS, 2022 (%)

-

SNAPSHOT

-

SE: FINANCIAL OVERVIEW SNAPSHOT

-

HUNTSMAN INTERNATIONAL LLC: FINANCIAL OVERVIEW SNAPSHOT

-

INTERNATIONAL LLC: SWOT ANALYSIS

-

SNAPSHOT

-

FINANCIAL OVERVIEW SNAPSHOT

-

SWOT ANALYSIS

-

INOAC CORPORATION: SWOT ANALYSIS

-

SNAPSHOT

-

FINANCIAL OVERVIEW SNAPSHOT

-

CORPORATION: SWOT ANALYSIS

-

FINANCIAL OVERVIEW SNAPSHOT

-

SWOT ANALYSIS

-

BKINDS.IN: SWOT ANALYSIS

-

OVERVIEW SNAPSHOT

-

NEVEON HOLDING GMBH: FINANCIAL OVERVIEW SNAPSHOT

-

GMBH: SWOT ANALYSIS

-

OVERVIEW SNAPSHOT

PU Sole Footwear Polyurethane Market Segmentation

PU Sole Footwear Polyurethane Application Outlook (USD Billion, 2018-2032)

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formats

PU Sole Footwear Polyurethane Raw Material Outlook (USD Billion, 2018-2032)

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

PU Sole Footwear Polyurethane Regional Outlook (USD Billion, 2018-2032)

North America Outlook (USD Billion, 2018-2032)

- PU Sole Footwear Polyurethane by Application

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formats

- PU Sole Footwear Polyurethane by Raw Material

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

US Outlook (USD Billion, 2018-2032)

- PU Sole Footwear Polyurethane by Application

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formats

- PU Sole Footwear Polyurethane by Raw Material

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

Canada Outlook (USD Billion, 2018-2032)

- PU Sole Footwear Polyurethane by Application

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formats

- PU Sole Footwear Polyurethane by Raw Material

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

- PU Sole Footwear Polyurethane by Application

Europe Outlook (USD Billion, 2018-2032)

- PU Sole Footwear Polyurethane by Application

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formats

- PU Sole Footwear Polyurethane by Raw Material

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

Germany Outlook (USD Billion, 2018-2032)

- PU Sole Footwear Polyurethane by Application

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formats

- PU Sole Footwear Polyurethane by Raw Material

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

France Outlook (USD Billion, 2018-2032)

- PU Sole Footwear Polyurethane by Application

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formats

- PU Sole Footwear Polyurethane by Raw Material

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

UK Outlook (USD Billion, 2018-2032)

- PU Sole Footwear Polyurethane by Application

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formats

- PU Sole Footwear Polyurethane by Raw Material

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

Italy Outlook (USD Billion, 2018-2032)

- PU Sole Footwear Polyurethane by Application

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formats

- PU Sole Footwear Polyurethane by Raw Material

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

Spain Outlook (USD Billion, 2018-2032)

- PU Sole Footwear Polyurethane by Application

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formats

- PU Sole Footwear Polyurethane by Raw Material

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

Rest Of Europe Outlook (USD Billion, 2018-2032)

- PU Sole Footwear Polyurethane by Application

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formats

- PU Sole Footwear Polyurethane by Raw Material

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

- PU Sole Footwear Polyurethane by Application

Asia-Pacific Outlook (USD Billion, 2018-2032)

- PU Sole Footwear Polyurethane by Application

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formats

- PU Sole Footwear Polyurethane by Raw Material

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

China Outlook (USD Billion, 2018-2032)

- PU Sole Footwear Polyurethane by Application

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formats

- PU Sole Footwear Polyurethane by Raw Material

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

Japan Outlook (USD Billion, 2018-2032)

- PU Sole Footwear Polyurethane by Application

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formats

- PU Sole Footwear Polyurethane by Raw Material

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

India Outlook (USD Billion, 2018-2032)

- PU Sole Footwear Polyurethane by Application

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formats

- PU Sole Footwear Polyurethane by Raw Material

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

Australia Outlook (USD Billion, 2018-2032)

- PU Sole Footwear Polyurethane by Application

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formats

- PU Sole Footwear Polyurethane by Raw Material

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

Rest of Asia-Pacific Outlook (USD Billion, 2018-2032)

- PU Sole Footwear Polyurethane by Application

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formats

- PU Sole Footwear Polyurethane by Raw Material

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

- PU Sole Footwear Polyurethane by Application

Rest of the World Outlook (USD Billion, 2018-2032)

- PU Sole Footwear Polyurethane by Application

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formats

- PU Sole Footwear Polyurethane by Raw Material

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

Middle East Outlook (USD Billion, 2018-2032)

- PU Sole Footwear Polyurethane by Application

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formats

- PU Sole Footwear Polyurethane by Raw Material

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

Africa Outlook (USD Billion, 2018-2032)

- PU Sole Footwear Polyurethane by Application

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formats

- PU Sole Footwear Polyurethane by Raw Material

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

Latin America Outlook (USD Billion, 2018-2032)

- PU Sole Footwear Polyurethane by Application

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formats

- PU Sole Footwear Polyurethane by Raw Material

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

- PU Sole Footwear Polyurethane by Application

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment